Does Robinhood report to IRS for you?

Do I have to report my Robinhood account to the IRS

Do I need to file Robinhood taxes The short answer is yes. You must report any profits you receive from selling stocks on the Robinhood app or dividends on your individual tax return. Selling assets leads to capital gains or losses.

Cached

What happens if I don’t report Robinhood taxes

If you don't file your taxes and report any income that you earned through Robinhood, you may be subject to penalties and fines from the Internal Revenue Service (IRS). The IRS requires taxpayers to report all income they earn, regardless of the source, and failure to do so can result in penalties and fines.

Cached

Do I have to file Robinhood taxes if I didn’t make money

Many people think if they don't make any money, they shouldn't report it on their taxes. But when you do that, you are missing an opportunity to lower your tax bill. If you made no capital gains, you are still allowed to deduct up to $3,000 worth per year, to lower your tax payment for even your ordinary income.

Cached

Do I pay taxes if I lost money on stocks

The IRS allows you to deduct from your taxable income a capital loss, for example, from a stock or other investment that has lost money. Here are the ground rules: An investment loss has to be realized. In other words, you need to have sold your stock to claim a deduction.

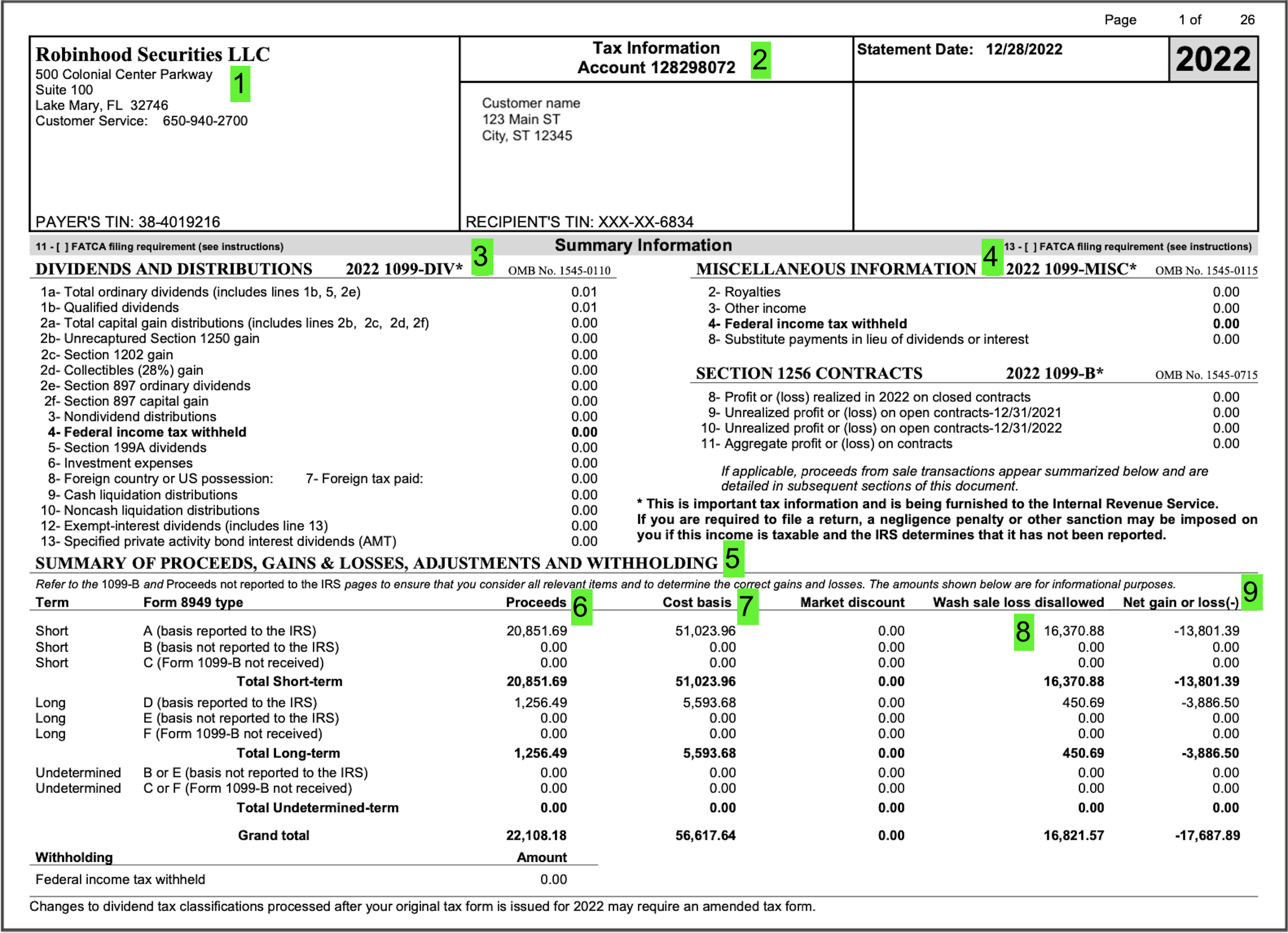

Will I receive a 1099 from Robinhood

For this tax year, you'll get a Consolidated 1099 PDF from Robinhood Markets, Inc. It'll include forms for Robinhood Securities, Robinhood Crypto, and Robinhood Money, as applicable.

Do you have to list every stock trade on your tax return

Enter all sales and exchanges of capital assets, including stocks, bonds, and real estate (if not reported on line 1a or 8a of Schedule D or on Form 4684, 4797, 6252, 6781, or 8824). Include these transactions even if you didn't receive a Form 1099-B or 1099-S (or substitute statement) for the transaction.

Will the IRS know if you don’t report stocks

If you fail to report the gain, the IRS will become immediately suspicious. While the IRS may simply identify and correct a small loss and ding you for the difference, a larger missing capital gain could set off the alarms.

How much do I have to make on Robinhood to file taxes

$600

If you received stocks through our referral program of $600 or more, it will be reported as miscellaneous income on your Robinhood Markets Consolidated 1099. If you have referral shares valued at less than $600, it may not have to be reported as miscellaneous income on the Robinhood Markets Consolidated 1099.

What happens if you owe Robinhood money

If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. Robinhood Financial charges a standard margin interest rate of 11.75% and a margin interest rate of 7.75% for customers who subscribe to Gold.

How much stock can I sell without paying tax

