Does Spotloan do credit checks?

What credit score do you need for Spotloan

Also, your credit score often needs to be at least 640 to qualify. As always, your credit score can determine the APR you're charged. The lower your credit score, the higher the interest rate—and vice versa.

Does Spotloan accept everyone

To qualify for personal loans with Spotloan Personal Loans, applicants need a minimum annual income of $12,000 or higher. Spotloan Personal Loans will consider borrowers regardless of their employment status if they can prove their ability to repay their obligations.

Cached

What do you need for Spotloan

To apply for a loan from Spotloan, you'll fill out an online application at spotloan.com. To apply, you must be age 18 or older with verifiable employment or another regular source of income, an email address, a phone number and a bank account.

Cached

Does Spotloan do a hard pull

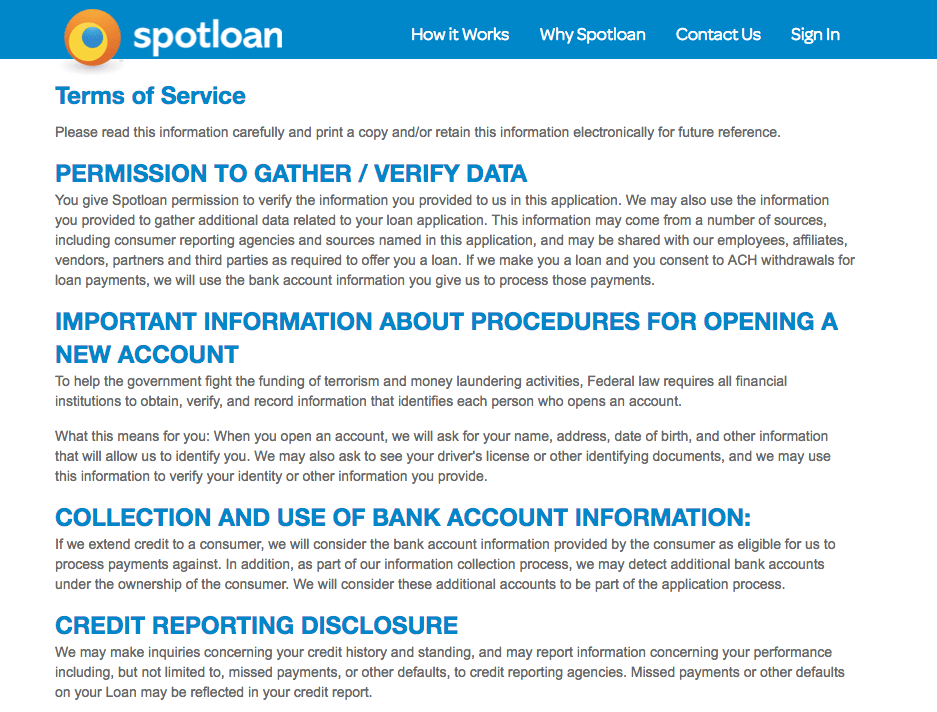

That's why you may want to investigate what kind of inquiry a lender uses before you apply for a loan. Spotloan, which offers short-term installment loans, does not use major credit reports to make credit decisions and your application will not impact your credit report.

Cached

Does Spotloan pay instantly

Most people complete the process in about 10 minutes. If you accepted your loan terms on a Monday through Friday, before 11:30 a.m. CT, Spotloan will transfer the money to your bank by no later than the end of the same business day.

Can I get a loan with 1 credit score

A score of 0 or -1 could mean that you won't get a loan, but some good banks and NBFC lenders are looking at credit appraisals, income proofs, employer and employment details etc.

How much is the Spotloan settlement check

13, 2023, Top Class Actions viewers started receiving checks in the mail from the Spotloan class action settlement worth $168. Congratulations to everyone who filed a claim and got PAID! UPDATE: The Spotloan High Interest Rates Class Action Settlement was granted final approval on July 9, 2023.

What app spots you money instantly

FloatMe can spot you up to $50*. When life gets in your face, FloatMe has your back. Take control of your finances to pay bills, pay rent, even buy groceries, with no credit check, no hidden fees, and no interest. Request Floats instantly starting at $20* cash from FloatMe when you need it most.

Can I get a loan with a credit score under 500

Rick Bormin, Personal Loans Moderator

Yes, you can get a personal loan with a credit score of 500 if you have a steady source of income, but your choices are very limited. The best way to get a personal loan with a 500 credit score is to start by checking to see if you pre-qualify for loans from major lenders.

What is the lowest credit score to borrow

Generally, borrowers need a credit score of at least 610 to 640 to even qualify for a personal loan.

Does settlement improve credit score

Debt settlement will have a negative impact on your credit score, even though you are reducing your debt obligations. High credit scores are designed to reward those accounts that have been paid on time according to the original credit agreement before they're closed.

How long does Spotloan take to deposit

If you accepted your loan terms on a Monday through Friday, before 11:30 a.m. CT, Spotloan will transfer the money to your bank by the end of the business day. If you accepted your loan terms on a Monday through Thursday between 11:30 a.m. CT and 8 p.m. CT, Spotloan will transfer your funds to your bank overnight.

What app can I use to get $500 instantly

Get up to $500 instantly (1) with ExtraCash™ from Dave. There's no interest, credit check, or late fees.

How do I borrow $200 from Cash App

How to Use Cash App BorrowOpen Cash App.Go to the “Banking” section of the home screen.Click “Borrow” if it's available to you.Tap “Unlock” to see how much you can borrow.Select your desired amount and repayment option.Agree to the terms and accept the loan offer.

What are the easiest loans to get approved for

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

Can you get a loan with a 550 credit score

Though it may be more challenging to find a lender that's willing to work with you, it is indeed possible to obtain a loan with a credit score of 550. Most lenders require a minimum credit score of between 600 and 650, but some lenders specialize in personal loans for those with lower scores.

How many points will my credit score drop if I settle a debt

100 points

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

Is it better to settle or pay in full

It's better to pay off a debt in full (if you can) than settle. Summary: Ultimately, it's better to pay off a debt in full than settle. This will look better on your credit report and help you avoid a lawsuit. If you can't afford to pay off your debt fully, debt settlement is still a good option.

What app will spot me $100 dollars instantly

EarnIn, Brigit, MoneyLion and Albert all offer immediate loans for no instant transfer fee, though some charge a membership fee. Dave and Payactiv also offer instant loans for a fee.

How can I make $1000 quick today

Food Delivery. This is one of the easiest ways to make $1,000 fast, and food delivery drivers make anywhere from $15 to $25/hour on average.Take Online Surveys.Start Freelancing.Pet Sitting and Dog Walking.Earn Cash Back When You Shop.Rent Out Your Unused Space.Rent Out Your Car.Open a New Bank Account.