Does settlement money come in a check?

Is it safe to deposit check from settlement

Yes, you can deposit your settlement check. But it is worth discussing your settlement negotiations and where you want to deposit your settlement check after it is delivered. You must remember that you will get only one chance to settle your claim after an accident.

Cached

How do settlement payments work

Structured settlements are the scheduled payments made to a plaintiff who settles a lawsuit or wins a judgment outright in court. Instead of taking a lump sum of money, the plaintiff receives the amount over time. Structured settlement payments do not count as taxable income even if they earn interest.

What happens once a settlement is reached

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How long does it take to get a compensation payout

After your claim has settled you should receive your compensation between 14 – 21 days. This depends on if your claim was settled in or out of court.

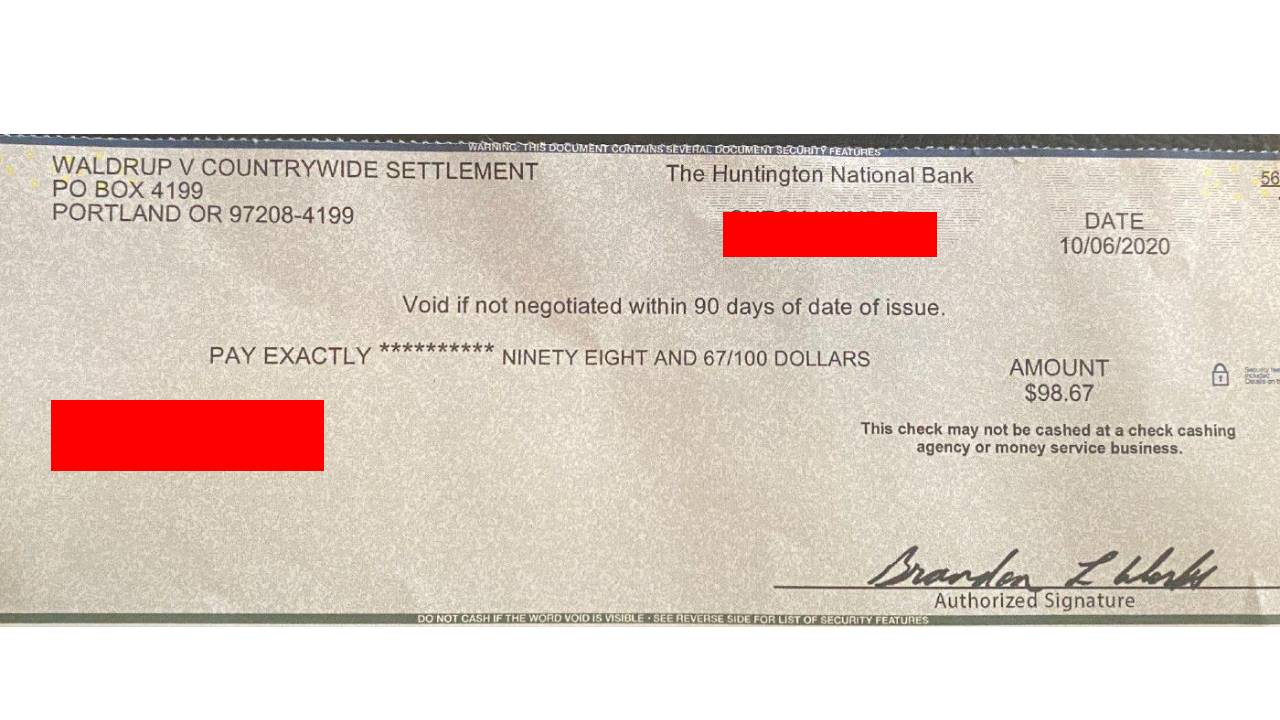

How do I know if my settlement check is real

Check with the bank that supposedly issued the check to make sure it is real. Make sure you look up the phone number on the bank's official website and don't use the phone number printed on the check (that could be a phone number controlled and answered by the scam artist).

How do I cash a large settlement check without a bank account

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.

What is the difference between a settlement and a payout

Lump sum payouts are where you receive the full amount owed to you in one large payment. Structured settlements is a guaranteed payment of certain amounts over a long period of time. Both types of payouts have their advantages and disadvantages based on your current financial needs.

How many days is settlement usually

two business days

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

Is settlement money taxable

If you're involved in a lawsuit in California, you may be wondering whether any settlement or award you receive is taxable. The good news is that, in most cases, personal injury settlements are not taxable in California.

How long do most car accident settlements take

In some cases, a settlement may be reached relatively quickly, within a matter of weeks or a few months. However, in more complex cases where there are disputes over liability, damages, or insurance coverage, it can take several months or even years to reach a fair settlement.

How long does a compensation review take

This step could take up to six to eight weeks, depending on the size of your organization. This information is usually embedded in the company handbook, and the deeper philosophy sits with the CEO or HR Heads. A compensation philosophy discusses the organization's compensation philosophy and how they reward employees.

How long does it take to settle check

The answer depends on the various processing steps and payments required before you get the check, but in most cases, you can expect to receive your funds in about six weeks. Knowing the steps that go into processing your settlement check can help you understand why it takes so long to receive it.

Should I cash a class-action settlement check

Consumers are inundated with mailings about class actions settlements that could bring you money, such as cash back for overpriced tuna fish, or a settlement over moldy front loading washing machines. Those are very legit, and if you get a check form them, go ahead and cash it.

What happens when you deposit over $10000 check

Depositing over $10k only results in an IRS form being filed by the bank. You often won't have to do anything to explain it unless you are suspected of fraud or money laundering.

Why won’t my settlement check cash

Some reasons why a bank won't cash a check include not having a proper ID, not having an account with that bank, the check is filled out incorrectly, or the check being too old.

Is it better to accept a settlement or pay in full

Summary: Ultimately, it's better to pay off a debt in full than settle. This will look better on your credit report and help you avoid a lawsuit. If you can't afford to pay off your debt fully, debt settlement is still a good option.

What is the difference between a lump sum and a settlement

Lump sum payouts are where you receive the full amount owed to you in one large payment. Structured settlements is a guaranteed payment of certain amounts over a long period of time. Both types of payouts have their advantages and disadvantages based on your current financial needs.

Why does settlement take 2 days

A payment or check must arrive at the broker's office by the close of business on Tuesday, unless a public holiday delays the settlement day. The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement.

What is the longest settlement period

The length of the property settlement is mutually agreed upon by the seller and the buyer – this means that how long it would take can be negotiated. That said, the length of the settlement period typically lasts between 30 and 90 days.

Do I have to report settlement money to IRS

Damages For Lost Wages Are Taxable

In these situation, the IRS will consider those proceeds to be taxable income as they will replace the taxable earnings (wages) earned before or after the injury. Often the largest portion of a settlement, these amounts will need to be reported on your state and federal tax returns.