How close is my FICO score to my VantageScore?

How far off is VantageScore from FICO

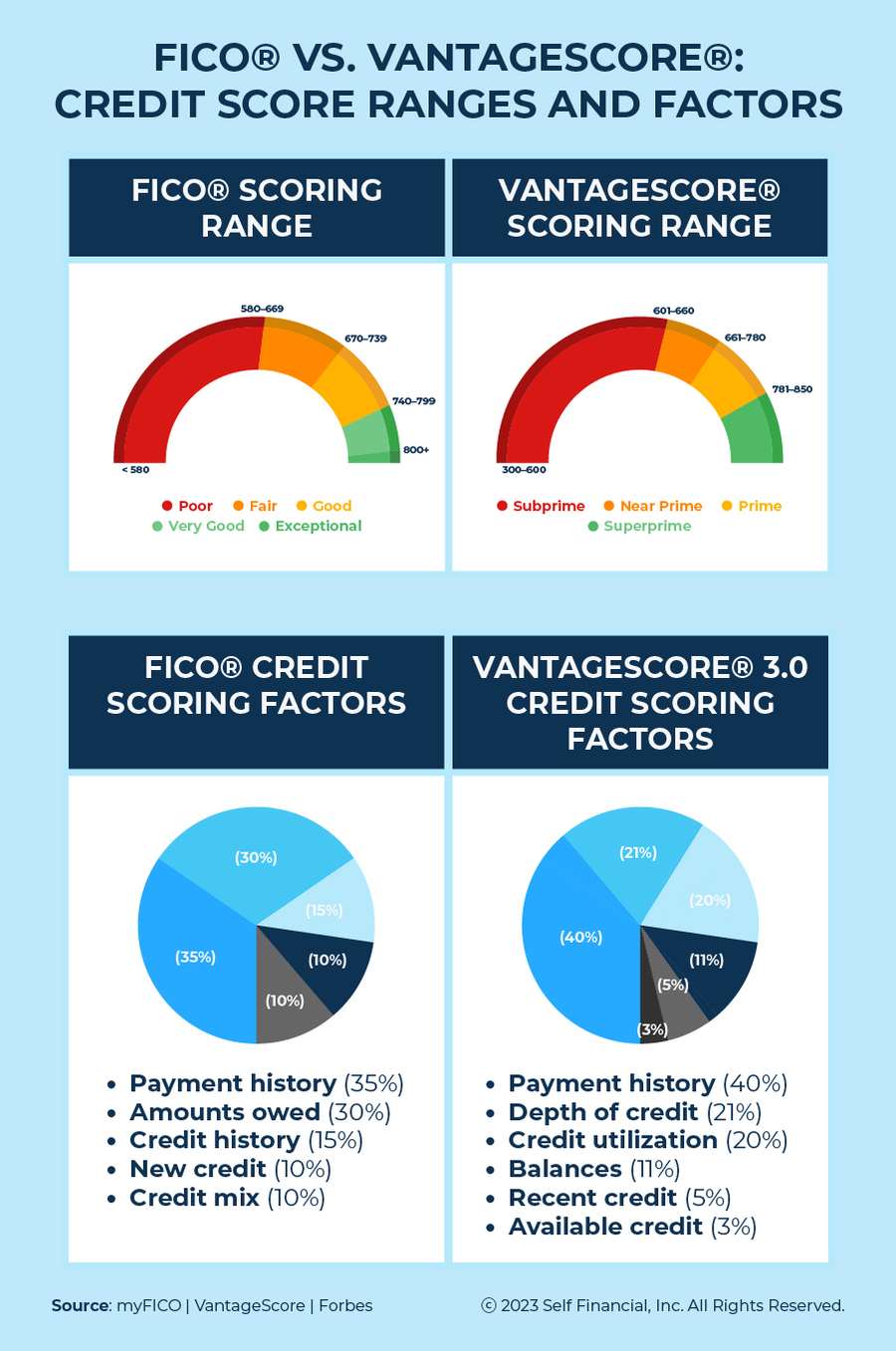

While VantageScore and FICO now use the same 300-850 range, VantageScore tiers run about 50 points lower than FICO tiers.

Cached

Is FICO usually higher or lower than Vantage

Differences between FICO and VantageScore

Monitoring your score for changes can be useful, as long as you understand that the two score types likely won't ever match. In Brian's experience, scores based on VantageScore are 100 points lower than FICO-based scores, which are what lenders tend to use.

Cached

Why is Vantage so much lower than FICO

Since VantageScore and FICO scores differ in the weights they assign to each category and variable within the scoring model, it is likely that one will usually be lower than the other. Since payment history is weighted more heavily with VantageScore than FICO (40% vs.

Cached

Is FICO score 8 same as VantageScore

It was created to provide some consistency between the scores offered by the existing credit bureaus. If you're wondering, “why is my FICO score higher than Vantage” VantageScore runs about 50 points lower than FICO, despite using the same range.

Cached

Do lenders look at FICO or Vantage

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates. You can check your FICO score in a few different ways.

How close is VantageScore 3.0 to FICO score

The first two versions of the VantageScore ranged from 501 to 990, but the latest VantageScore 3.0 and 4.0 use the same 300-to-850 range as base FICO® scores. What qualifies as a good score can vary from one creditor to another.

Do banks look at FICO or Vantage

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates.

How do I convert my VantageScore 3.0 to FICO score

There is no official method of converting a VantageScore to a FICO score. Because each scoring uses different criteria and methods of pulling data, it's nearly impossible to convert. However, keeping both scores in mind can give you a much more well-rounded understanding of your credit health.

Is Vantage or FICO more accurate

Although VantageScore credit scores have been around for about 15 years, the FICO Score is still the preferred choice of most lenders. In the U.S., lenders use FICO Scores in 90% of lending decisions.

What is considered a good FICO 8 score

Consequently, when lenders check your FICO credit score, whether based on credit report data from Equifax, Experian, or TransUnion, they will likely use the FICO 8 scoring model. FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score.

Is Vantage more accurate than FICO

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates. You can check your FICO score in a few different ways.

Do banks use VantageScore 3.0 or FICO

Although VantageScore credit scores have been around for about 15 years, the FICO Score is still the preferred choice of most lenders. In the U.S., lenders use FICO Scores in 90% of lending decisions.

Do lenders use Vantage or FICO

According to the company, FICO® scores are used today by 90% of top lenders to make lending decisions. The VantageScore model wasn't introduced until 2006.

Is your FICO score usually higher than Credit Karma

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

How close is VantageScore 3.0 to FICO

The base FICO® Scores range from 300 to 850, while FICO's industry-specific scores range from 250 to 900. The first two versions of the VantageScore ranged from 501 to 990, but the latest VantageScore 3.0 and 4.0 use the same 300-to-850 range as base FICO® scores.

Why is my FICO score 8 higher than credit karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

What does a 850 FICO score look like

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates.

Do banks use Vantage or FICO

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates. You can check your FICO score in a few different ways.

Do banks use FICO or Vantage

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates. You can check your FICO score in a few different ways.

Why is my FICO score so much higher than my VantageScore

The main reason why credit scores can vary is because they use different scoring models. A FICO® Score is calculated using a different formula than a VantageScore. And while most credit scores use a scale of 300 to 850, that isn't always the case.