Does WIFI bill affect credit?

Does having a wifi bill in your name build credit

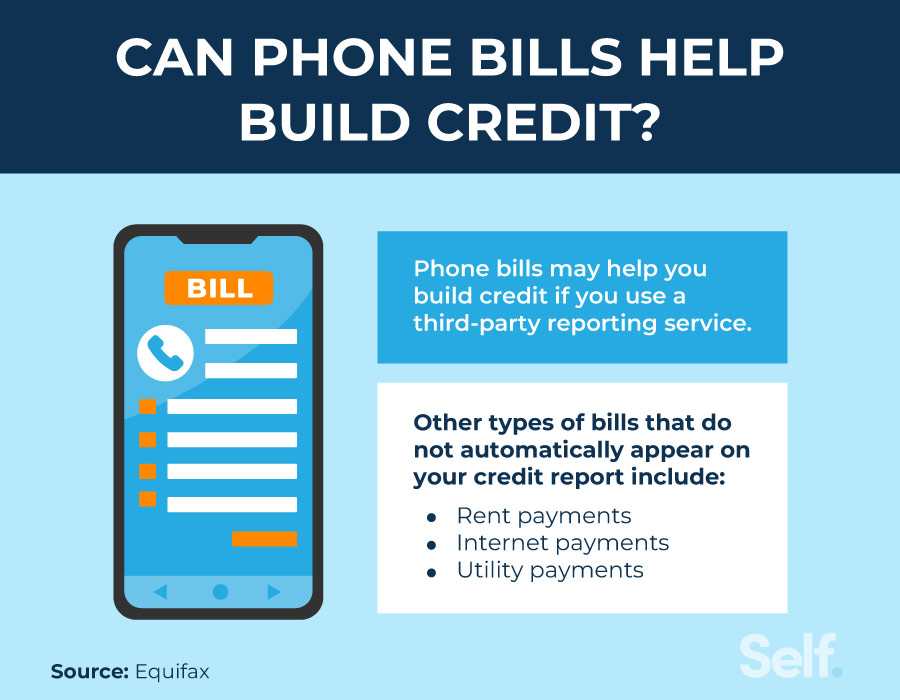

Paying your monthly utility bills — water, gas, trash, electric, cable and internet — can help you build your credit if those payments are paid on time as agreed and are reported to the credit bureaus.

Cached

What bills affect your credit

Here are the main six bills to be aware of when building up your credit score.Rent Payments. Before property management platforms, renters were unable to report rent payments to credit bureaus to build their credit health.Utility Bills.Auto Loan Payments.Student Loan Payments.Credit Card Payments.Medical Bills.

Cached

Do utility bills build credit

You cannot usually use utility bills to improve your credit. Most utility bills typically have no impact on your credit score because the information is not generally reported to credit bureaus as they are not credit accounts.

Do Internet providers report credit

Unfortunately, most cable companies, like many other utilities, don't report payments to credit reporting agencies. With no information, it's impossible for these agencies to use this information when calculating your credit score. So, making these payments on time typically doesn't impact your credit score.

Cached

What pops up on your Wi-Fi bill

Wi-Fi bills only show the devices that accessed the internet and how much data they used, not the websites that were visited. That said, if a Wi-Fi admin wanted to see the activity on their network, they could check the router logs at any time.

How do I remove utility bills from my credit report

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

What brings your credit score down the most

5 Things That May Hurt Your Credit ScoresHighlights: Even one late payment can cause credit scores to drop.Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

What brings up your credit score the most

One of the best things you can do to improve your credit score is to pay your debts on time and in full whenever possible. Payment history makes up a significant chunk of your credit score, so it's important to avoid late payments.

What increases your credit score

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit.

Does paying Netflix build credit

If you've wondered whether Netflix payments can help you build credit, the short answer is yes. Almost all streaming-service subscriptions can help build and bump up your credit scores.

Does internet bill go to collections

If you default on a credit card, loan, or even your monthly internet or utility payments, you run the risk of having your account sent to a collection agency. These third-party companies are hired to pursue a firm's unpaid debts. You're still liable for your bill even after it's sent to a collection agency.

Can the Internet bill show your sites

Can you see a person's internet activity on their Wi-Fi bill No. Wi-Fi bills only show the devices that accessed the internet and how much data they used, not the websites that were visited.

Can my parents see my search history through the Wi-Fi bill

No, your parents cannot see your internet history on the bill. The bill is unable to record destination addresses, sites, or web surfing. However, your parents will be able to see if you have made any purchases that were directly charged to your phone service, as those will be presented in the bill.

Can you delete Wi-Fi history

Sign in to your router. The default username and password are on your router. Find the admin panel in the settings to access your router logs. Click on the “Clear Logs” button to delete your Wi-Fi history.

What utilities affect credit score

The Takeaway. With rent, phone bills, electric bills, and other utilities, on-time payments or one late payment won't make any difference to your credit score, because they're not considered credit accounts by the three major credit bureaus.

How long does utility debt stay on credit report

seven years

A utility bill sent to collections will impact your credit score. Like any other delinquent account, the debt can stay on your credit report for up to seven years, even if you've paid the bill.

Why is my credit score going down if I pay everything on time

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

What causes a 500 credit score

FICO® Scores in the Very Poor range often reflect a history of credit missteps or errors, such as multiple missed or late payments, defaulted or foreclosed loans, and even bankruptcy.

How to build a 850 credit score

I achieved a perfect 850 credit score, says finance coach: How I got there in 5 stepsPay all your bills on time. One of the easiest ways to boost your credit is to simply never miss a payment.Avoid excessive credit inquiries.Minimize how much debt you carry.Have a long credit history.Have a good mix of credit.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.