Does too many credit cards affect buying a house?

Does having a lot of credit cards affect buying a house

Credit card debt can impact your ability to qualify for funding when seeking a mortgage. That's partially because the card's interest rates can spiral out of control if payments are missed. Getting a mortgage with credit card debt is really all about determining the risk you present to the lender.

Cached

Can too many credit cards affect mortgage

Having multiple credit cards, even if you're not using them, increases your total credit limit across all of your credit cards. This can have a very negative impact on your mortgage application.

How many credit cards can I have to buy a house

The number of accounts the lenders requests you to close depends on how many accounts you have open and your monthly payments. Although there is no magic number, having two-to-three credit card accounts is usually a good number but it depends on the balances, monthly payments and terms for your accounts.

Cached

Should I stop using credit cards before buying a house

In most cases, it makes sense to pay off credit card debt before buying a home. Paying off credit card debt can increase your credit score and decrease your debt-to-income ratio, both of which may qualify you for lower mortgage rates.

Is 20 credit cards too many

There's no such thing as a bad number of credit cards to have, but having more cards than you can successfully manage may do more harm than good. On the positive side, having different cards can prevent you from overspending on a single card—and help you save money, earn rewards, and lower your credit utilization.

Is 5 credit cards too many

How many credit cards is too many or too few Credit scoring formulas don't punish you for having too many credit accounts, but you can have too few. Credit bureaus suggest that five or more accounts — which can be a mix of cards and loans — is a reasonable number to build toward over time.

Do lenders look at how many credit cards you have

There isn't a set number of credit cards you should have, but having less than five credit accounts total can make it more difficult for scoring models to issue you a score and make you less attractive to lenders.

Do mortgage lenders look at credit cards

Your credit card usage can make or break your mortgage loan approval. Lenders look not only at your credit score but also at your debt-to-income ratio, which includes the payments on your credit cards.

Is 10 credit cards too many

There is no universal number of credit cards that is “too many.” Your credit score won't tank once you hit a certain number. In reality, the point of “too many” credit cards is when you're losing money on annual fees or having trouble keeping up with bills — and that varies from person to person.

How long before buying a house should you stop applying for credit cards

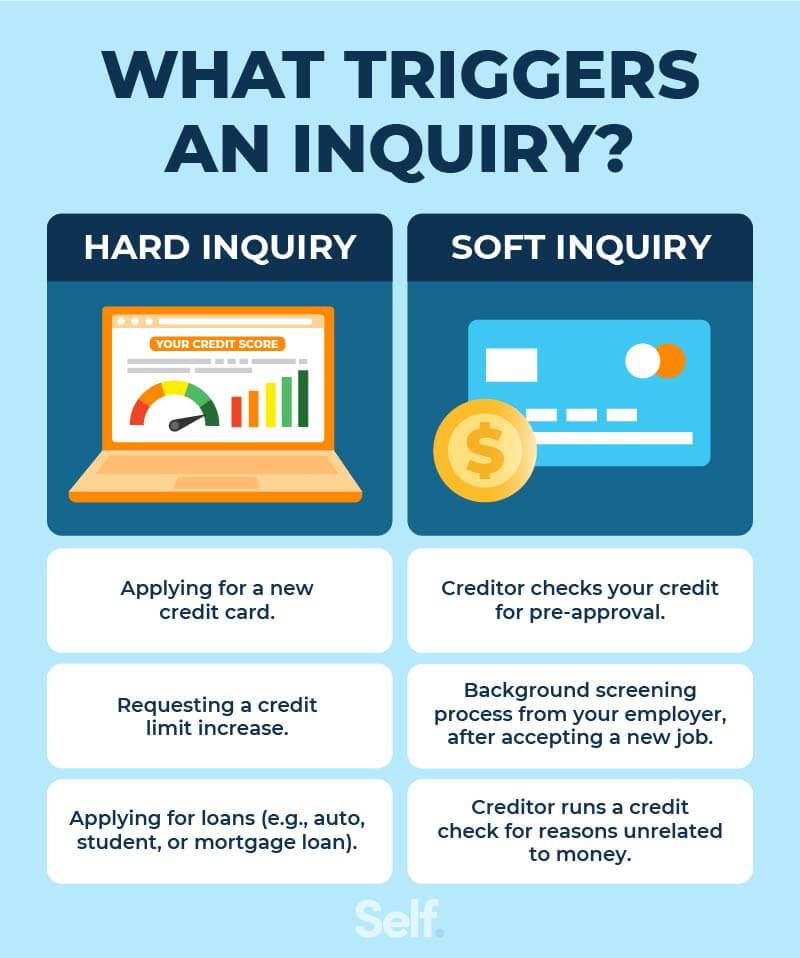

Depending on how soon you plan on buying a house, you might be able to apply for a new credit card before. At a minimum, apply for a home mortgage at least three months after you apply for a new credit card. Ideally, wait six months. This waiting period gives your credit score time to rebound from the recent inquiry.

Does credit card usage affect mortgage approval

Your credit card usage can make or break your mortgage loan approval. Lenders look not only at your credit score but also at your debt-to-income ratio, which includes the payments on your credit cards. So improper use of your credit cards could make it harder to get approved for a mortgage.

Is it bad to have 14 credit cards

There is no universal number of credit cards that is “too many.” Your credit score won't tank once you hit a certain number. In reality, the point of “too many” credit cards is when you're losing money on annual fees or having trouble keeping up with bills — and that varies from person to person.

Is it OK to have 15 credit cards

Having too many open credit lines, even if you're not using them, can hurt your credit score by making you look more risky to lenders. Having multiple active accounts also makes it more challenging to control spending and keep track of payment due dates.

Is it bad to have 12 credit cards

There is no universal number of credit cards that is “too many.” Your credit score won't tank once you hit a certain number. In reality, the point of “too many” credit cards is when you're losing money on annual fees or having trouble keeping up with bills — and that varies from person to person.

How many credit cards do lenders like to see

If your goal is to get or maintain a good credit score, two to three credit card accounts, in addition to other types of credit, are generally recommended. This combination may help you improve your credit mix. Lenders and creditors like to see a wide variety of credit types on your credit report.

Is it bad to have 7 credit cards

Is it bad to have multiple credit cards No, experts say, if you handle your credit wisely, keep your credit line utilization ratio below 30%, and keep track of payment due dates.

How many credit cards is too many to have open

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

Can a new credit card affect closing on a house

The answer is yes. A new credit card application before you close on a home could affect your mortgage application. A mortgage lender will usually re-pull your credit before closing to ensure you still qualify and that new credit was not opened.

Do mortgage lenders look at your spending

They will look at things like how much you spend on credit cards, how much you spend on groceries, and how much you spend on entertainment. Mortgage lenders want to see that you are living within your means and that you are not spending more than you can afford.

How much debt is too much to buy a house

Debt-to-income ratio targets

Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high. The biggest piece of your DTI ratio pie is bound to be your monthly mortgage payment.