Short-term and long-term capital gains taxes

| Long-Term Capital Gains Tax Rate | Single Filers (Taxable Income) | Head of Household |

|---|---|---|

| 0% | Up to $44,625 | Up to $59,750 |

| 15% | $44,626-$492,300 | $59,751-$523,050 |

| 20% | Over $492,300 | Over $523,050 |

How much do you get back in taxes for stock losses

$3,000

If your net losses in your taxable investment accounts exceed your net gains for the year, you will have no reportable income from your security sales. You may then write off up to $3,000 worth of net losses against other forms of income such as wages or taxable dividends and interest for the year.

Do I have to report every stock I sold

Do I Have to Report All Stock Sales on My Taxes Yes, whether you earn a profit or take a loss, every transaction has to be reported to the IRS on your annual tax return. This goes for any capital asset, not just stocks.

How does the IRS determine if you are a day trader

You must seek to profit from daily market movements in the prices of securities and not from dividends, interest, or capital appreciation; Your activity must be substantial; and. You must carry on the activity with continuity and regularity.

How does IRS know you sold stock

Investment Transactions –– Gains from sales and trades of stocks, bonds, or certain commodities are usually reported to you on Form 1099-B, Proceeds From Broker and Barter Exchange Transactions, or an equivalent statement.

Can the IRS see my stocks

If you have investment accounts, the IRS can see them in dividend and stock sales reportings through Forms 1099-DIV and 1099-B. If you have an IRA, the IRS will know about it through Form 5498.

Does Robinhood tax you when you sell

The amount of taxes you will pay on Robinhood stocks depends on whether you make a profit. You pay taxes only if you sell a stock for more than you paid for it. If you sell a stock for a profit within a year or less of buying it, you are taxed at the short-term capital gains tax rate.

What happens if I don’t pay my Robinhood deficit

If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. Robinhood Financial charges a standard margin interest rate of 11.75% and a margin interest rate of 7.75% for customers who subscribe to Gold.

Do I owe taxes from Robinhood

We'll also begin 24% backup tax withholding on your Robinhood Securities account. That means that all cash proceeds, including future sell orders, dividends, interest, and certain other payments that we make to your account will be subject to 24% withholding.

How do I avoid paying taxes on stocks sold

9 Ways to Avoid Capital Gains Taxes on StocksInvest for the Long Term.Contribute to Your Retirement Accounts.Pick Your Cost Basis.Lower Your Tax Bracket.Harvest Losses to Offset Gains.Move to a Tax-Friendly State.Donate Stock to Charity.Invest in an Opportunity Zone.

Do you have to file a 1099 if under 1000

Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year.