Does Vans have a credit card?

Does Vans have a payment plan

Pay in 4 interest-free installments so you can spread the cost. Pay later in 4 installments. The first payment is taken when the order is processed and the remaining 3 are automatically taken every two weeks.

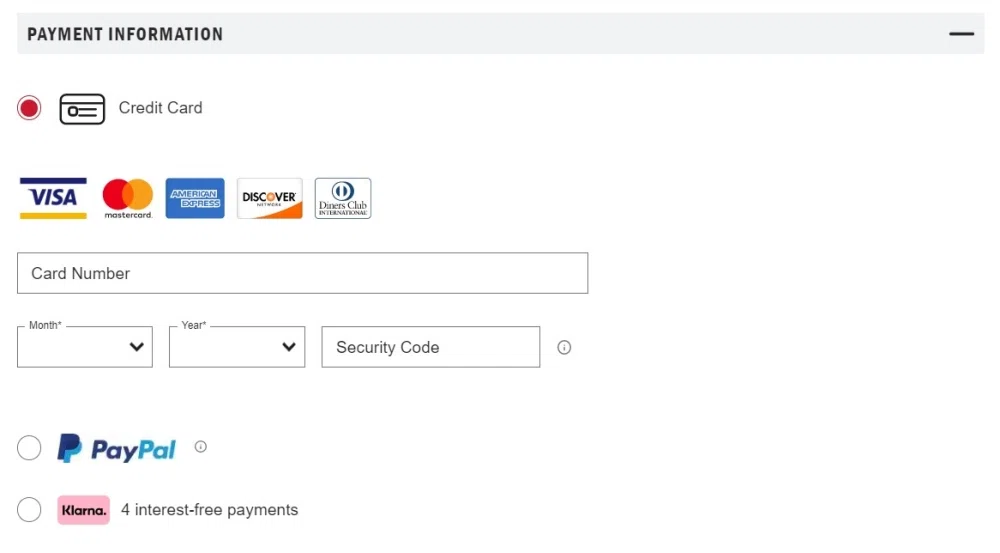

What payment methods does Vans accept

TERMS OF SALE – PAYMENT TERMS

We accept the following payment methods for purchases made on our Site: Visa (credit/debit), MasterCard (credit/debit), Maestro, Visa Electron, American Express, Paypal, ApplePay and Klarna Pay in 3.

Cached

Does Vans do pay later

Pay for your next purchase at Vans in 4 installments over 6 weeks when you check out with Zip.

Cached

Who owns Capital One credit card

Meet Our Founder. Mr. Fairbank is founder, Chairman, Chief Executive Officer, and President of Capital One Financial Corporation.

How long can you finance a van

Lenders offer payment plans with term lengths up to 20 years. Unsecured personal loans are not backed by collateral, meaning you do not run the risk of losing your van if you cannot pay off the loan. The interest rates for unsecured personal loans tend to be higher, especially for those with poor credit.

Can you use Klarna for Vans

Vans is already smoooth, so you can use the Klarna payment option you like, right on the checkout page. Pay in 4. Take control of your budget. Use Klarna to split the cost of your purchase into 4 smaller interest-free payments, paid every 2 weeks.

Do Vans run big or small

Most Vans do fit true to size, especially the core models like the Old Skools or Authentics. Some of the other models like the Eras or other Vans Vault collaborations, may run a little bigger. Vans are such a simple shoe, especially compared to other sportswear or high fashion sneakers.

Can I buy something and pay later

Buy now, pay later (BNPL) is a type of short-term financing. These loans are also called point-of-sale (POS) installment loans. Consumers can make purchases and pay for them over time after an up-front payment. Buy now, pay later plans typically charge no interest.

What companies allow you to pay later

The 5 best 'buy-now, pay-later' platforms of 2023Sezzle.Zip.Klarna.Afterpay.Paypal.

Is Capital 1 a good credit card

Capital One offers some of the best cash-back and rewards credit cards available to consumers and small business owners. The Savor and Venture cards both rank on Select's list of best dining and travel cards, respectively, and other cardholders can earn generous rewards on everyday spending.

Is Capital One an actual credit card

Capital One offers an impressive lineup of credit cards for a variety of financial needs, including cash back, travel, business and credit-building.

Is 72-month car loan bad

Is a 72-month car loan worth it Because of the high interest rates and risk of going upside down, most experts agree that a 72-month loan isn't an ideal choice. Experts recommend that borrowers take out a shorter loan. And for an optimal interest rate, a loan term fewer than 60 months is a better way to go.

How much is the payment on a 30 000 car

With a $1,000 down payment and an interest rate of 20% with a five year loan, your monthly payment will be $768.32/month.

Do you need credit to buy with Klarna

Klarna does not have a minimum credit score requirement for its pay-in-four credit product.

Who is approved for Klarna

Be at least 18. Have a valid bank card/bank account. Have a positive credit history. Be able to receive verification codes via text.

Should I buy Vans a half size bigger

Most Vans do fit true to size, especially the core models like the Old Skools or Authentics. Some of the other models like the Eras or other Vans Vault collaborations, may run a little bigger. Vans are such a simple shoe, especially compared to other sportswear or high fashion sneakers.

Should Vans be tight or loose

Tie them up as normal – unless you're breaking in a pair of our Slip-Ons of course – but don't lace them up too tight! The idea is to stretch the shoe out slightly for a more comfortable and personal fit to you. Wear your Vans around the house when you're in – an hour or two each evening is perfect.

How do you qualify for buy now, pay later

Applying for a Buy Now, Pay Later loan

Generally, you must: be at least 18 years old. have a mobile phone number. and have a debit card, credit card, or bank account to make payments.

How do you qualify for pay later

Be 18 years of age or older. Be a U.S. citizen or a lawful resident with a valid, physical U.S. address that's not a P.O. Box. Set up Apple Pay with an eligible debit card on your device. You can only make Apple Pay Later down payments using a debit card.

Is there an Afterpay that doesn’t require credit

No credit check is required to use AfterPay, and no interest is charged. Customers can sign up for a free AfterPay account, shop at select online retailers, and then use AfterPay to make purchases.