Does Robinhood tax your profit?

Do you pay taxes on Robinhood profits

Short-term capital gains — profits on assets held less than one year — are taxed as ordinary income. For instance, if you're in the 24% federal tax bracket, you'll pay taxes at that rate, or even higher if the gain bumps you into the next tax bracket.

Cached

Do I have to pay taxes on Robinhood if I lost money

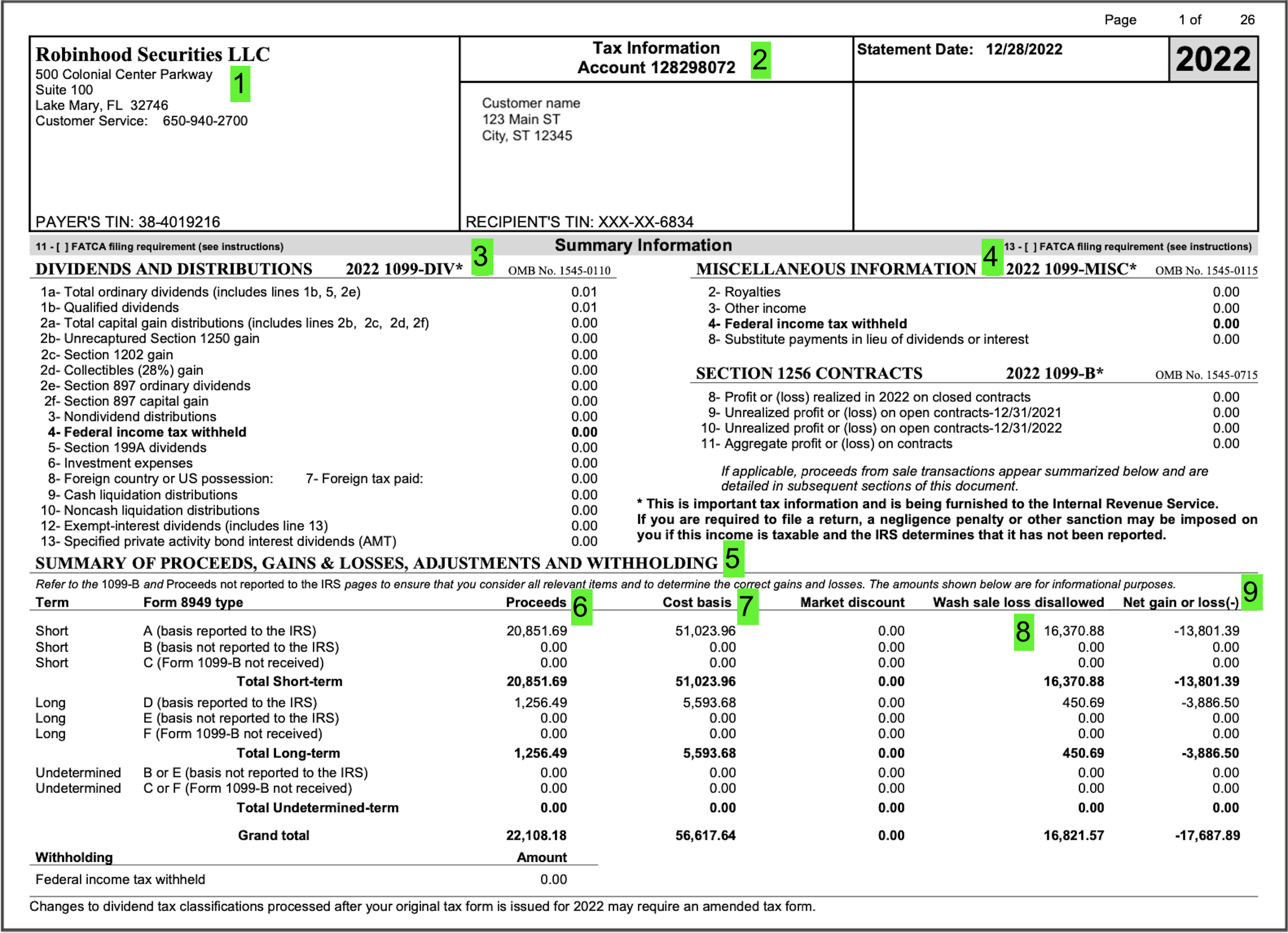

As stated earlier when you make a sale, that triggers a taxable event so you have to report all sales to the IRS on a form 1099. If you incurred a loss, then you can write that off as a tax deduction to lower your tax bill.

