Does the American Express business card have an annual fee?

Does the American Express business Platinum Card have an annual fee

The Business Platinum Card® from American Express (Terms apply. See rates & fees) sports a hefty $695 annual fee, but small business owners who can take advantage of the card's many statement credits and travel benefits could find value well in excess of its annual fee.

Cached

How much does an Amex business card cost

$695

Compare to Other Cards

| The Business Platinum Card® from American Express | Ink Business Preferred® Credit Card |

|---|---|

| Apply now | Apply now |

| Annual fee $695 | Annual fee $95 |

| Regular APR 19.24%-27.24% Variable APR Rates & fees | Regular APR 20.99%-25.99% Variable APR |

| Intro APR N/A | Intro APR N/A |

Cached

Which Amex card doesn’t have an annual fee

Amex EveryDay® Credit Card

The Amex EveryDay® Credit Card*, which doesn't charge an annual fee, offers a key benefit: Cardholders can earn a 20% bonus on all points earned by making 20 purchases or more in a billing cycle.

Do you have to pay American Express business card every month

Unlike traditional credit cards, American Express cards do not have a regular APR or charge interest, as all balances must be paid in full each month.

How much income do you need for Amex business Platinum

What does your credit score need to be for the Amex Platinum card While there is no set score needed, we recommend you have a credit score of at least 670, 2 years of clean credit history, and an income of at least $50,000 per year to apply for the Amex Platinum card.

Is it hard to get American Express business Platinum

It's not hard to get the Business Platinum Card from American Express if you have a 740 credit score and a history of earning business income. This card can be most beneficial if you're a business traveler who will use the travel benefits often.

Is it hard to get an American Express business card

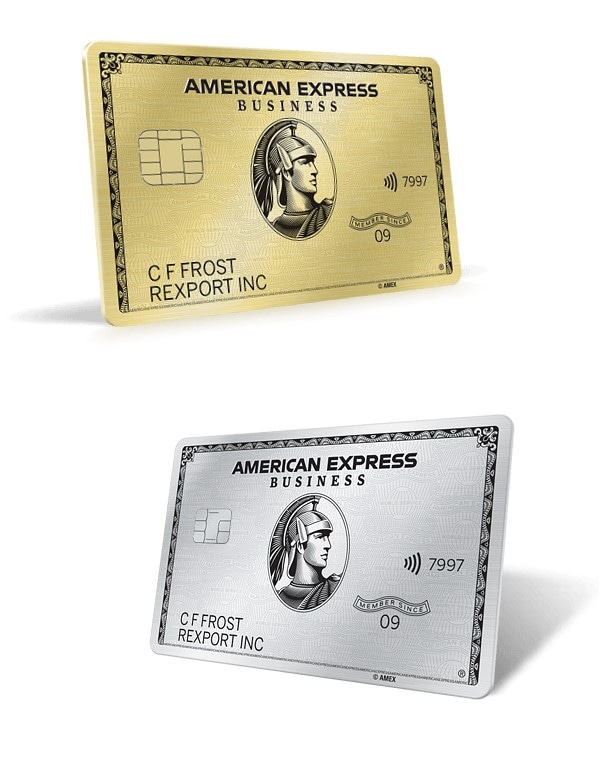

Summary. Getting the American Express® Business Gold Card isn't difficult if you have a credit score of at least 670, consistent income, and positive payment history with at least one other card.

What are the benefits of Amex business

Enjoy exceptional rewards and benefits of Business Cards from American ExpressRewards. Earn Membership Rewards®points‡, cash back in the form of a statement credit or partner rewards for purchases you and your employees make with your Business Cards.Amex Offers.Expense Tools.Support.

Why is Amex annual fee so high

Bianca Smith, WalletHub Credit Cards Analyst

The main reason why Amex cards are so expensive is that many American Express credit cards offer generous rewards rates and high-end perks, which warrant steep annual fees.

Does Amex ever waive annual fee

Amex waives the annual fee on all of their cards, including the AMEX Platinum. Cards opened while on active duty are waived with Military Lending Act (MLA). Cards opened before active duty are waived with SCRA.

Is it hard to get an American Express Business Card

Summary. Getting the American Express® Business Gold Card isn't difficult if you have a credit score of at least 670, consistent income, and positive payment history with at least one other card.

What happens if you don’t pay Amex business in full

Interest charges accrue when you don't pay the bill off in full. Pay Over Time charges an interest rate that is the same across the Green, Gold and Platinum products. As of August 2023, cardholders who use the feature will pay an APR between 15.99% to 22.99%, depending on creditworthiness.

Is Amex business a hard pull

There is not a hard pull to your credit profile when applying for an American Express® Business Line of Credit if pre-approved, therefore, applying will not have any impact on your credit score.

Is Amex Platinum for millionaires

Unlike some of the other cards on this list, The Platinum Card® from American Express is an elite card, but it's not invite-only. This accessible card is one of the best credit cards for millionaires.

What is the minimum income for Amex business Platinum

Person Income/Business Income

We recommend that your annual income be at least $50,000 or higher before applying for the Amex Platinum.

Do Amex business cards have a credit limit

If you have a Consumer or Business Green, Gold or Platinum Card, your Card does not have a credit limit.

Does the business American Express card hurt your credit

The bottom line

Business credit affects personal credit. Applying for your first business credit card will trigger a hard credit inquiry on your personal credit, which could lower your score by a few points.

Is it easy to get Amex business card

If you have a good to excellent score (670-850 points) your application for a business card may be accepted even if your business credit score is low or non-existent. The credit limit and interest rate on the card will then be based on your personal credit score.

Is Amex business the same as platinum

When spending with the Amex Platinum card and Amex Business Platinum card, you'll find that the earning power of the 2 cards is slightly different: Amex Platinum card: 5x points per dollar spent on flights booked directly through the airline and Amex Travel, up to $500,000 on these purchases per calendar year.

How do I get out of American Express annual fee

Most people will need to pay the $695 annual fee on The Platinum Card® from American Express in full each year. However, there are a few ways to waive the Amex Platinum annual fee if you're eligible. One way to have the fee waived in full is to qualify under the Military Lending Act or Servicemembers' Civil Relief Act.