Does Social Security count as income for ACP?

What does ACP consider income

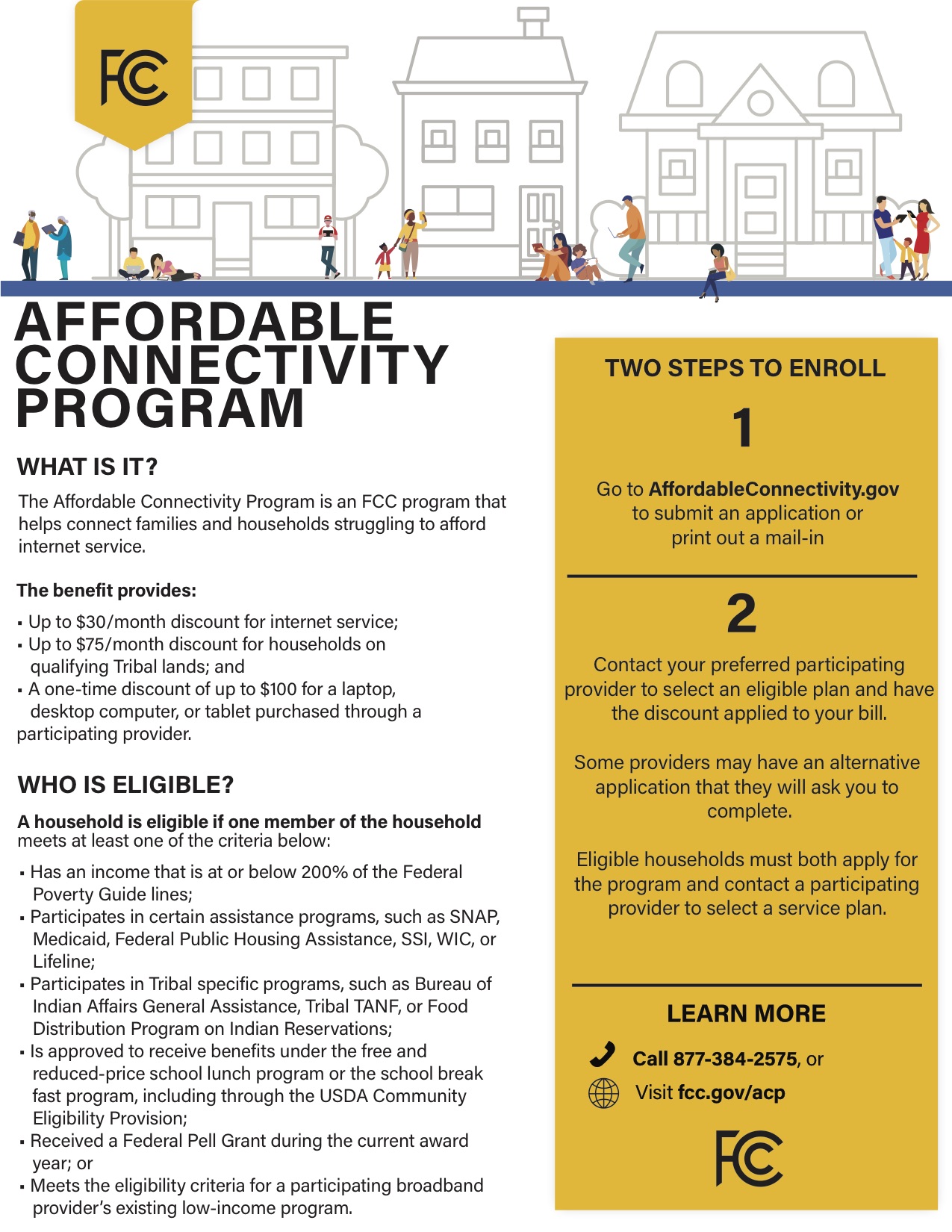

If a consumer household's gross annual income is 200% or less than the federal poverty guidelines, they qualify for the ACP. The table below reflects the income limit by household size, which is 200% of the 2023 Federal Poverty Guidelines.

Cached

Is the ACP based on adjusted gross income

Under the Affordable Care Act, eligibility for income-based Medicaid and subsidized health insurance through the Marketplaces is calculated using a household's Modified Adjusted Gross Income (MAGI).

Cached

How do I get $100 off my tablet with ACP

Visit redpocket.com/shop/acp. Select your device and then enter your enrollment ID to apply your $100 program discount to the purchase. Tablet devices do not include talk or text capabilities.

What is considered income for Social Security benefits

Only earned income, your wages, or net income from self-employment is covered by Social Security. If money was withheld from your wages for “Social Security” or “FICA,” your wages are covered by Social Security.

Is the ACP program ending

Despite largely unvarnished success—with over 16.8 million U.S. households enrolled—the ACP is expected to become insolvent as early as 2024 without a permanent wellspring of funding.

What’s the difference between ACP and lifeline

ACP has a broader eligibility criterion than the Lifeline program, allowing a household to receive the benefit if at least one member is at or below 200 percent of the federal poverty guidelines, participates in similar support programs, received a federal Pell Grant during the current year, or otherwise meets the …

Does modified adjusted gross income include Social Security income

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn't include Supplemental Security Income (SSI).

What counts as income

In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

How many devices can you have on ACP

Please note that only one ACP benefit and one device discount are allowed per household.

How to get discounted tablet from ACP

Once you're approved for the ACP benefit and have registered your number with us, log into your account at https://my.truconnect.com. Buy your discounted tablet. Go to “Buy Devices” and select the tablet that's best for you. Enter your preferred method of payment, and your tablet will be on its way to you.

Do I count my Social Security as income

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

Is ACP ending 2023

Despite largely unvarnished success—with over 16.8 million U.S. households enrolled—the ACP is expected to become insolvent as early as 2024 without a permanent wellspring of funding.

Does ACP have to be renewed every year

Recertification is an annual requirement for ACP subscribers.

Is lifeline in ACP two different things

But in California, the state LifeLine benefit cannot be combined with ACP; instead, a household must use the subsidies on separate accounts — typically, a LifeLine mobile phone and an ACP-funded broadband connection to a home computer.

How do you qualify for bidens internet plan

You or someone in your household participates in one of these other programs:Supplemental Nutrition Assistance Program (SNAP), formerly known as Food Stamps.Medicaid.Special Supplemental Nutrition Program for Women, Infants, and Children (WIC)Supplemental Security Income (SSI)Federal Public Housing Assistance (FPHA)

Is Social Security counted as income

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return).

What is usually not included in the adjusted gross income

What Is AGI Adjusted Gross Income, or AGI, starts with your gross income, and is then reduced by certain “above the line” deductions. Some common examples of deductions that reduce adjusted gross income include 401(k) contributions, health savings account contributions and educator expenses.

What income is not countable

For example, a $25 a birthday gift is not countable. In-kind income: Any gain or benefit not in the form of money and provided directly to the household. For example, a client's neighbor provides produce from his garden. Loans: Any amount of money that must be repaid is not countable as income.

Can you have 2 ACP accounts

Yes. You can also combine these benefits with other state and local benefits where available. They can be applied to the same qualifying service or separately to a Lifeline service and an Affordable Connectivity Program service with the same or different providers.

Can you use ACP on more than one account

Only one ACP benefit is available per household as defined by the FCC.