How can I get bankruptcy removed from my credit report early?

Can bankruptcy be legally removed from credit report

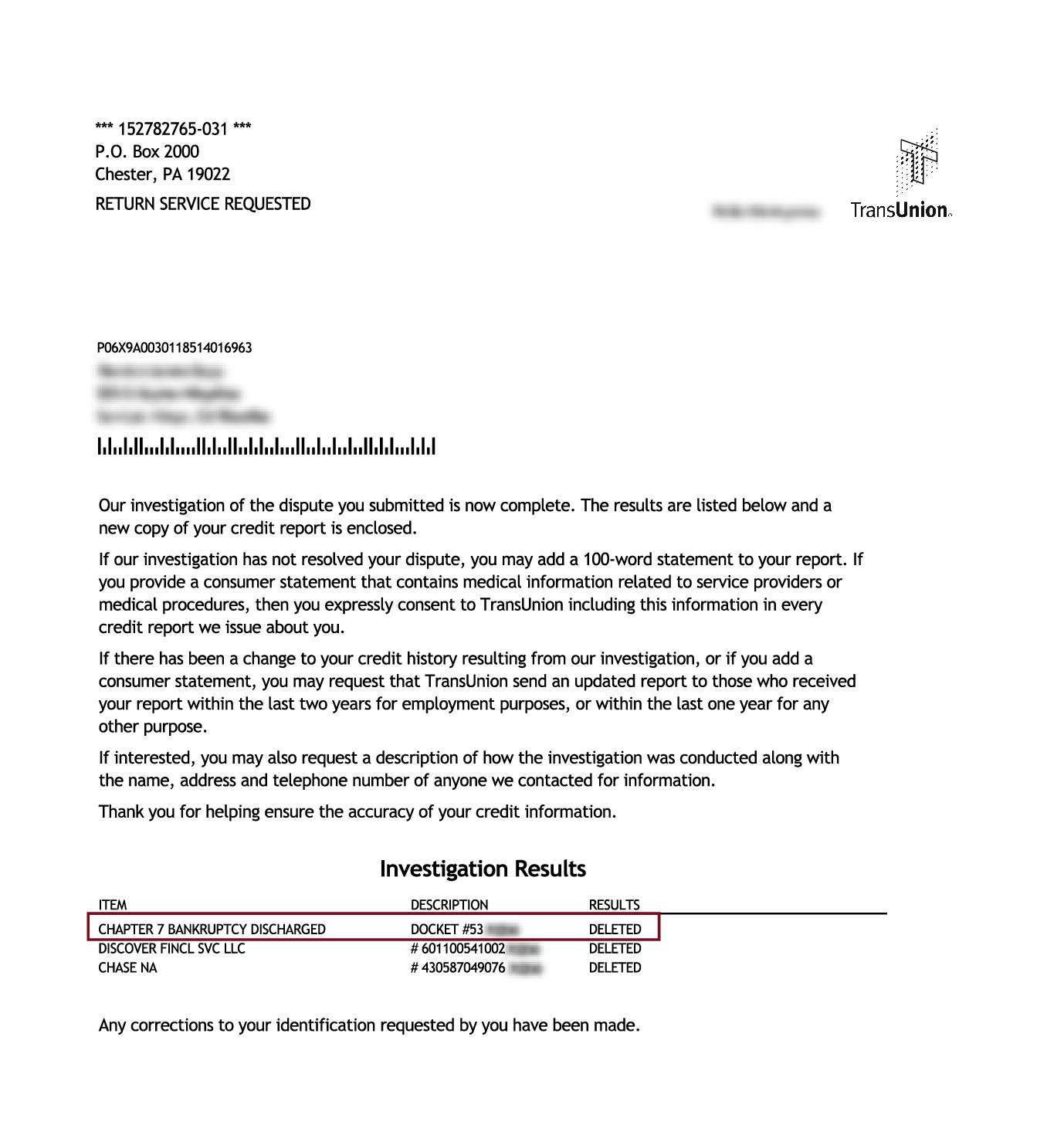

The law states that credit reporting agencies may not report a bankruptcy case on a person's credit report after ten (10) years from the date the bankruptcy case is filed. Generally, bad credit information is removed after seven (7) years.

