How close is VantageScore 3.0 to FICO?

How much higher is FICO than Vantage

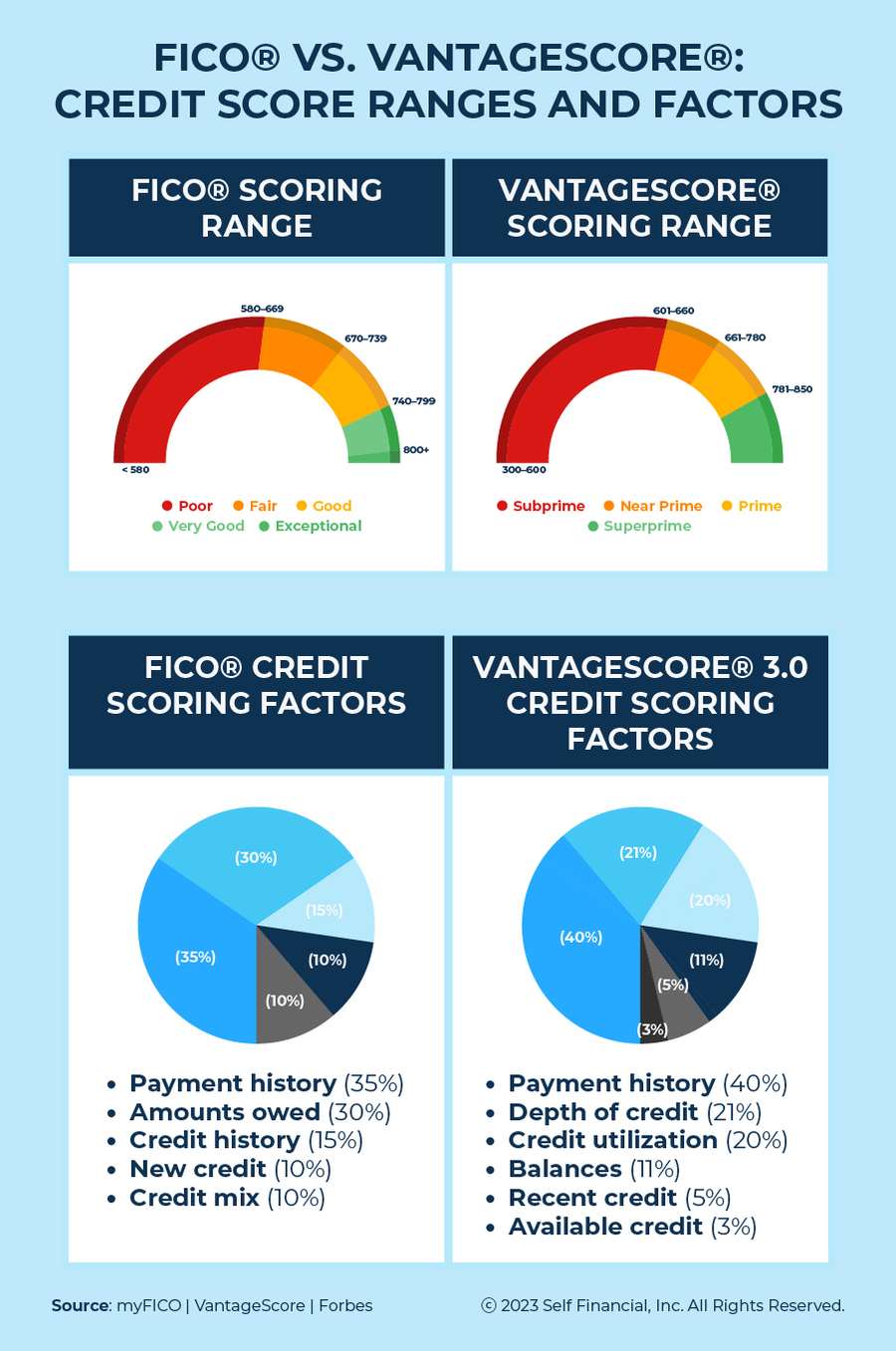

While VantageScore and FICO now use the same 300-850 range, VantageScore tiers run about 50 points lower than FICO tiers.

Cached

Why is my Vantage 3.0 score lower than FICO

In Brian's experience, scores based on VantageScore are 100 points lower than FICO-based scores, which are what lenders tend to use. This is because the scores are composed in a different way. However, not everyone will experience such large differences between their FICO and VantageScore numbers.

Cached

Is Vantage 3.0 credit score accurate

Predictiveness: VantageScore 3.0 outperformed its benchmarks in 99% of the tests performed by the company. That means it's doing its job as a credit score really well. Obviously, the more accurate a credit score is, the more lenders will use it and the more you can learn from it.

Does the VantageScore have the same range as the FICO score

As mentioned, FICO Scores and VantageScore credit scores share the same range of 300 to 850. Higher scores indicate less risk. But the way lenders interpret the two types of scores may not be identical.

Cached

Do banks use Vantage or FICO

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates. You can check your FICO score in a few different ways.

How far apart are Vantage and FICO score

The time period, however, generally differs. FICO uses a 45-day span, while VantageScore uses 14 days. And while FICO only includes mortgages, vehicle loans and student loan inquiries, VantageScore will do the same for hard inquiries dealing with other types of credit, including credit cards.

Do lenders look at FICO or Vantage

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates. You can check your FICO score in a few different ways.

Is Vantage 3.0 higher than FICO

The Score Ranges

The base FICO® Scores range from 300 to 850, while FICO's industry-specific scores range from 250 to 900. The first two versions of the VantageScore ranged from 501 to 990, but the latest VantageScore 3.0 and 4.0 use the same 300-to-850 range as base FICO® scores.

Why is my Vantage 3.0 score higher than FICO

Borrowers who have an excellent record of making on-time payments may find their VantageScore is higher than their other credit scores. That's because VantageScore places greater emphasis on your payment history than other bureaus do.

What is considered a good vantage 3.0 score

Understanding credit score ranges

In addition to “good,” VantageScore 3.0 classifies other ranges as well. A very poor credit score is in the range of 300 – 600, with 601 – 660 considered to be poor. A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Do banks look at FICO or Vantage

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates.

Do dealerships use FICO or Vantage

What credit score do auto lenders look at The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. We're going to take at look at FICO® since it has long been the auto industry standard.

Why is FICO so much higher than Vantage

FICO scores are more strongly influenced by the length of your credit history. It will take you longer to earn a FICO score. Typically, you'll have to have six months' worth of credit activity before you'll get a FICO score, while you may earn a VantageScore within a month of making a credit purchase.

Is VantageScore 3.0 used for mortgages

The FICO® Score versions used in mortgage lending and the more recently released versions, such as FICO® Score 9 and 10, have the same 300 to 850 range. VantageScore, a competing maker of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 model credit scores.

Do mortgage companies use VantageScore vs FICO

VantageScore vs.

FICO scores are the most widely used scores used by lenders to determine the creditworthiness of consumers. This means more institutions use FICO over any other scoring model to decide if someone should get a loan, mortgage, or any other credit product.

Which of the 3 credit scores is usually the highest

Which credit score matters the most While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

How far off is Credit Karma

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Do any lenders use VantageScore

Overall 6 of the top 10 largest banks, 55 of the 100 largest credit unions and many of the largest Fintech's in the United States use VantageScore credit scores in one of more lines of business.

Do auto loans look at VantageScore

What credit score do auto lenders look at The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage.