How can I avoid paying on PayPal?

How can I use PayPal without paying

No transaction fee

When you use your PayPal Cash or PayPal Cash Plus balance to transfer money, you can send money online for free within the U.S.

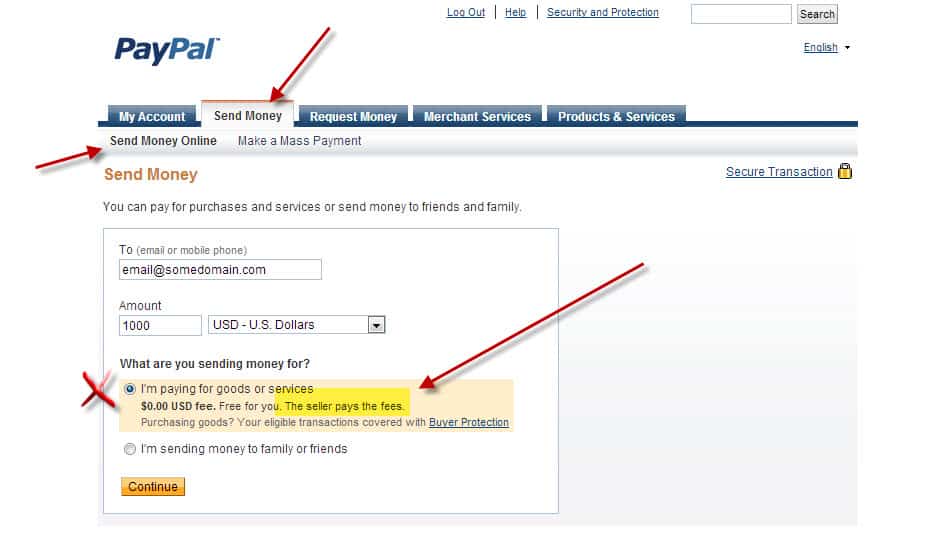

How do I avoid PayPal charges when sending money

Does PayPal Charge a Fee to Send Money The PayPal transaction fee is waived if you send money from your online PayPal account, a linked bank account, or from the PayPal Cash app. But you'll be hit with a 2.9% fee and a 30-cent fixed transaction fee if you make a payment with your PayPal credit, debit, or credit card.

Cached

Is there an alternative to PayPal

Skrill, Stripe, Square, Venmo, Payoneer, Shopify, and QuickBooks all offer viable PayPal alternatives.

Cached

Why is PayPal charging me a fee to receive money

PayPal fee structure

To stay in business, the company needs to make some form of income off of its services. To do this, PayPal charges a fee for most transactions that go through its system. And in most cases, these fees are charged to the person or company receiving the money.

Cached

How can I send money for free

Google Pay: Fastest (tie with Zelle)

Google Pay lets you transfer money for free using a QR code, the recipient's name, phone number or email address. You can also cash out instantly from the in-app wallet to a debit card for a 1.5% fee.

What fee does PayPal charge

PayPal fees for sending money

PayPal charges 2.99% of the total transaction amount when sending or receiving money in exchange for goods and services. This is free, or 0%, for consumer-to-consumer transactions.

How much is the PayPal fee for $100

$3.98

How much is the PayPal fee for $100 For the most common PayPal fee of 3.49% + $0.49, the fee for a $100 transaction will be $3.98, making the total money received after fees $96.02.

Does PayPal charge a fee for friends and family

Friends and Family payments can be made to anyone in the U.S. for free (from your bank account or PayPal). If you are sending money internationally, you may be charged a transaction fee equal to 5% of the send amount (up to $4.99 USD).

Is Venmo better than PayPal

Venmo and PayPal have some overlap in functionality, but Venmo is considered strongest as a fast, convenient way for individuals to send funds to each other. PayPal can also provide person-to-person service, but its real strength is as a payment service for e-commerce that is accepted widely.

Is Venmo an alternative to PayPal

Like Venmo, PayPal is a fast and secure way to make payments, receive money and transfer funds to family and friends. However, PayPal is more oriented toward business transactions, or payments for goods and services, while Venmo is more focused on personal transactions.

Does PayPal charge a fee to send money to a friend

Friends and Family payments can be made to anyone in the U.S. for free (from your bank account or PayPal). If you are sending money internationally, you may be charged a transaction fee equal to 5% of the send amount (up to $4.99 USD).

Does PayPal charge a fee to send money

PayPal fees for sending money

PayPal charges 2.99% of the total transaction amount when sending or receiving money in exchange for goods and services. This is free, or 0%, for consumer-to-consumer transactions.

Is it free to send money on PayPal

If you send money using a PayPal balance, bank account, or Amex sendTM account, there is no fee. If you send money using a credit or debit card, there is a 2.9% + fixed fee. Fees are subject to change. You can learn more about our fees here.

Who pays the credit card fee on PayPal

It's the merchant that pays the interchange fee, which is typically 1% to 3% of the purchase price plus a flat fee. When you make a purchase with PayPal, it's also free (as long as it's within the U.S.), and similarly, the merchant pays a fee, which is 2.9% plus 30 cents per sale. Ready for a new credit card

How much does PayPal charge you per transaction

PayPal charges 2.99% of the total transaction amount when sending or receiving money in exchange for goods and services. This is free, or 0%, for consumer-to-consumer transactions.

How much does PayPal take from $10

How much are PayPal fees

| PayPal product | Per-transaction rate | Per-transaction fee |

|---|---|---|

| Under $10 | 2.4%. | $0.05. |

| Online card payment services | ||

| Advanced credit / debit card | 2.59%. | $0.49. |

| Payments Advanced | 2.89%. | $0.49. |

Who pays the fee for PayPal Friends and Family

We cover eligible goods and services payments under PayPal Purchase Protection. When you make this type of payment, the seller pays a small fee to receive your money. Go to our Fees page for more information. Was this article helpful

Does PayPal charge a fee for person to person transactions

PayPal charges a fee for merchants to use its platform. PayPal is a for-profit company, so it looks to earn a profit after paying all of its operating expenses. PayPal does not charge a fee for consumer-to-consumer money transfers.

Why is everyone use Venmo instead of PayPal

Venmo is very user-friendly: You can send and receive payments with just a few clicks. The app will even automatically sync the contacts in your phone to make sending money to people you know easier. Compared to Paypal, Venmo charges fewer fees. There are no fees for debit card purchases, for example.

Why do people use Venmo instead of PayPal

Venmo and PayPal have some overlap in functionality, but Venmo is considered strongest as a fast, convenient way for individuals to send funds to each other. PayPal can also provide person-to-person service, but its real strength is as a payment service for e-commerce that is accepted widely.