How do beginners buy stocks?

How do I buy stocks for the first time

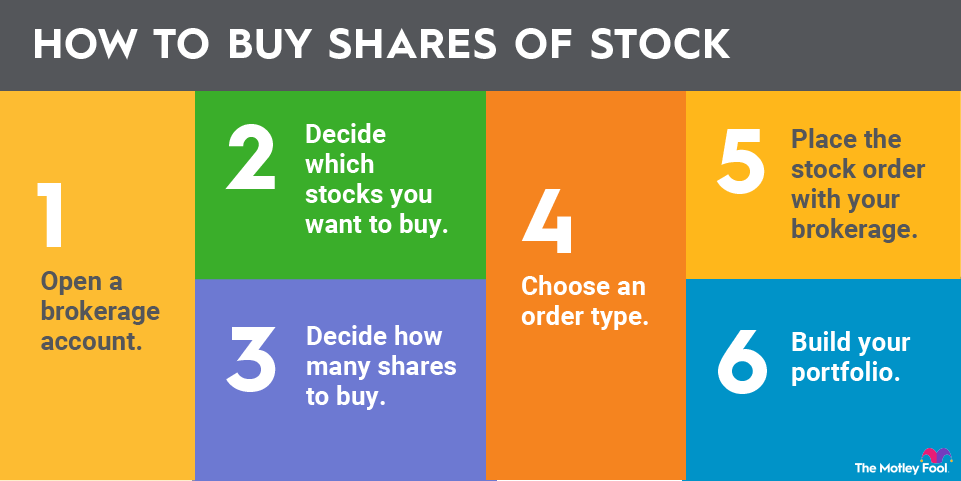

How To Buy StocksOpen an Online Brokerage Account to Buy Stock.Research Which Stocks You'd Like to Buy.Execute Trades in Your Account.Use Dollar-Cost Averaging to Buy Stock Over Time.Think Carefully About When to Sell Your Stock.

Cached

How much should you invest in stocks first time

There's no minimum to get started investing, however you likely need at least $200 — $1,000 to really get started right. If you're starting with less than $1,000, it's fine to buy just one stock and add more positions over time.

Is it worth buying 1 stock

While purchasing a single share isn't advisable, if an investor would like to purchase one share, they should try to place a limit order for a greater chance of capital gains that offset the brokerage fees.

How to invest your first $100 in stocks

How to Invest $100 in Stocks & MoreStart an emergency fund.Use a micro-investing app or robo-advisor.Invest in a stock index mutual fund or exchange-traded fund.Use fractional shares to buy stocks.Put it in your 401(k)Open an IRA.

Is $100 dollars enough to invest in stocks

With only $100, you could buy a few shares of a company with a lower stock value, or you could purchase some fractional shares of high-revenue companies instead. The easiest way to purchase a fractional share is through a brokerage like Stash, a micro-investing app where you need only $1 to get started with investing.

How much money will you have if you invest $100 a month

You plan to invest $100 per month for five years and expect a 6% return. In this case, you would contribute $6,000 over your investment timeline. At the end of the term, your portfolio would be worth $6,949. With that, your portfolio would earn around $950 in returns during your five years of contributions.

How much money do I need to invest to make $1000 a month

Investment Required To Make $1,000 In Monthly Income

However, the exact investment required will vary for every investor. Therefore, your precise amount will depend on your specific investments and your return on those investments. Thus, the money required will range from $240,000 to $400,000.

Can I buy stocks with $50

Investing in stocks that trade for under $50 can be a great way to make money in the stock market. These stocks are often overlooked by investors and analysts and can help investors outperform the broad market with a relatively small investment.

How much can you make with $100 dollars in stocks

Here's an example of how investing $100 can grow over time: With a 4% rate of return, you could reach $100,000 in 37 years. With a 6% rate of return, you could reach $100,000 in 30 years. With an 8% rate of return, you could reach $100,000 in 25.5 years.

Can you invest $1 dollar in stocks and make money

On Robinhood, investors can buy fractional shares of stocks and exchange-traded funds (ETFs) with as little as $1. Stocks worth over $1.00 per share, and which have a market capitalization of more than $25 million, are eligible for fractional shares on Robinhood.

How much will I have if I invest 200 a month

Investing as little as $200 a month can, if you do it consistently and invest wisely, turn into more than $150,000 in as soon as 20 years. If you keep contributing the same amount for another 20 years while generating the same average annual return on your investments, you could have more than $1.2 million.

How much is $500 a month invested for 10 years

If you invested $500 a month for 10 years and earned a 4% rate of return, you'd have $73,625 today. If you invested $500 a month for 10 years and earned a 6% rate of return, you'd have $81,940 today. If you invested $500 a month for 10 years and earned an 8% rate of return, you'd have $91,473 today.

Is investing $50 a month worth it

Although $50 a month may not get you to retirement completely, it's a good start. $250 a month is even better, and can get you to a minimum retirement income level of about $2,000 a month. Every little bit helps.

How much will I have if I invest $500 a month for 10 years

If you invested $500 a month for 10 years and earned a 4% rate of return, you'd have $73,625 today. If you invested $500 a month for 10 years and earned a 6% rate of return, you'd have $81,940 today.

How much will I make if I invest $100 a month

You plan to invest $100 per month for five years and expect a 6% return. In this case, you would contribute $6,000 over your investment timeline. At the end of the term, your portfolio would be worth $6,949. With that, your portfolio would earn around $950 in returns during your five years of contributions.

How much will I have if I invest $100 a month for 10 years

But by depositing an additional $100 each month into your savings account, you'd end up with $29,648 after 10 years, when compounded daily.

How much money will I have if I invest $100 a month

Short-term investor: Let's say that you are investing $100 per month with a big purchase in mind. You plan to invest $100 per month for five years and expect a 6% return. In this case, you would contribute $6,000 over your investment timeline. At the end of the term, your portfolio would be worth $6,949.

How can I make money in stocks with $100

How to Invest $100 in Stocks & MoreStart an emergency fund.Use a micro-investing app or robo-advisor.Invest in a stock index mutual fund or exchange-traded fund.Use fractional shares to buy stocks.Put it in your 401(k)Open an IRA.

What will $10,000 be worth in 20 years

With that, you could expect your $10,000 investment to grow to $34,000 in 20 years.

How much will I have if I invest $500 a month for 15 years

Investing for your financial goals is much like the story of the tortoise and the hare. The tortoise is slow but determined to take step after step to ultimately achieve his goal. The hare is fast and snickers at the tortoise's speed.