How can I add my bills to my credit report?

Can you add your utility bills to your credit report

While you can't report your utility bills and rent payments directly to the credit bureaus, there are alternative options. You can use a service provider to report these payments for you or use a credit card to pay these bills. These services can be ideal for those with thin credit files.

Cached

What bills can I report to build credit

What Bills Help Build CreditRent Payments. Before property management platforms, renters were unable to report rent payments to credit bureaus to build their credit health.Utility Bills.Auto Loan Payments.Student Loan Payments.Credit Card Payments.Medical Bills.

Cached

Why are my utilities not on my credit report

Most utility companies will not report your payment history to the three credit bureaus, because you're paying for services rather than meeting payments on a line of credit.

Cached

Can I add bills to Equifax

Yes, you can add a free Consumer Statement of up to 475 characters to your Equifax credit report to express disagreement with the outcome of a dispute, explain negative information on your credit file, or describe circumstances that led to missed or late payments, for instance.

How do I add phone and utilities to my credit report

Experian Boost™ offers you the opportunity to add eligible mobile phone, utility, and subscription service bills to your Experian credit report. The service is free of charge, but you do have to give the credit bureau permission to scan your bank (and/or credit card) account for evidence of positive payment history.

What utilities build credit

Paying your monthly utility bills — water, gas, trash, electric, cable and internet — can help you build your credit if those payments are paid on time as agreed and are reported to the credit bureaus.

How do I add utilities to my credit score

Generally, utility bills typically do not appear on a credit report unless they're delinquent and referred to a collection agency. You can use a service like Experian Boost to include utilities bills in your payment history.

What bills don’t affect your credit score

Paying noncredit bills like rent, utilities, and medical expenses on time won't bump up your credit score because they're usually not reported to credit bureaus. But if they're very late or in collections, they'll likely get reported and affect credit scores negatively.

How do I add utilities to credit Karma

How do I link a biller with Bill PayAccess the Money tab of your Credit Karma account.Select Bills in the drop down section, then select Learn more to get started.Review Credit Karma's Bill Tracking Terms and select Continue.Bills from your TransUnion credit report that are eligible to link will display.

