Does Tesla offer 0% financing?

Can you get 0% APR on a Tesla

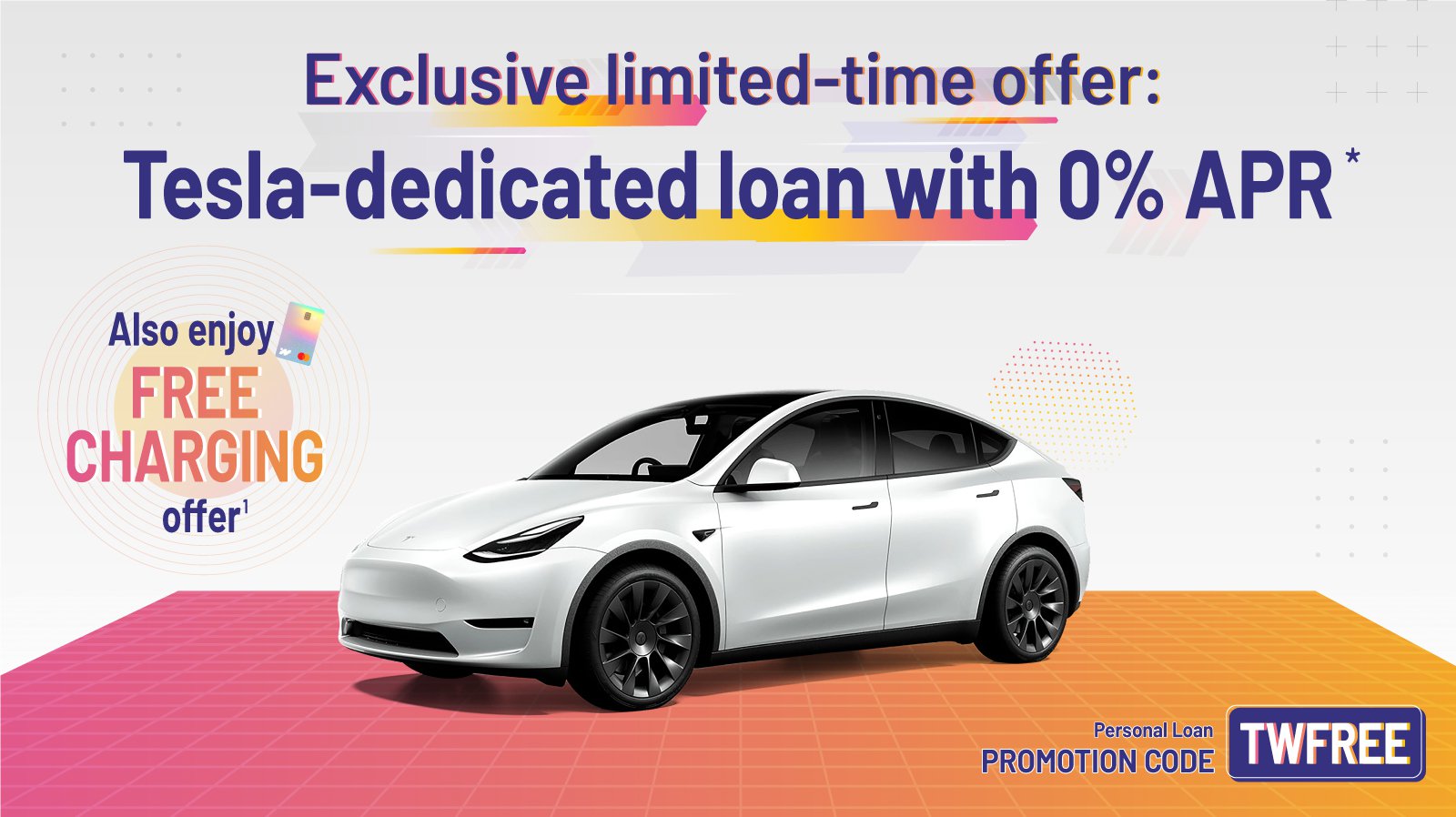

The offer is only eligible to Selected Tesla customers who fulfill designated requirements set by Tesla. , please click HERE to learn more about relevant information regarding selected Tesla customers. In just 4 simple steps done via WeLab Bank app, you can enjoy fixed APR at 0%*!

