How can I tell if my credit card is blocked?

How do I know if my credit card is blocked

How do I know if my card is blocked You can know the status of your card by calling the credit card customer care number of the bank and or by logging in to your net banking account as well.

What happens if your credit card is blocked

If your bank notices that you have been quite irregular with the payments of your credit bills, your credit card may get blocked. In such cases, you will have to make immediate payment of your bill in order to re-activate your card.

How do I unblock my credit card

Depending on the reason for the block, you can unblock your credit card by calling the bank or credit card company and discussing the issue. You may need to go through extra steps such as: Answering security questions to confirm your ID. Negotiating your credit limit.

How long does it take to unblock credit card

The process generally takes 45-60 days. 6. Suspicious activity! Many banks follow a very stringent method to ensure that your credit card remains safe and secured.

Can we activate blocked credit card

Your card can be re-activated in case you log a request with us within 3 months of blocking your card, post which you need to apply afresh.

How do I check to see if my card is active

One way to check if your card is active is by calling your card issuer's customer support phone number and asking. This number is usually listed on the back of your card. Besides maybe a few seconds of hold time, this is the quickest and easiest way to check the status of your card.

How long can a credit card be blocked

15 days

Paying your bill with that same card means your final charge will most likely replace the block in a day or two. But if you pay that bill with a different card — or with cash or a check — the block may last up to 15 days. That's because the card issuer doesn't know you paid another way.

Can money still go into a blocked card

No, you can't make payments if your card is blocked, however you can still receive payments in your account if your account is still live.

How long will my credit card be blocked

Paying your bill with that same card means your final charge will most likely replace the block in a day or two. But if you pay that bill with a different card — or with cash or a check — the block may last up to 15 days. That's because the card issuer doesn't know you paid another way.

Why is my credit card temporarily blocked

It could be the CVV number, the date of expiry, or the PIN being entered wrong. To protect against fraudulent usage, banks usually block a card if the wrong data has been entered more than once. The way to prevent this from happening is to be careful when entering the data.

Can I check my credit card status

Many banks and credit card issuers allow customers to check their credit card application status online through their website. There are also offline methods to do so, such as customer care phone number or the bank branch. The below section details the steps for checking the credit card status.

How do I know if my debit card is blocked

You can confirm if the card is blocked by calling customer care service or at the bank branch. You must raise an application for unblocking the ATM card online or offline through call/SMS/bank branch if your ATM card gets blocked.

Why would my credit card be blocked

It could be the CVV number, the date of expiry, or the PIN being entered wrong. To protect against fraudulent usage, banks usually block a card if the wrong data has been entered more than once. The way to prevent this from happening is to be careful when entering the data.

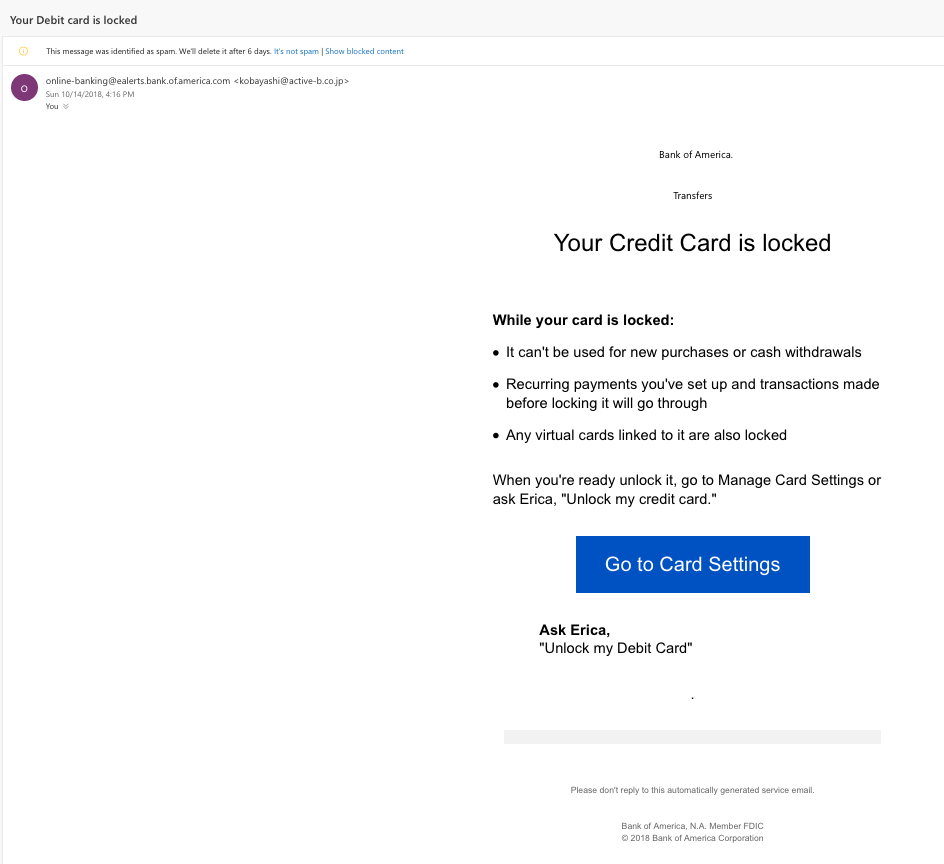

Does blocking your card stop payments

Locking your debit card will prevent new purchases, but recurring transactions and scheduled bill payments will still go through.

How long is a card blocked for

If your debit card is locked, it will typically stay that way for up to 15 days. This can vary depending on your bank or credit card issuer, so it's always best to check with them directly if you're unsure. If your card is still locked after 15 days, you may need to contact your issuer to have it unlocked.

Why is my credit card declined when I have money

You've Hit Your Credit Limit

One of the most common reasons why credit cards get declined is that the cardholder has reached the credit limit. Let's say you have a credit limit of $1,000 and a current card balance of $900.

Why is my credit card being declined when I have money

You may have hit a credit limit, expiration date or an errant keystroke. A merchant 'hold' or issuer 'freeze' may also be to blame.

Can a blocked card be charged

When you lock a card, new charges and cash advances will be denied. However, recurring autopayments, such as subscriptions and monthly bills charged to the card, will continue to go through. Typically, so will bank fees, returns, credits, interest and rewards.

How long is temporary block on credit card

7 days

Your Card will be unblocked automatically, 7 days after you first block your Card.

Can I check my credit card activity online

You can view your credit card statement online at any time by logging into your online credit card account and navigating to the statement information. If you've opted into electronic statements, your card issuer should send you an email every month when your new statement is available.