Does the IRS use 2023 tax for stimulus?

Will IRS use 2023 instead of 2023 for stimulus

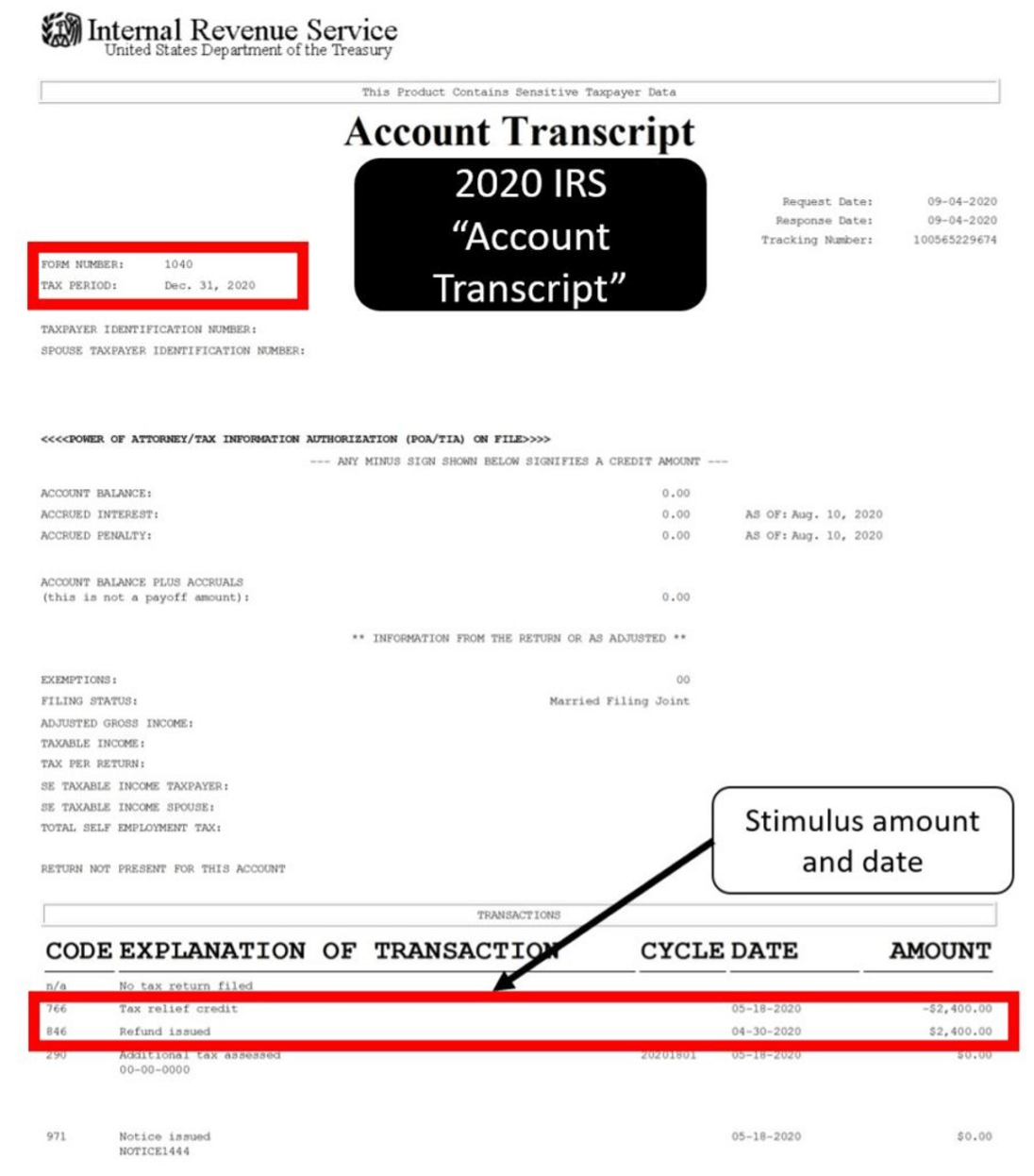

Payments are automatic for eligible people who filed a tax return for 2023 or 2023. Typically, the IRS uses information from the 2023 tax return to calculate the Economic Impact Payment. Instead, the IRS will use the 2023 return if the taxpayer has not yet filed for 2023.

Cached

Is EIP based on 2023 or 2023

The eligibility criteria for the RRC is generally the same as for EIPs, except that the RRC is based on tax year 2023 information, instead of the tax year 2023 or tax year 2023 information used for EIP1 and tax year 2023 information used for EIP2.

Will I get stimulus check if I owe 2023 taxes

Yes, you can still receive a stimulus check even if you owe back taxes.

Can I still claim my 2023 stimulus check

First and Second Stimulus Check

The tax filing extension deadline is October 15, 2023. If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks.

Can I use my 2023 taxes for 2023

You will need your 2023 tax return to take advantage of the lookback. If you earned less in 2023 than in 2023, then you can choose which income to use. If your 2023 earnings were higher than in 2023, you must use your 2023 income.

Can I amend my 2023 tax return to get a stimulus check

You can include additional changes to your originally filed return on the “Stimulus Payment” Form 1040X. However, the only information that will be used to figure your stimulus payment amount is the information on your original return and the qualifying income you reported on this Form 1040X.

Is EIP3 based on 2023 tax return

The amount of the third payment is based on your latest processed tax return from either 2023 or 2023. If your 2023 return hasn't been processed, the IRS used 2023 tax return information to calculate the third payment.

What tax year is the EIP based on

The payment is based on adjusted gross income, the number of eligible individuals, and the number of qualifying children. The Economic Impact Payment is considered an advance credit against 2023 tax. Taxpayers will not include the payment in taxable income on their 2023 tax return or pay income tax on the payment.

What happens if I didn’t receive 2023 stimulus

Please note: If you didn't receive the first or second stimulus payments, even though you're eligible based on your income, you need to file or amend your Tax Year 2023 returns to receive those payments. Learn more about your options if you need to amend your taxes on the IRS page.

How do I claim an expired stimulus check

What you need to do. Call us at 800-829-0115 to request a replacement check.

Can I use my 2023 taxes for 2023

Eric Smith, an I.R.S. spokesman, said the agency accepts electronically filed returns for the current season and two years prior. For this year, that means you can electronically file returns for tax years 2023, 2023 and 2023.

Why can I use my 2023 income for 2023 taxes

Can I elect to use my 2023 earned income to figure my Earned Income Tax Credit for 2023 (added March 2, 2023) A15. Yes. For 2023, eligible taxpayers can choose to figure the Earned Income Tax Credit using their 2023 earned income if it was higher than their 2023 earned income.

How do I correct my tax return for a stimulus check

Filing an Amended Tax Return

If you need to amend your tax return and filed your original return electronically, you can also file the amended return electronically. Of course, you can also submit a paper version of Form 1040-X and receive a paper check if you're due a refund.

Will the IRS reissue a stimulus check

If the check wasn't cashed, you'll receive a replacement check once the original check is canceled. If the refund check was cashed, the Bureau of the Fiscal Service (BFS) will provide you with a claim package that includes a copy of the cashed check.

What tax return is $1,400 stimulus based on

“Individuals must claim the 2023 Recovery Rebate Credit on their 2023 income tax return in order to get this money,” the IRS said in its fact sheet. To see if you are eligible for a payment, you can find more information on the Recovery Rebate Credit on the agency's website.

What tax year is EIP3 based on

The amount of the third payment is based on your latest processed tax return from either 2023 or 2023. If your 2023 return hasn't been processed, the IRS used 2023 tax return information to calculate the third payment.

What tax year is the third stimulus check based on

The third-round Economic Impact Payment was an advance payment of the tax year 2023 Recovery Rebate Credit. The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual's 2023 or 2023 income tax return.

What tax year is eip3 based on

The amount of the third payment is based on your latest processed tax return from either 2023 or 2023. If your 2023 return hasn't been processed, the IRS used 2023 tax return information to calculate the third payment.

Is it too late to claim missing stimulus check

Stimulus Update: It Is Not Too Late to Claim Missed Stimulus Checks on Your Tax Returns.

Will I get a second stimulus check if I didn’t file 2023 taxes

Will I get the second stimulus check If you did not file a 2023 tax return, then the IRS didn't send your second stimulus check automatically.