Does unpaid insurance go on your credit?

Do insurance payments go on your credit report

Insurance companies don't report information about your premium payments or claims (or lack thereof) to the national credit bureaus. Some insurers use credit checks to help set your premiums, however, and failure to pay insurance bills could lead to negative entries on your credit report.

Cached

Can unpaid insurance premiums go to collections

If you're behind on your insurance premium, your outstanding balance could be sent to collections. That delinquent account will likely be reported on your credit report and drag down your credit score.

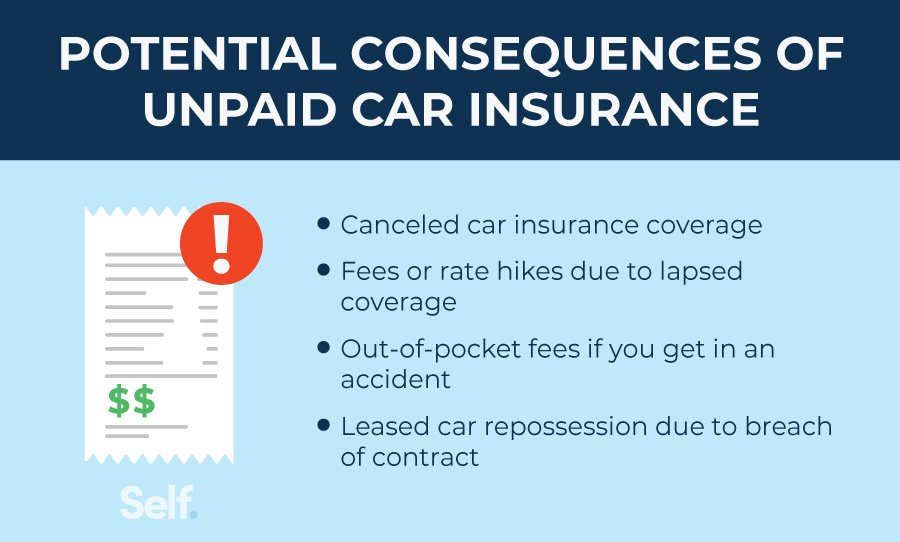

What happens if you don’t pay insurance

If you don't pay your insurance premiums, your policy will lapse, and you won't have coverage. That means that, depending on where you live, it might be illegal to continue driving your car. Doing so anyways could mean pricey fines and even license suspension, depending on your state.

Do insurance companies affect credit score

It is true that insurance companies check your credit score when giving you a quote. However, what they're doing is called a 'soft pull' — a type of inquiry that won't affect your credit score. You'll be able to see these inquiries on your personal credit reports, but that's it.

What bills affect your credit score

Only those monthly payments that are reported to the three national credit bureaus (Equifax, Experian and TransUnion) can do that. Typically, your car, mortgage and credit card payments count toward your credit score, while bills that charge you for a service or utility typically don't.

Is car insurance considered debt

More in depth: Monthly Debt Service is a potentially misleading term, as it is limited to certain monthly debts. It does not include health insurance, auto insurance, gas, utilities, cell phone, cable, groceries, or other non-recurring life expenses.

How long before insurance goes to collections

The grace period provided until the auto insurance company sends you to collections depends on the company. Some may send the collections agencies as soon as after one month of late payment, while others will wait up to 6 months. However, different companies operate within their timeline and regulations.

Does paid collection look better than unpaid

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years.

How long does insurance last without paying

What is a car insurance lapse grace period Your car insurance policy won't be cancelled immediately because you miss a payment. Auto insurance companies are required by state law to provide notice before cancelling your policy. Depending on the state, you'll usually have between 10 and 20 days.

What is the insurance collection process

Insurance debt collection is a thought-out process that involves three important aspects of successful debt recovery which include: Commercial credit score and credit risk analysis. Analysis of company credit records gives us the platform on which to build our case against a creditor.

Why is insurance tied to credit score

The reason insurers check your credit is because studies have shown that credit rating tends to be a good indicator of how many claims a driver will file. That allows insurers to match more expensive rates with drivers who will likely use their insurance more.

What are 3 items not included in a credit score

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education.

What brings your credit score up the most

One of the best things you can do to improve your credit score is to pay your debts on time and in full whenever possible. Payment history makes up a significant chunk of your credit score, so it's important to avoid late payments.

Will not paying my car insurance affect my credit score

The effect of NOT paying your car insurance

If you are late with your car insurance, utility bills, or other payments, they may eventually go to collections. When that happens, it can make a negative mark on your credit score. That can affect how easily you qualify for loans, credit cards, and other credit products.

What is not included in debt

It should be noted that the total debt measure does not include short-term liabilities such as accounts payable and long-term liabilities such as capital leases and pension plan obligations.

Does insurance send you to collections

Yes. Auto insurance can send you to collections under the circumstances that you default on your agreed payments.

Do unpaid collections go away

A debt doesn't generally expire or disappear until its paid, but in many states, there may be a time limit on how long creditors or debt collectors can use legal action to collect a debt.

Is it OK not to pay collections

Several potential consequences of not paying a collection agency include further negative impacts to your credit score, continuing interest charges and even lawsuits. Even if you can't pay the debt in full, it's often best to work with the collection agency to establish a payment plan.

How do I get around my insurance lapse

What to do if you have a lapse in coverageCall your insurance agent. It's best to confirm with your insurer if a lapse has occurred or if you are just overdue on your payment.Many insurers offer a grace period.Set up a new policy.Avoid driving.

Can a lapsed insurance policy be reinstated

Typically, insurers allow parties to reinstate a lapsed policy within three to five years after the lapse. The process will be more labor-intensive than simply paying during the grace period, however.