Does Social Security notify credit bureaus of death?

Should credit bureaus be notified when someone dies

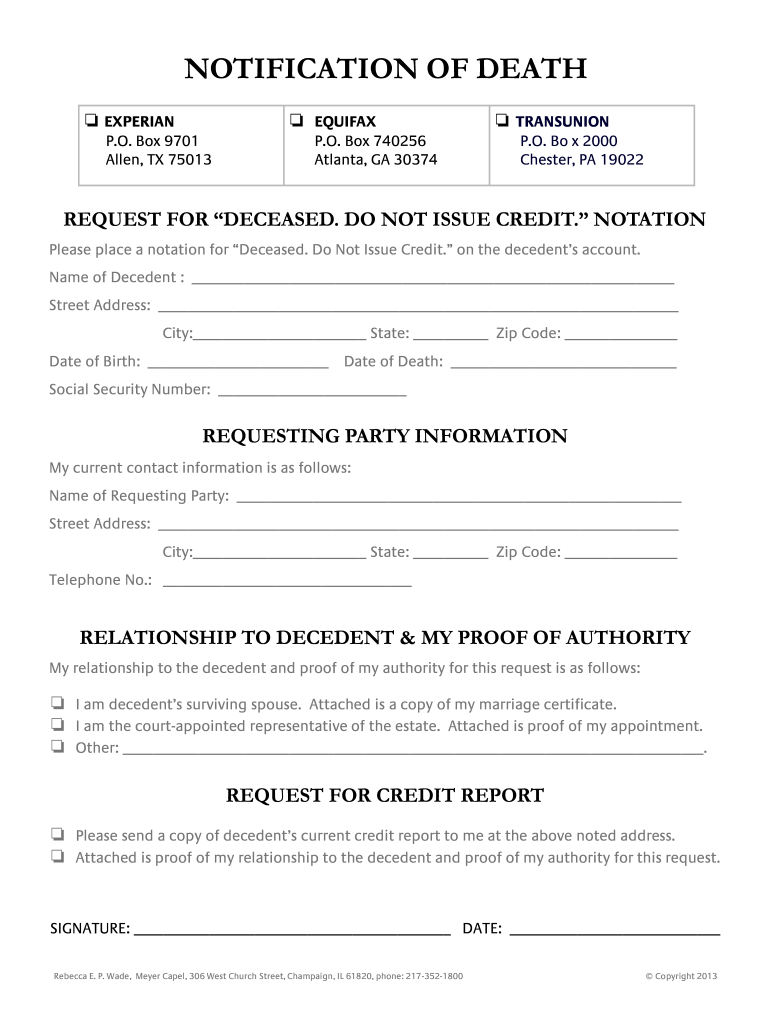

Notifying any one of the three credit bureaus — Equifax, Experian, and TransUnion — allows the individual's credit report to be updated with a deceased notice, which may help prevent theft of their identity.

Does Social Security notify credit card companies of death

Credit reporting companies regularly receive notifications from the Social Security Administration about individuals who have passed away, but it's better to also notify them on your own to ensure no one applies for credit in the deceased's name in the meantime.

Cached

Who notifies Social Security when someone dies

the funeral home

In most cases, the funeral home will report the person's death to us. You should give the funeral home the deceased person's Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778).

Can you notify credit bureaus of death online

Here's how to report a death to each credit reporting agency: Experian: Mail a copy of the death certificate to Experian's Consumer Assistance Center, P.O. Box 4500, Allen, TX 75013, or upload it online. TransUnion: Mail a copy of the death certificate to TransUnion, P.O. Box 2000, Chester, PA 19016.

Cached

How long does it take Social Security to notify credit bureaus of death

When someone passes away, one of the first action items is reporting the death to credit bureaus. While Social Security will eventually notify the agencies, it can take several months.

How do credit reporting agencies know when someone dies

However, once the three nationwide credit bureaus — Equifax, Experian and TransUnion — are notified someone has died, their credit reports are sealed and a death notice is placed on them. That notification can happen one of two ways — from the executor of the person's estate or from the Social Security Administration.

What happens when Social Security is notified of a death

What happens if the deceased received monthly benefits If the deceased was receiving Social Security benefits, you must return the benefit received for the month of death and any later months. For example, if the person died in July, you must return the benefits paid in August.

Can you keep the Social Security check for the month someone dies

Social Security does not pay any benefits for the month in which a person dies. This means that any payments received the month after a person dies must be returned to the SSA. The same is true for any subsequent payments. If a February social security payment is sent to a person who died in January, it cannot be kept.

Who gets the $250 Social Security death benefit

A surviving spouse, surviving divorced spouse, unmarried child, or dependent parent may be eligible for monthly survivor benefits based on the deceased worker's earnings. In addition, a one-time lump sum death payment of $255 can be made to a qualifying spouse or child if they meet certain requirements.

What debts are forgiven at death

No, when someone dies owing a debt, the debt does not go away. Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid.

How do I notify the credit bureau of a death letter

Draft a notification letter.

Specify your relationship to the deceased and provide supporting documents, as required. d. Ask that the credit bureau post on the decedent's credit report: “Deceased, Do Not Issue Credit.” e. Request a current copy of the decedent's credit report.

What documents are needed to report death to Social Security

Your Social Security number and the deceased worker's Social Security number. A death certificate. (Generally, the funeral director provides a statement that can be used for this purpose.) Proof of the deceased worker's earnings for the previous year (W-2 forms or self-employment tax return).

How do creditors find out you died

Your loved ones or the executor of your will should notify creditors of your death as soon as possible. To do so, they'll need to send each creditor a copy of your death certificate. Creditors generally pause efforts to collect on unpaid debts while your estate is being settled.

How long does Social Security pay after death

If a beneficiary dies

Let us know if a person who receives Social Security benefits dies. We can't pay benefits for the month of death. That means if the person died in July, the check received in August (which is payment for July) must be returned.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

What debt is not forgiven after death

Federal student loans are forgiven upon death. This also includes Parent PLUS Loans, which are forgiven if either the parent or the student dies. Private student loans, on the other hand, are not forgiven and have to be covered by the deceased's estate.

Does life insurance have to be used to pay the deceased debts

If you receive life insurance proceeds payable directly to you, you don't have to use them to pay your parent's debts. As the named beneficiary on a life insurance policy, that money is yours to use.

What not to do when someone dies

Top 10 Things Not to Do When Someone Dies1 – DO NOT tell their bank.2 – DO NOT wait to call Social Security.3 – DO NOT wait to call their Pension.4 – DO NOT tell the utility companies.5 – DO NOT give away or promise any items to loved ones.6 – DO NOT sell any of their personal assets.7 – DO NOT drive their vehicles.

What happens to credit bills when someone dies

Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid. Generally, no one else is required to pay the debts of someone who died.

What debts are not forgiven at death

Bottom line. Federal student loans are the only debt that truly vanishes when you pass away. All other debt may be required to be repaid by a co-owner, cosigner, spouse, or your estate.