How can I get Citibank credit card statement?

How do I get my Citi credit card statement online

Login to your Citi Mobile App.Click on Account Summary on your Home Screen.Click on the required account for statement, e.g. your Savings Account.You can view your debit and credit transactions as you scroll.

How do I get my credit card statement

Online: Card issuers usually send credit card statement to your registered email ID on the same date every month, which is known as the billing date. Another way to access your credit card statement online is by logging into your bank's net banking portal.

What is Citibank credit card statement

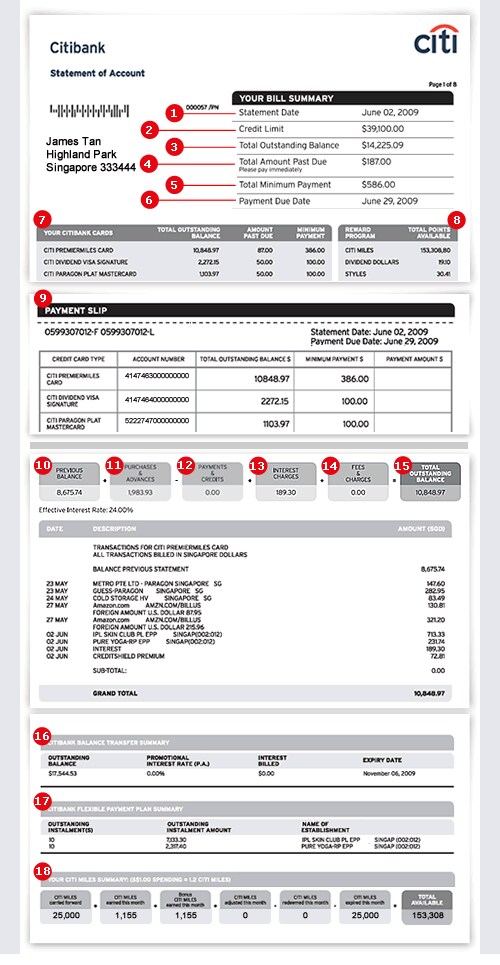

A Citibank credit card statement is a summary of all types of credit card bill payments. The statement documents all the purchases, payments, and credit and debit transactions made to your account within a billing cycle. Read your Citibank credit card statement regularly to spot unauthorized payments or billing errors.

Can I print credit card statements online

You can see and print up to seven years of your credit card statements online. Can I receive statements by mail and also see my bank statements online You can receive statements by mail and also see your statements online when you choose Statements.

Why am I not getting my credit card statement

A credit card company doesn't have to send you a monthly statement if: The account is considered uncollectible – There may be a number of circumstances where your account is uncollectable, including death, bankruptcy, failure to update your contact information, or the statute of limitations has expired for your debt.

Where can I get a credit statement

You may request your reports:Online by visiting AnnualCreditReport.com.By calling 1-877-322-8228 (TTY: 1-800-821-7232)By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

Does your credit card statement come

Credit card companies and banks typically mail out your monthly statement after the end of your billing cycle. If you've signed up for paperless billing, you'll receive an email notification that your monthly statement is available.

How do I get my old Citibank credit card statement

You may also request your Statement on E-mail through Citibank Online by visiting the Statement on E-mail section under the Banking/Credit Card tab: Download and view the last 18 months' statement from Citibank Online anytime, anywhere.

Can you print credit card statements

You can see and print up to seven years of your credit card statements online. Can I receive statements by mail and also see my bank statements online You can receive statements by mail and also see your statements online when you choose Statements.

Can credit card statements be emailed

Paperless billing allows you to access your monthly credit card statement online rather than receiving a mailed copy. Each month, your credit card issuer will send an email when your statement is ready.

When should I receive my credit card statement

By law, your statement is sent to you at least three weeks prior to your payment due date, but you should be able to find it available at any time through your bank's website.

Do you get a credit card statement every month

Credit card companies and banks typically mail out your monthly statement after the end of your billing cycle. If you've signed up for paperless billing, you'll receive an email notification that your monthly statement is available.

Can I go to the bank to get my statement

If you choose to request a printed statement, be careful, as your bank may charge a fee – typically around $6 – for this service. If you do not have access to online banking, you can call your bank's customer service line. They can help you receive a paper copy of your statement.

Why didn’t I receive my credit card statement

A credit card company doesn't have to send you a monthly statement if: The account is considered uncollectible – There may be a number of circumstances where your account is uncollectable, including death, bankruptcy, failure to update your contact information, or the statute of limitations has expired for your debt.

How do I get my full year credit card statement

If you use a Credit Card, you will receive a statement every month, which records all the transactions you have made during the previous one month. Depending on how you have opted to receive it, you will get the Credit Card statement via courier at your correspondence address or as an email statement or both.

Can I view old credit card statements

Most credit card companies offer online account access that enables account holders to access their statements for at least one year. Some companies offer a longer statement history. For example, Chase allows account holders to search up to seven years of statements.

How do I see all my credit card statements

You can view your credit card statement online at any time by logging into your online credit card account and navigating to the statement information. If you've opted into electronic statements, your card issuer should send you an email every month when your new statement is available.

Are credit card statements online

To access your credit card statement, you'll first have to create an online account via your card issuer's website. If you obtained a credit card through your current bank or credit union, your credit card account may be accessible through your existing online banking account.

Can you request a bank statement from an ATM

You can't get a full monthly statement from an ATM, however. For that, you'll either need to go online and access your electronic-banking portal, your financial institution's smartphone app or visit a teller in person for a printed statement.

Can a bank refuse to give you a statement

Is the bank required to send me a monthly statement on my checking or savings account Yes, in many cases. If electronic fund transfers (EFTs) can be made to or from your account, banks must provide statements at least monthly summarizing any EFTs that occurred each month.