How do banks verify a signature?

Do banks actually verify signatures on checks

Banks are not looking for dual signatures–they process certain information from the check including verifying that there is an allowed signature but will not be looking past the first signature.

Cached

Do banks check for forged signatures

And while it's true that banks are responsible for knowing their customer's signature, and flagging an account for fraud if a signature is discovered not to match, banks are prone to error, especially because they do not manually process checks.

Cached

What is the process of signature verification

Definition(s): The process of using a digital signature algorithm and a public key to verify a digital signature on data. The use of a digital signature algorithm and a public key to verify a digital signature on data.

Which device is used to verify signature on bank cheque

MICR (magnetic ink character recognition) is a technology invented in the 1950s that's used to verify the legitimacy or originality of checks and other paper documents. Special ink, which is sensitive to magnetic fields, is used to print certain characters on the original documents.

What happens if someone forged my signature on a check

Contact your bank or credit union right away. State law generally provides that you are not responsible for a check if someone forged the signature of the person to whom you made out the check. Tell your bank or credit union what happened and ask for the money to be restored to your account.

What happens if someone faked my signature

Is Forging a Signature a Crime Forging a signature is a crime in all 50 U.S. states, and is considered a felony by all though many also have allowances for forgery being a misdemeanor in certain cases. Punishment varies by state, with forgery resulting in everything from jail time down to probation or restitution.

Is signature forgery hard to prove

Detecting a forged signature is difficult but with proper training, tools, time, and following standard procedures, a document examiner should be able to determine whether a questioned signature is genuine or not.

How do banks detect forgery

How Do Banks Investigate Fraud Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction.

Who can verify your signature

A lawyer can verify signatures on documents written by them as well as on documents not prepared by them, provided that the respective person signs such document in the presence of the lawyer. This is the so-called certificate of authenticity of the signature.

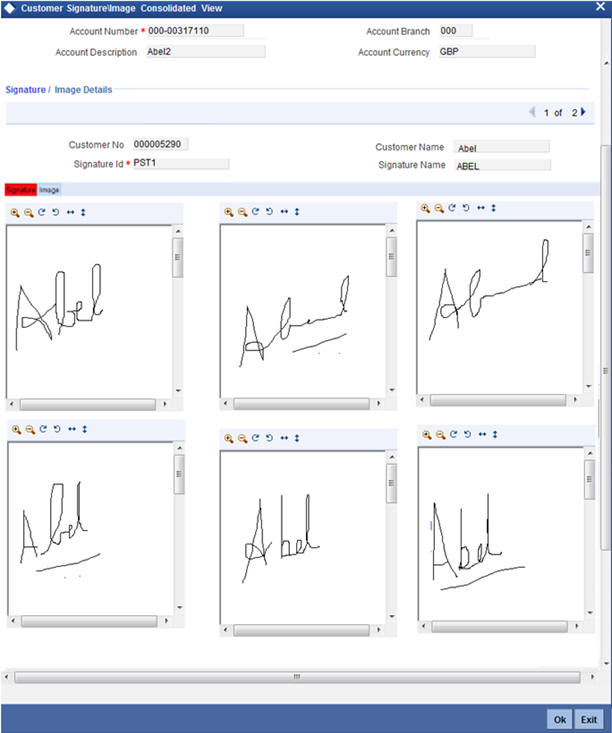

What is the reason for signature verification

Signature verification allows organizations to confirm the authenticity of customer signatures.

What system do banks use to verify checks

With machine learning and verification system technology, banks can quickly and accurately spot counterfeit patterns.

Do banks use electronic signatures

Electronic signatures enable the banks to offer banking freedom to the customers. It also provides convenient, easy, and personal access to documents and transactions.

How do you prove signature forgery

These features include the following as well as others:Shaky handwriting.Pen lifts.Signs of retouching.Letter proportions.Signature shape and dimensions.Letter slants.Speed, acceleration, and smoothness of curves.Pen pressure and pressure changes.

How do you prove a signature is forged

These features include the following as well as others:Shaky handwriting.Pen lifts.Signs of retouching.Letter proportions.Signature shape and dimensions.Letter slants.Speed, acceleration, and smoothness of curves.Pen pressure and pressure changes.

What is the best way to prove forgery

There are several elements to the crime of forgery, and all must be proven before someone can be found guilty:A person must make, alter, use, or possess a false document.The writing must have legal significance.The writing must be false.Intent to defraud.

How are forged signatures detected

Computer-Aided Analysis – In a forensic analysis of a signature, handwriting experts take a high-quality photograph of the signature and magnify the signature on a computer. Sometimes just magnifying a signature makes a forgery obvious.

How long does it generally take bank to investigate forgery

In the US, banks are required to complete fraud investigations within 10 business days of the time they are advised of the claim. Banks can request an extension, but in most cases, they will be required to issue a temporary refund to the customer within 10 days.

What is the easiest form of forgery to detect

TYPES OF FORGERY

The first is blind forgery, in which the forger has no idea what the signature to be forged looks like. This is the easiest type of forgery to detect because it is usually not close to the appearance of a genuine signature.

What is considered a fake signature

Forged Signature means the handwritten signing of the name of another genuine person or a copy of said person's signature without authority and with intent to deceive; it does not include the signing in whole or in part of one's own name, with or without authority, in any capacity, for any purpose.

How do I get a digitally verified signature

How to validate digital signatures in e-AadhaarDownload your E-Aadhaar and open the pdf in Adobe Reader only.Right click on the 'validity unknown' icon and click on 'Validate Signature'You will get the signature validation status window, click on 'Signature Properties'.Click on 'Show Signer's Certificate.'