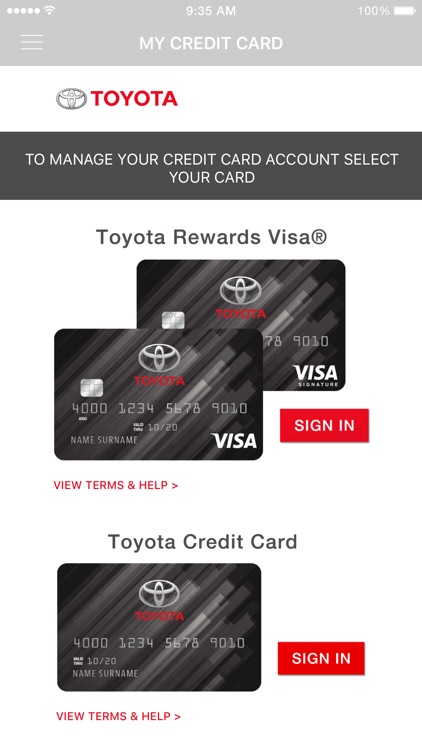

Does the Toyota credit card have an app?

How do I check the balance on my Toyota credit card

The Toyota Credit Card phone number for customer service is (844) 271-2712. You can use this number to check your account balance, make a payment, or for other general customer service inquiries. Alternatively, you can use the card's online Virtual Assistant or contact customer service via mail.

How do I pay my Toyota credit card

The easiest way you can pay your Toyota Credit Card is either online or over the phone at (844) 271-2704. Alternatively, you can make a payment via mail.

Cached

Can you only use the Toyota credit card at Toyota

Get More with the Toyota Rewards Card

This Toyota Rewards Credit Card can be used at more than just your local Toyota dealership, you can use it at the gas station, your favorite Jacksonville restaurants, online purchases, or anywhere a Visa card is accepted!

Cached

What bank does Toyota credit card use

Comenity Capital Bank

Toyota Rewards Visa® Credit Card Accounts are issued by Comenity Capital Bank pursuant to a license from Visa U.S.A. Inc.

Cached

Can I use my Toyota credit card anywhere

Cardholders earn 5 points per dollar spent at Toyota dealerships and 2 points per dollar on gas, dining, and entertainment. All other purchases earn 1 point per dollar. Because it's a Visa, this card can be used almost anywhere in the world.

How do I check my credit card status on the app

How else can I check my credit card application status Major credit card issuers have customer service phone lines that you can usually use to check an application status. The line might quickly lead to a specialist who can provide detailed information about your credit card application, if available.

How do I set up payment on my Toyota app

With the toyota. App you can conveniently link and manage your monthly toyota financial service payments all from the palm of your hand scroll to the toyota financial services tile to start the setup

What credit score do you need for Toyota Rewards Visa

Compare to other cards

| Toyota Rewards Visa® | AAdvantage® Aviator® Red World Elite Mastercard® | AAdvantage® Aviator® Silver Mastercard® |

|---|---|---|

| Recommended Credit Score 720850excellent | Recommended Credit Score 690850good – excellent | Recommended Credit Score 720850excellent |

Is Toyota Motor credit the same as Toyota Financial

Toyota Financial Services (TFS) is an umbrella brand that markets the products of Toyota Motor Credit Corporation (TMCC) and Toyota Motor Insurance Services (TMIS).

What is the highest credit limit for credit one

Key Features of the Credit One Bank Platinum Visa for Rebuilding CreditCredit Limit. This card carries a minimum credit limit of $300 and a maximum credit limit of $1,500.Credit Limit Increase.Earning Cash Back Rewards.Redeeming Cash Back Rewards.Free FICO Score Each Month.Important Fees.Credit Required.

How do I activate my credit card on my I mobile app

Activate ICICI Credit Card through iMobile AppDownload and Install the iMobile App from the App Store.Login using your ID and Password.Then go to the Services and Aadhar option.Choose the Card Services option.Then touch the Generate Credit Card PIN option.Provide the necessary details as asked on the iMobile App.

Is it smart to pay off your car

The bottom line

Paying off a car loan early can save you money — provided the lender doesn't assess too large a prepayment penalty and you don't have other high-interest debt. Even a few extra payments can go a long way to reducing your costs.

What is the lowest credit score Toyota will finance

610

The primary factor used to determine car finance eligibility is a credit score. With Toyota financing, for example, you must have a minimum credit score requirement of 610 to qualify for a loan. You should note, however, that an auto loan's interest rate also depends on your credit score.

Can you make a payment with a credit card for Toyota financial

Unfortunately, we can't process credit or debit card payments. However, we do offer a number of other options to help you keep your account up to date: Pay Online – This flexible, convenient and secure service allows you to schedule a one-time or recurring payment, and avoid writing monthly checks.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

What is a respectable credit limit

A good credit limit is above $30,000, as that is the average credit card limit, according to Experian. To get a credit limit this high, you typically need an excellent credit score, a high income and little to no existing debt.

How do I activate my credit card without the app

You can easily activate your credit card by reaching out to the bank's customer care service. Once you contact the bank's customer support department, they will guide you in activating your credit card. You can visit the bank's official website to find the customer care numbers.

How do I activate my virtual credit card

Go to pay.google.com. Payment methods. Find the card that you want. Tap Turn on virtual card.

What happens if I pay an extra $100 a month on my car loan

Your car payment won't go down if you pay extra, but you'll pay the loan off faster. Paying extra can also save you money on interest depending on how soon you pay the loan off and how high your interest rate is.

Will it hurt my credit to pay off a car loan early

Paying off your car loan early can hurt your credit score. Any time you close a credit account, your score will fall by a few points. So, while it's normal, if you are on the edge between two categories, waiting to pay off your car loan may be a good idea if you need to maintain your score for other big purchases.