Does Southwest credit card charge a fee?

Is there a fee for Chase Southwest credit card

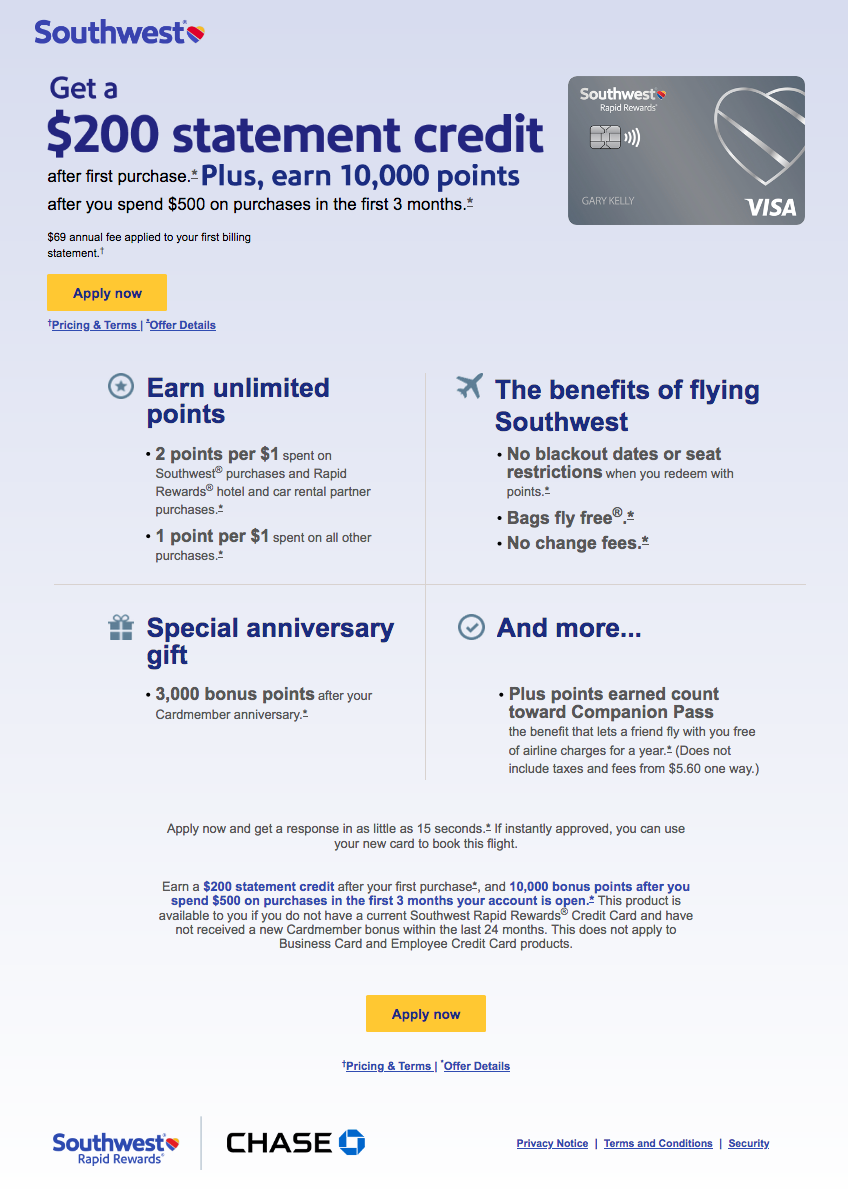

The card's annual fee is $69, but you'll earn a bonus of 3,000 Southwest points (worth ~$45 in Southwest flights) each year on your card member anniversary.

Cached

How much is Southwest visa annual fee

Earn 60,000 points

| Features | Plus Learn more | Priority Learn more |

|---|---|---|

| $75 Southwest® annual travel credit | no | yes |

| 1,500 Tier Qualifying Points towards A-List and A-List Preferred status | no | yes |

| No foreign transaction fees | no | yes |

| Annual fee | $69 | $149 |

Cached

Can you waive Southwest annual fee

Annual fee isn't waived the first year

Many airline cards with comparable annual fees waive the fee in the first year, but the Southwest Rapid Rewards® Premier Credit Card offers no such break.

