Does writing letters to credit bureaus work?

Does sending letters to credit bureaus work

A credit dispute letter doesn't automatically fix this issue or repair your credit. And there are no guarantees the credit reporting agency will remove an item—especially if you don't have strong documentation that it's an error. But writing a credit dispute letter costs little more than a bit of time.

Cached

Do 609 letters really work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Cached

Do goodwill letters to creditors work

One possible solution: You may be able to remove late payments on your credit reports and start to improve your credit with a “goodwill letter.” A goodwill letter won't always work, but some consumers have reported success. It's worth trying because these derogatory marks on your credit can last seven years.

Is it better to write or type dispute letters

Write clearly or type your complaint. If your handwriting is legible, feel free to handwrite your complaint. If it's not, type it.

Cached

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

Does sending someone to collections affect their credit

Unfortunately, a debt in collections is one of the most serious negative items that can appear on credit reports because it means the original creditor has written off the debt completely. So when a debt is sent to collections, it can have a severe impact on your credit scores.

What is the 11 word credit loophole

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

Can a goodwill letter remove a charge-off

Request a goodwill adjustment: You can write a goodwill letter to your debt owner explaining your situation and asking them to remove the charge-off from your report. If you're lucky, they'll say yes.

How well do goodwill letters work

There's no guarantee that a goodwill letter will work, and there's no officially approved formula to follow in order to give yourself the best chance of success. Keep in mind that because creditors aren't required to consider your request, you may get no response at all.

What is the most effective way to dispute a credit report

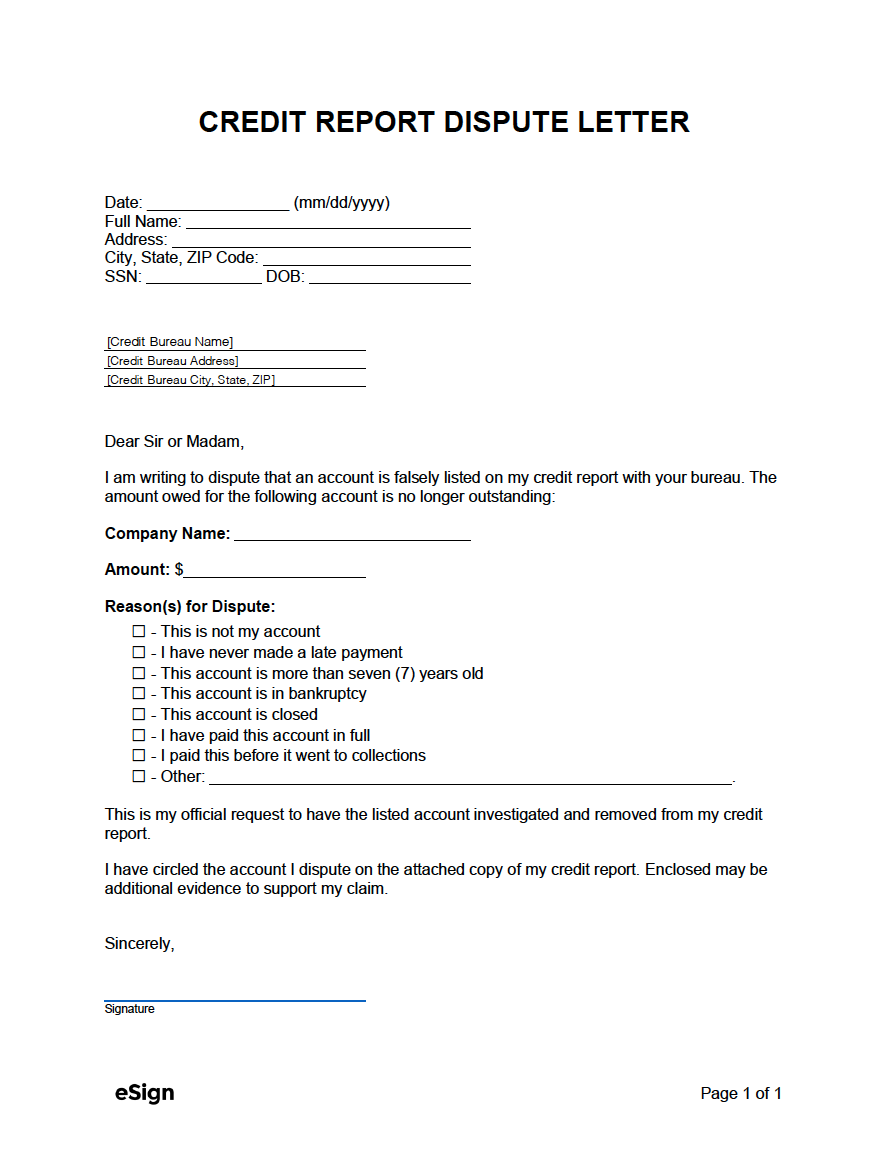

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

How do I get collections removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

What does the 15 3 credit hack do

The 15/3 hack can help struggling cardholders improve their credit because paying down part of a monthly balance—in a smaller increment—before the statement date reduces the reported amount owed. This means that credit utilization rate will be lower which can help boost the cardholder's credit score.

How to build a 900 credit score

Tips to Perfect Your Credit ScorePay your credit card bills often.Keep a solid payment history.Consider your credit mix.Increase your credit limit.Don't close old accounts.Regularly monitor your credit report.Only apply for credit when you really need it.

What is a 611 credit letter

The 611 credit dispute letter is a follow-up letter when a credit agency replies that they have verified the mentioned information. It requests the agency's verification method of the disputed information and refers 611 Section of the Fair Credit Reporting Act.

How do I remove a charge-off without paying

Having an account charged off does not relieve you of the obligation to repay the debt associated with it. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily be rebuilt by paying other bills on time.

Do charge offs go away after 7 years

How long will the charge-off stay on credit reports Similar to late payments and other information on your credit reports that's considered negative, a charged-off account will remain on credit reports up to seven years from the date of the first missed or late payment on the charged-off account.

How long does a creditor have to respond to a goodwill letter

A goodwill letter is an unofficial letter sent to a creditor. As such, there's no timeline requirement or even an obligation on the creditor to respond to the letter.

Is there a downside to disputing credit report

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.