How can I check my statement balance?

What is my statement balance

Your statement balance is the amount shown on your monthly billing statement. It doesn't reflect any new activity since your last statement ended. Instead, a statement balance represents the purchases and payments on your card during a set period, known as your billing cycle, which falls between 28 to 31 days.

Cached

Do I need to pay statement balance or current balance

Pay your statement balance in full to avoid interest charges

But in order to avoid interest charges, you'll need to pay your statement balance in full. If you pay less than the statement balance, your account will still be in good standing, but you will incur interest charges.

Why do I have a statement balance when I already paid

A statement balance is what you owe at the end of a credit card's billing cycle. It includes purchases, balance transfers, cash advances, and any fees or interest charged. It also will reflect any payments you've made during the billing cycle.

How can I view my credit card statement online

You can view your credit card statement online at any time by logging into your online credit card account and navigating to the statement information. If you've opted into electronic statements, your card issuer should send you an email every month when your new statement is available.

Cached

What is an example of a statement balance

For example, if your card's billing cycle is between the 1st and 28th of the month and during that time you spent $1,000 on purchases, your statement balance as of the 28th will be $1,000.

Why is my statement balance 0

If your statement balance is $0, that means there is no minimum payment due. If there's no minimum payment due, but there's a current balance on your account, it means those charges were made after the end of the last billing period and will be listed on the next statement.

What happens if you don’t pay your statement balance

Any amount not paid on your statement balance by the due date will roll over into the next month and start to accrue interest and depending on the credit card agreement, possibly finance fees.

Is it good to pay balance before statement

Paying your credit card balance before your billing cycle ends can have a positive impact on your finances. It'll prevent you from missing a payment, help you avoid expensive interest charges, increase your credit limit and improve your credit score faster.

What happens if you overpay your statement

The Bottom Line

And the credit card issuer is required to return the overpayment, so you won't be out the money, either. This can be accomplished either with a check or deposit to your bank account, or through using the overpayment to cover new charges.

Why do I still have a balance on my credit card after paying it off

Residual interest, sometimes called trailing interest, can be a tricky and frustrating part of using a credit card. Even if you think you've paid your balance off in full and you don't make any other purchases, interest might show up on your next statement.

How do I check my credit card balance on my phone

You can check your credit card balance. Online via mobile app or by phone the easiest ways to check your credit card balance are online and through the credit card company's mobile app though either

When can I see my credit card statement

When do credit card statements come out Your monthly credit card statement is typically available at the end of your billing cycle. A billing cycle is a period of time during which your credit card transactions are recorded and processed into a monthly statement.

What is the difference between statement balance and total balance

Remaining Statement Balance is your 'New Balance' adjusted for payments, returned payments, applicable credits and amounts under dispute since your last statement closing date. Total Balance is the full balance on your account, including transactions since your last closing date.

What happens if you don t pay your statement balance in full

Any amount not paid on your statement balance by the due date will roll over into the next month and start to accrue interest and depending on the credit card agreement, possibly finance fees.

Can your statement balance be negative

Reasons why you might have a negative credit card balance

You may have paid off your balance in full without considering a potential credit. You overpaid your statement balance: If you accidentally overpay your statement balance, your balance will end up in the negative.