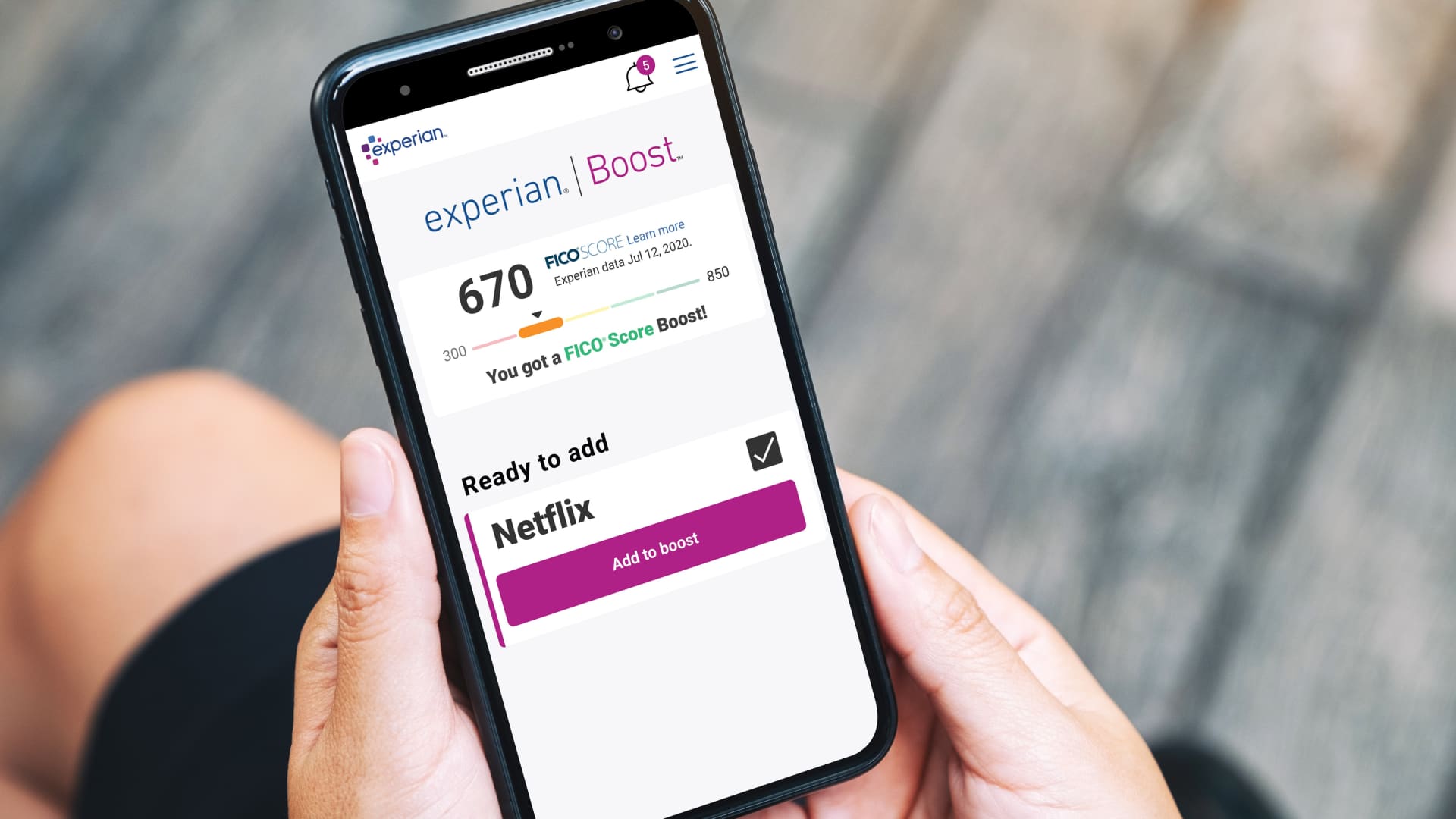

How do I add a utility bill to Experian boost

How Experian Boost WorksVisit the Experian website to connect the bank account (or accounts) you use to pay your utility and mobile phone bills.Pick the accounts you want to add to your report and skip over any you don't want included.See immediately whether or not Boost improves your score.

Can you add utility bills to Credit Karma

You can add more bills or remove a tracked bill from Credit Karma Money Spend. You can manage your tracked bills on the Bills page of your Credit Karma Money Spend account. If you would link to add a new account to your bill tracking, select Add accounts.

What utility bills build credit

Paying your monthly utility bills — water, gas, trash, electric, cable and internet — can help you build your credit if those payments are paid on time as agreed and are reported to the credit bureaus.

What builds credit the fastest

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

Is it smart to put utilities on a credit card

Generally speaking, paying your monthly bills by credit card can be a good idea as long as you adhere to two rules. Always pay your balance in full and on time each month. Never put bills on a credit card because you can't afford to pay them.

What are 3 things that hurt your credit score

5 Things That May Hurt Your Credit ScoresHighlights:Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

Do bills help build credit

If you want to improve your credit score, simply paying your utility bills on time usually won't do the trick. Strategies to boost credit scores include repaying debt on time and keeping debt utilization ratios low.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How do I add my phone and utility to my credit score

Signing up for Experian Boost lets you add phone and utility bills to your Experian report, and a history of on-time payments can boost your credit score. You can also sign up for UltraFICO, a new service that includes your bank account balances in your credit score.

How can I add my cell phone bill to my credit report

Experian Boost™ offers you the opportunity to add eligible mobile phone, utility, and subscription service bills to your Experian credit report. The service is free of charge, but you do have to give the credit bureau permission to scan your bank (and/or credit card) account for evidence of positive payment history.

How can I build my credit fast

The quickest ways to increase your credit scoreReport your rent and utility payments.Pay off debt if you can.Get a secured credit card.Request a credit limit increase.Become an authorized user.Dispute credit report errors.