Does TD Bank have pre-approval?

What credit score is needed for TD Bank

A credit score of 660 or better is required for a personal loan if you have a TD Bank checking or savings account. If not, a score of 750 is required.

Is TD Bank hard to get approved for

TD Bank credit card approval odds are best for people with a good or excellent credit score of 700+, an annual income of $50,000+, and relatively little debt. Applicants will also need to be 18+ years old with a U.S. mailing address and an SSN to get a TD Bank credit card.

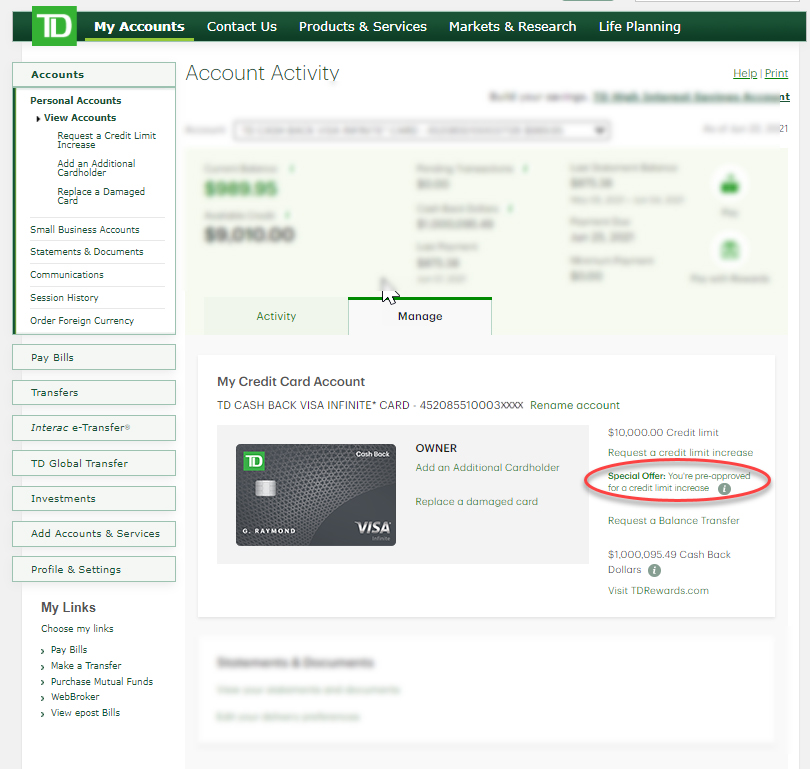

How do I check my TD pre-approval

From your credit card account activity page, click on the Manage tab. Your pre-approved credit limit offer is located just below your current credit limit.

Is TD credit card instant approval

Typically, an application will take 2 business days to process, plus an additional 7-10 business days to have the card directly mailed to your residence.

Which TD credit card is easiest to get approved

The easiest credit card to get from TD Bank is the TD Cash Secured Credit Card, which is available to applicants with bad credit. Depending on your credit score, you may be able to qualify for other TD Bank credit cards, too.

Does TD Bank do a soft credit check

TD Bank only uses a soft pull of your credit, which does not affect your score, to pre-qualify potential borrowers, and your odds of approval are very high if you get pre-qualified.

What is the easiest TD Bank credit card to get

TD Cash Secured Credit Card

The easiest credit card to get from TD Bank is the TD Cash Secured Credit Card, which is available to applicants with bad credit. Depending on your credit score, you may be able to qualify for other TD Bank credit cards, too.

What are the requirements to open a TD Bank

Opening a Personal AccountLocation of your local branch.The name of, the routing number of, and the account number at the institution you will use to fund the Opening Deposit of your new account(s).Your Social Security number.Your driver's license number.Your mother's maiden name.

How fast can I get pre-approved

Depending on the mortgage lender you work with and whether you qualify, you could get a preapproval in as little as one business day, but it usually takes a few days or even a week to receive — and, if you have to undergo an income audit or other verifications, it can take longer than that.

Which card is easiest to get approved for

FULL LIST OF EDITORIAL PICKS: EASIEST CREDIT CARDS TO GETOpenSky® Plus Secured Visa® Credit Card. Our pick for: No credit check and no bank account required.Chime Credit Builder Visa® Credit Card.Petal® 2 "Cash Back, No Fees" Visa® Credit Card.Mission Lane Visa® Credit Card.Self Visa® Secured Card.Grow Credit Mastercard.

Which bank will give credit card easily

1. HDFC Bank instant approval credit card. HDFC Bank credit cards are not only 100% secure, but they also provide instant activation and ownership.

Which bank credit card is hard to get

Centurion® Card from American Express

Why it's one of the hardest credit cards to get: The hardest credit card to get is the American Express Centurion Card. Known simply as the “Black Card,” you need an invitation to get Amex Centurion.

Does TD use Equifax or TransUnion

TransUnion

According to Loans Canada, CIBC, TD, HSBC, Desjardins, and Meridian Credit Union only use Equifax. Conversely, RBC, Laurentian Bank, and Vancity use TransUnion only. Many other lenders use both bureaus, like BMO, Scotiabank, National Bank, and Tangerine.

Does TD Bank do a hard pull for credit limit increase

When you request a TD Bank credit limit increase, TD Bank will conduct a hard pull of your credit report, which will cause a short-term dip in your credit score. TD Bank cannot do a hard pull without your permission, though.

Is TD or Chase better

If your priority is to avoid paying a monthly service fee, you may favor TD Bank over Chase. The TD Bank Convenience Checking Account has a lower minimum balance requirement than Chase Total Checking®. You'll also be eligible to waive the monthly service fee at TD Bank if you are between the ages of 17 and 23.

How much money do you need to open a bank account with TD Bank

What you pay

| Monthly Maintenance Fee | $5 |

|---|---|

| Online Statements | Free |

| Paper Statements | Free |

| Minimum Opening Deposit | $0 |

| Free with this Account | TD Bank Mobile Deposit4 |

How much does TD Bank require to open an account

What you pay

| Monthly Maintenance Fee | $15 |

|---|---|

| Checks | Discount on first order of select styles |

| Online Statements | Free |

| Paper Statements | $1 monthly fee |

| Minimum Opening Deposit | $0 |

How much does a pre-approval hit your credit

five points

A mortgage pre-approval affects a home buyer's credit score. The pre-approval typically requires a hard credit inquiry, which decreases a buyer's credit score by five points or less. A pre-approval is the first big step towards purchasing your first home.

Does a pre-approval hurt my credit score

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have. The good news is that this ding on your credit score is only temporary.

What banks give you a card instantly

Top credit cards you can use instantly after approvalBlue Cash Preferred® Card from American Express.Chase Sapphire Preferred® Card.Bank of America® Premium Rewards® credit card.Amazon Prime Rewards Visa Signature Card.United℠ Explorer Card.SoFi Credit Card.Other notable options.