Cached

How do you get a 700 credit score after bankruptcy

By continuing to pay all of your bills on time, and properly establishing new credit, you can often attain a 700 credit score after bankruptcy within about 4-5 years after your case is filed and you receive a discharge.

How do I write a letter to remove bankruptcy from my credit report

Write a letter explaining that the bankruptcy was dismissed. Include any previous addresses they may have on file. Request that the change be made within 30 days. Include a copy of the documentation for the bankruptcy dismissal.

How soon will my credit score improve after bankruptcy removed

As long as you take steps to rebuild your credit after bankruptcy, you could see your credit score increase within two years. Some may even see improvements within one year. However, many lenders and creditors offer credit building products that can help you improve your credit standing in the meantime.

Cached

How long does it take to remove bankruptcies

The bankruptcy public record is deleted from the credit report either seven years or 10 years from the filing date of the bankruptcy, depending on the chapter you filed. Chapter 13 bankruptcy is deleted seven years from the filing date because it requires at least a partial repayment of the debts you owe.

Does bankruptcy wipe out collections

Once the debt is discharged by the bankruptcy court, the discharge permanently bars the creditor or debt collector from collection of the debt. Filing for bankruptcy can have long-term consequences so consult a bankruptcy attorney to learn more.

How long does it take to get 800 credit score after bankruptcy

Take your time.

The amount of time it takes to rebuild your credit after bankruptcy varies by borrower, but it can take from two months to two years for your score to improve. Because of this, it's important to build responsible credit habits and stick to them—even after your score has increased.

How do I get a 720 credit score after Chapter 7

Building a 720 Credit Score After BankruptcyOut with the old, in with the new.Carefully consider credit card offers.Keep your credit lines low.Fix high priority errors on credit reports, and don't sweat the small stuff.Know that banks aren't on your side.

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

What is a 609 letter to remove bankruptcy

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And if you're willing, you can spend big bucks on templates for these magical dispute letters.

Can you overcome a bankruptcies

While your credit score will typically take a significant hit after a bankruptcy filing, with hard work, patience and discipline it is possible to fully recover and get back on your feet.

How much does credit score go up after Chapter 7 falls off

When a chapter 7 falls off your report, you can expect a boost of around 50–150 points on your credit score. Can't wait 7–10 years for it to fall off Try partnering with an expert — like Credit Glory — & dispute any inaccurate items on your report!

What type of bankruptcy wipes out all debt

Chapter 7 bankruptcy

Chapter 7 bankruptcy, also known as “liquidation bankruptcy” or “straight bankruptcy,” is a legal process that allows qualifying debtors to get most of their debts discharged (wiped out). If you qualify for Chapter 7, you can get your unsecured debts wiped out, usually within 6 months of filing.

Can accounts included in bankruptcy be deleted

Depending on the payment history of the account and the chapter filed, accounts included in bankruptcy may be deleted before the bankruptcy listing itself, but they will not be removed immediately.

How bad does bankruptcy hurt your credit score

If you know your score and file for bankruptcy, get ready to watch it plunge. A person with an average 680 score would lose between 130 and 150 points in bankruptcy. Someone with an above-average 780 score would lose between 200 and 240 points.

Can you have a good credit score after Chapter 7

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can't remove bankruptcy from your credit report unless it is there in error.

How low will my credit score drop after Chapter 7

If you know your score and file for bankruptcy, get ready to watch it plunge. A person with an average 680 score would lose between 130 and 150 points in bankruptcy. Someone with an above-average 780 score would lose between 200 and 240 points.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

Does a 609 letter work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Do 609 letters really work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.