Will paying the statement balance hurt my credit score

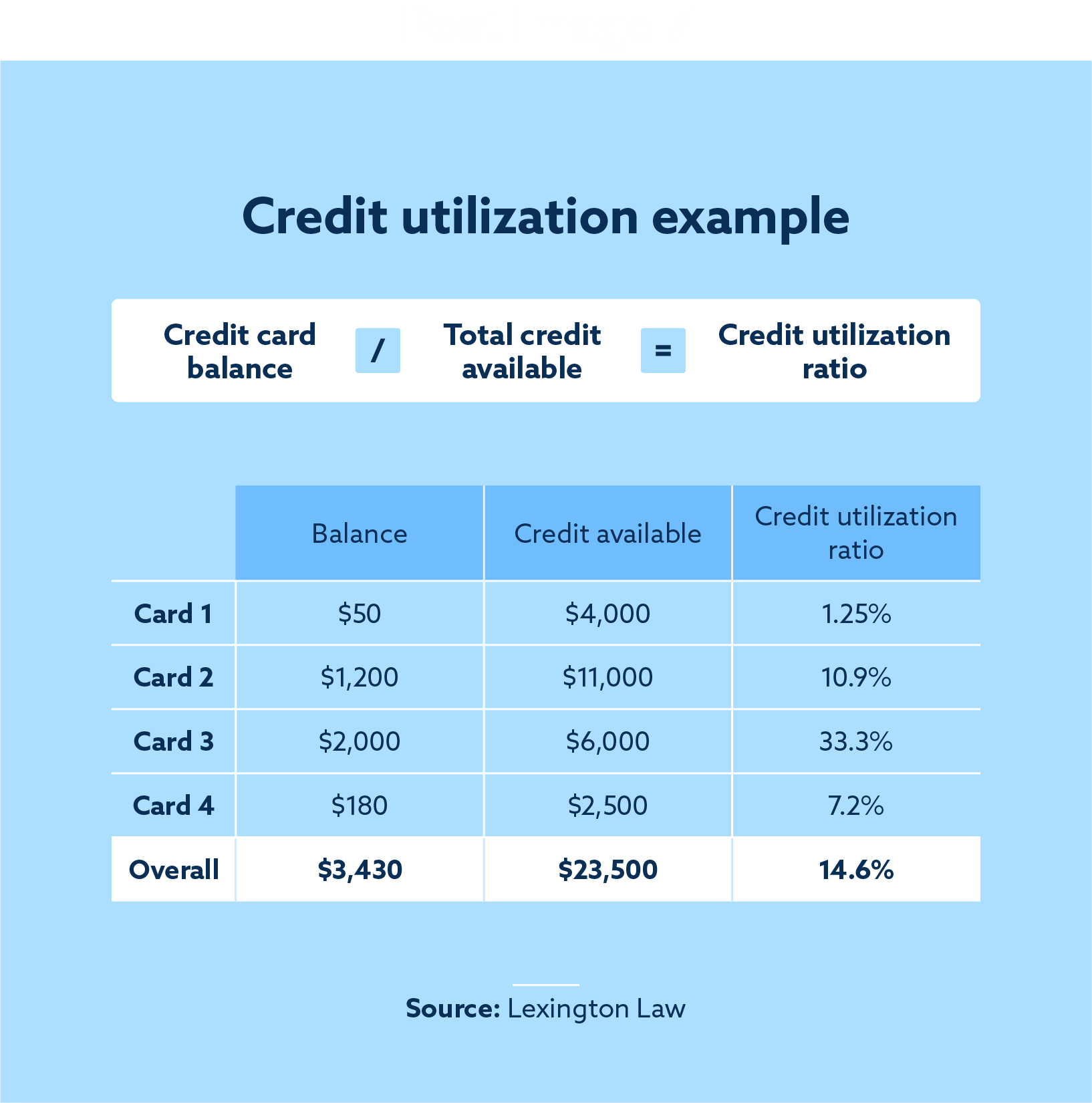

Paying off your credit card balance every month may not improve your credit score alone, but it's one factor that can help you improve your score. There are several factors that companies use to calculate your credit score, including comparing how much credit you're using to how much credit you have available.

Is it bad to pay statement balance early

Paying off your balance early or making additional payments before the billing cycle ends decreases your credit utilization — or the ratio of your total credit to your total debt. Credit utilization makes up 30% of your credit score, and it helps to keep this number low.

Is it OK to pay more than statement balance

There's nothing wrong with paying your current balance in full, even if it's higher than your statement balance, if you want to do so. But you should understand that paying your current balance won't save you any extra money in interest, unless you've previously lost your card's grace period.

What happens if you pay off your credit card before the statement date

Paying off your balance early or making additional payments before the billing cycle ends decreases your credit utilization — or the ratio of your total credit to your total debt. Credit utilization makes up 30% of your credit score, and it helps to keep this number low.

Why is my statement balance so high after paying it off

Why is my statement balance more than my current balance Your statement balance is more than your current balance because your current balance reflects the current total of all charges and payments to your account — and that changes every time a transaction occurs.