Is there a fee for Southwest Rapid Rewards

Southwest Rapid Rewards® Premier Credit Card. The Premier card charges $99 per year, compared to the Plus card's $69. However, the Premier card offers additional benefits. The Southwest Rapid Rewards® Premier Credit Card offers a 6,000-point anniversary bonus vs.

Cached

How do I avoid Chase fees

You can avoid the fee on your Chase Total Checking account if any one of the following requirements are met:Electronic payments made to your Chase Total Checking account totaling at least $500.Balance in the account at the start of each day of at least $1,500.

Does Chase require monthly fees

Does Chase have a free checking account Almost all Chase checking accounts carry a monthly fee. However, there are ways to get the fee waived on most accounts, such as by keeping a certain balance in the account or setting up direct deposit. Chase does offer two checking accounts with no monthly fee.

How do I cancel my Southwest credit card after the annual fee

To cancel your Southwest Rapid Rewards Premier card, you will need to call the issuer's customer service department at 800-432-3117.

Does Southwest have an annual membership fee

All Southwest cards offer free first and second checked bags and all points you earn can be applied toward a Southwest Companion pass. If the welcome bonus is all that matters to you, stick with Southwest Rapid Rewards® Plus Credit Card, which has the lowest annual fee at $69 per year.

How do I get my annual card fee waived

How to get your card's annual fee waivedCall your issuer.See if your issuer will waive the fee in exchange for card usage.Ask your issuer to match another offer.Ask to cancel.Use military benefits.Switch to a different card.Earn rewards to offset the fee.Apply for a card that doesn't charge a fee.

Is it worth it to buy Rapid Rewards points

No, buying Southwest points is not worth it. Southwest Rapid Rewards points are worth an average of 1.33 cents each, while buying them costs around 3 cents per point, which means you would not be getting a good deal.

Why is Chase charging me a $12 service fee

Why this petition matters. Chase Bank has recently implemented a $12 monthly "service fee" to checking accounts that do not receive a direct deposit of $500 or more. According to Chase, the direct deposits "must be an ACH credit, may include payroll, pension or government benefit payments, such as Social Security."

Does Chase charge a monthly fee

Does Chase have a free checking account Almost all Chase checking accounts carry a monthly fee. However, there are ways to get the fee waived on most accounts, such as by keeping a certain balance in the account or setting up direct deposit. Chase does offer two checking accounts with no monthly fee.

How do I avoid the $12 monthly service fee Chase

Chase Bank charges a $12 monthly fee on Chase Total Checking accounts. You can avoid the fee on your Chase Total Checking account if any one of the following requirements are met: Electronic payments made to your Chase Total Checking account totaling at least $500.

How do I avoid Chase monthly service fee

Monthly Service Fee — $0 or $5A balance at the beginning of each day of $300 or more in this account.OR, $25 or more in total Autosave or other repeating automatic transfers from your personal Chase checking account (available only through chase.com or Chase Mobile® app)

Do I still need to pay annual fee if I cancel my credit card

Usually, yes—many card issuers will refund an annual fee if you close the account and request a refund quickly enough. You usually have about 30 days after an annual fee is incurred—sometimes more, sometimes less.

How hard is it to cancel a Southwest credit card

Call customer service at 1 (800) 432-3117 and enter your account number and Social Security number to verify your identity. Then, follow the prompts to speak to a customer service representative, and let them know you want to cancel.

What is Southwest $40 fee

Southwest Airlines on Monday announced a new $40 fee to let passengers board early — the latest carrier to charge additional fees for everything from priority boarding to guaranteed seats next to your kids.

Can I cancel a credit card and not pay the annual fee

Most banks and credit card companies have a grace period of at least 30 days where you can cancel the card and still get the annual fee refunded. Operating this way, you have the option to call for a possible retention offer after your annual fee posts.

Can I cancel my credit card to avoid annual fee

Usually, yes—many card issuers will refund an annual fee if you close the account and request a refund quickly enough. You usually have about 30 days after an annual fee is incurred—sometimes more, sometimes less. It varies highly by issuer and is not always guaranteed.

How many Rapid Rewards do I need for a free flight

What is Southwest Rapid Rewards

| Southwest Rapid Rewards quick facts | |

|---|---|

| Airline alliance | Doesn't belong to an alliance |

| Airline lounges | No lounge network |

| Number of miles needed for a free flight | Varies based on the cash ticket price. Generally ranges from 2,600 to over 29,000 points each way. |

| Southwest miles value | ~1.4 cents. |