Cached

Do I pay taxes on stocks I don’t sell

The tax doesn't apply to unsold investments or "unrealized capital gains." Stock shares will not incur taxes until they are sold, no matter how long the shares are held or how much they increase in value. Most taxpayers pay a higher rate on their income than on any long-term capital gains they may have realized.

How much will Robinhood tax me

We'll also begin 24% backup tax withholding on your Robinhood Securities account. That means that all cash proceeds, including future sell orders, dividends, interest, and certain other payments that we make to your account will be subject to 24% withholding.

Do I have to pay tax on stocks if I sell and reinvest

Yes, since you are actually selling one fund and purchasing a new fund. You need to report the sale of the shares you sold on Form 8949, Sales and Dispositions of Capital Assets. Information you report on this form gets posted to Form 1040 Schedule D. You are liable for Capital Gains Tax on any profit from the sale.

What happens if you owe Robinhood money

If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. Robinhood Financial charges a standard margin interest rate of 11.75% and a margin interest rate of 7.75% for customers who subscribe to Gold.

How do I avoid paying tax on stock gains

9 Ways to Avoid Capital Gains Taxes on StocksInvest for the Long Term.Contribute to Your Retirement Accounts.Pick Your Cost Basis.Lower Your Tax Bracket.Harvest Losses to Offset Gains.Move to a Tax-Friendly State.Donate Stock to Charity.Invest in an Opportunity Zone.

How do I sell stocks and avoid taxes

How to Reduce Capital Gains Tax On StocksControl Your Asset Location.Consider Donating Appreciated Stock.Use Tax-Loss Harvesting.Try Qualified Opportunity Funds.Know Your Tax Brackets (And Use Them to Your Advantage)Add Stock Into Your Estate Plan.Realize Capital Gains With A Unified Strategy.

Do you pay taxes on trades

If you're a successful trader, you're going to have to pay on your earnings. Any profit you earn selling an investment could be subject to what is called the capital gains tax. So if you buy a stock for $20 and sell it for $25, you have $5 in capital gains that will be taxed.

What happens if you don’t pay Robinhood margin

If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. Robinhood Financial charges a standard margin interest rate of 11.75% and a margin interest rate of 7.75% for customers who subscribe to Gold.

Is Robinhood good for long term investing

Robinhood (HOOD) is a popular financial services company with more than 12.2 million monthly active users (MAU) as of September 2023. 1 It's considered a safe option for investors' securities and cash for various reasons: Robinhood is a member of the Securities Investor Protection Corp. (SIPC).

What happens if you don’t pay taxes on stock gains

The IRS has the authority to impose fines and penalties for your negligence, and they often do. If they can demonstrate that the act was intentional, fraudulent, or designed to evade payment of rightful taxes, they can seek criminal prosecution.

What happens if you sell a stock but don’t withdraw money

Even if you don't take the money out, you'll still owe taxes when you sell a stock for more than what you originally paid for it. When tax time rolls around, you'll need to report those capital gains on your tax return.

How much tax do I owe if I sell stocks

If you sell stocks for a profit, you'll likely have to pay capital gains taxes. Generally, any profit you make on the sale of a stock is taxable at either 0%, 15% or 20% if you held the shares for more than a year, or at your ordinary tax rate if you held the shares for a year or less.

How long do I have to hold a stock to avoid taxes

To correctly arrive at your net capital gain or loss, capital gains and losses are classified as long-term or short-term. Generally, if you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. If you hold it one year or less, your capital gain or loss is short-term.

How much tax do you pay on trading profit

Their income from trading is treated as business income, and they are required to file their returns under the head "Profits and gains from business or profession." Their profits are taxed as per the applicable slab rates, which can go up to 30% depending on their income level.

How much tax do I pay on stock gains

Short-term capital gains taxes are paid at the same rate as you'd pay on your ordinary income, such as wages from a job. Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income.

Is using margin on Robinhood a good idea

You have to determine whether margin investing is consistent with your investment strategy. You should consider your own investment experience, goals, and sensitivity to risk. By enabling margin investing for your brokerage account, Robinhood is not recommending the use of margin investing.

How long do you have to pay back margin

There's no set repayment schedule with a margin loan—monthly interest charges accrue to your account, and you can repay the principal at your convenience.

What is the downside to Robinhood

The main downside of Robinhood is that the investment selection is limited for hands-off, passive investors: The broker offers no mutual funds or index funds, which financial advisors typically suggest using as the basis of a diversified portfolio.