How do banks verify signatures?

Do banks check for forged signatures

And while it's true that banks are responsible for knowing their customer's signature, and flagging an account for fraud if a signature is discovered not to match, banks are prone to error, especially because they do not manually process checks.

Cached

How are signatures verified

Verifying a signature will tell you if the signed data has changed or not. When a digital signature is verified, the signature is decrypted using the public key to produce the original hash value. The data that was signed is hashed. If the two hash values match, then the signature has been verified.

Does bank charge for signature verification

If you do need a printed statement, take a printout yourself and get it attested by the bank. But some banks charge for attestation too. For instance, SBI charges ₹150 for signature verification.

What happens if you mess up your signature on a check

If you mess up – like making a spelling mistake – don't worry. Cross out the mistake, then add your initials. Try to make a clear line through the mistake, instead of scribbling it out. Once you've done this, you can endorse the check like normal.

Is signature forgery hard to prove

Detecting a forged signature is difficult but with proper training, tools, time, and following standard procedures, a document examiner should be able to determine whether a questioned signature is genuine or not.

How do banks detect forgery

How Do Banks Investigate Fraud Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction.

Who confirms signatures

A signatory is someone who signs a contract, therefore creating a legal obligation. There could be several signatories for a specific contract.

How do you tell if a signature is forged

These features include the following as well as others:Shaky handwriting.Pen lifts.Signs of retouching.Letter proportions.Signature shape and dimensions.Letter slants.Speed, acceleration, and smoothness of curves.Pen pressure and pressure changes.

Why would the bank need your authorized signature

Abilities of Authorized Signers

Essentially, the authorized signer has the ability to deposit and withdraw funds, as can any owner of any other account. This is why company owners need to explicitly trust authorized signers because the ability to take – or steal – the company's money is voluntarily given to them.

Do banks use electronic signatures

Electronic signatures enable the banks to offer banking freedom to the customers. It also provides convenient, easy, and personal access to documents and transactions.

Can a check bounce because of signature

A bounced check is returned by the bank due to insufficient funds, incorrect data, signature mismatch, or other reasons and becomes void between the parties.

Can you falsify a signature

Forging a signature is a crime in all 50 U.S. states, and is considered a felony by all though many also have allowances for forgery being a misdemeanor in certain cases. Punishment varies by state, with forgery resulting in everything from jail time down to probation or restitution.

What is the best way to prove forgery

There are several elements to the crime of forgery, and all must be proven before someone can be found guilty:A person must make, alter, use, or possess a false document.The writing must have legal significance.The writing must be false.Intent to defraud.

What is the easiest form of forgery to detect

TYPES OF FORGERY

The first is blind forgery, in which the forger has no idea what the signature to be forged looks like. This is the easiest type of forgery to detect because it is usually not close to the appearance of a genuine signature.

How long does it generally take bank to investigate forgery

In the US, banks are required to complete fraud investigations within 10 business days of the time they are advised of the claim. Banks can request an extension, but in most cases, they will be required to issue a temporary refund to the customer within 10 days.

What makes a signature official

Those conditions are: The identity of the person signing the document or contract can be verified. Their intent to sign the document electronically is clear. There are records of the contract kept by both parties for integrity purposes.

Who can verify a forged signature

Forensic Document Examiner

Indications of a Forged Signature

The legal system commonly relies upon an experienced, professional Forensic Document Examiner to confirm a forgery. There are features a document examiner, and you, may look for when evaluating a signature suspected of being forged.

What is considered an authorized signature

What is an authorized signatory Simply put, an authorized signatory or signer is a person who's been given the right to sign documents on behalf of the authorizing organisation.

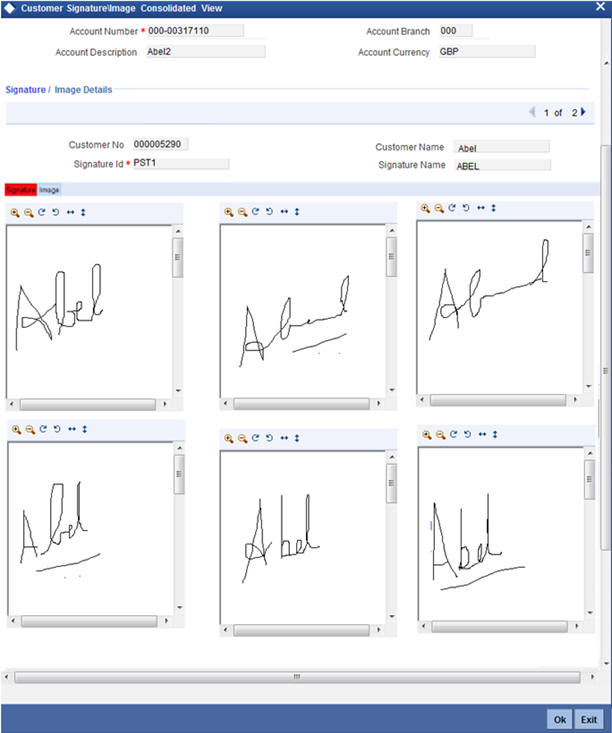

How does a bank use a signature

A signature card allows tellers to compare the signature of an individual requesting a withdrawal with the signature(s) on file for that account. The signature card form also indicates the number of authorized signatures required for an account withdrawal.

Can electronic signature be verified

Each digital signature has an icon identifying its verification status. Verification details are listed beneath each signature and can be viewed by expanding the signature. The Signatures panel also provides information about the time the document was signed, and trust and signer details.