What is the interest rate for Tesla financing

Leasing a Tesla

| Tesla Model | Lease Term | APR* |

|---|---|---|

| Model 3 | 36 months | Starts at 5.37% for those with excellent credit |

| Model Y | 36 months | Starts at 6.06% for those with excellent credit |

| Model S | 24 or 36 months | Starts at 5.92% for those with excellent credit |

| Model X | 24 or 36 months | Starts at 6.57% for those with excellent credit |

Apr 29, 2023

Cached

What credit score do you need for Tesla financing

What credit score do I need to finance a Tesla Tesla does not state a minimum credit score for financing. However, as with other brands, you will have much better luck securing a lower APR if you have a better score. Try aiming for a credit score of 720 or higher to get the best possible rate.

Does Tesla offer their own financing

We provide multiple financing options for your vehicle. The Tesla financing calculator is available in the Design Studio to help estimate your payments for purchasing and leasing your vehicle. You can lease a Tesla vehicle over the terms of 24 to 36 months.

Cached

How to afford a Tesla on low income

How You Can Afford a Tesla Even If You're Not RichGet thousands of dollars back via government incentives.Switch from gas to electric and save upwards of $700 a year.Cut down on electricity costs by charging your car for free.Slash your monthly car payment using this service.Pay a lot less by buying used.

Why are Tesla loans so expensive

Tesla price financing now more expensive than predicted because of aggressive interest rate hikes. The average interest rate to finance a Tesla vehicle has climbed to 4.74% at the beginning of Q4.

What bank does Tesla use for financing

Another option is to take out a loan through Tesla's financing partners, which are currently US Bank and Wells Fargo (both have high APR). These options allow you to finance the car through Tesla, and the process is often faster and more convenient than going through a traditional bank or credit union.

Can I get a Tesla with a 700 credit score

What credit score is needed for Tesla financing Tesla does not disclose the minimum credit score required to qualify for financing. As with most lenders, however, you will have a better chance of qualifying if your scores are in the mid-600s or higher.

Can I buy a Tesla with 700 credit score

Eligibility Criteria of Tesla Financing

A minimum credit score is not required, but a 720 will help to get the best rates and options. Tesla's in-house financing is available in 26 states, including California, Florida, and Texas.

How to get best financing on a Tesla

Tesla partners with big banks like Wells Fargo and US Bank for financing. A good credit score (720 or higher) or a large down payment (typically 20%) make it more likely that you'll get approved for a lower rate. US Bank's lowest auto loan rate as of February 2023 is 6.86%.

What salary do I need to afford a Tesla

so you'll need to earn 9000 and $50 every month, or $108,600 every year to afford a Tesla model.

What salary do you need to buy a Tesla Model 3

Let's start our Tesla Model 3 demographics analysis with average household income. In 2023 a Tesla Model 3 owner has household income of $133,879 per year, up from $128,140 per year four years ago.

Does insurance cost more for Tesla

Teslas are more expensive to insure than many other cars because of their high repair costs, which increase the price of collision coverage. Your car insurance rate depends on the Tesla model and trim you choose, your location and driving history, and the amount of coverage you choose.

What is the average Tesla payment

How much is a Tesla per month Even though every car loan is different, the average monthly payment for a Tesla car loan is between $1,100 and $2,500. The actual cost of your loan each month will depend on a few things, though.

Why is Tesla insurance so high

Tesla cars are expensive to insure because they are expensive to buy and repair. Teslas have especially high collision coverage costs due to their high repair and maintenance costs, which are more expensive than other luxury or electric vehicles. Teslas can only be repaired at Tesla-approved body repair shops.

What salary do you need to afford a Tesla

so you'll need to earn 9000 and $50 every month, or $108,600 every year to afford a Tesla model.

Which bank finances Tesla

Another option is to take out a loan through Tesla's financing partners, which are currently US Bank and Wells Fargo (both have high APR). These options allow you to finance the car through Tesla, and the process is often faster and more convenient than going through a traditional bank or credit union.

What interest rate can I get with a 770 credit score

Buying a home with an 770 credit score

To illustrate this, as of Nov. 1, 2023, the average mortgage APR in the U.S. was approximately 7.1%. Borrowers with a 760 FICO Score or higher received an average APR of 6.61%, while those in the 700-759 range had an average APR of 6.83%.

How to get lower interest rate on Tesla

Tesla partners with big banks like Wells Fargo and US Bank for financing. A good credit score (720 or higher) or a large down payment (typically 20%) make it more likely that you'll get approved for a lower rate. US Bank's lowest auto loan rate as of February 2023 is 6.86%.

What credit score do you need for a Tesla Model 3 loan

Tesla does not disclose the minimum credit score required to qualify for financing. As with most lenders, however, you will have a better chance of qualifying if your scores are in the mid-600s or higher.