How do I add two people to my credit card?

Can you put 2 names on a credit card

A joint credit card works just like a traditional credit card, except the account is shared by two people—each cardholder gets their own card that's linked to the account.

How do I add a joint user to my credit card

Here's how to add an authorized user to a credit card:Find someone willing to add you as an authorized user.Provide your full name and date of birth to the primary cardholder.Contact the card issuer.The card issuer mails your new card.Activate the card when it arrives.Create your online profile.

Cached

Can I add someone to my credit card to help build their credit

When you add an authorized user to your credit card account, information from the account — like the credit limit, payment history and card balance — can show up on that person's credit reports. That means their credit can improve as a result of being added to a credit account you keep in good standing.

Cached

Do both people on a credit card build credit

Joint account users that pay monthly bills on-time and keep their credit utilization ratio low will most likely find that they can both build good credit scores, while joint account users that miss payments or use most of their available credit could see dips in both of their credit scores.

Can I add my girlfriend to my credit card

While few credit cards allow joint cardholders, many credit issuers allow you to add your partner as an authorized user on your credit card. That way, your partner can use your line of credit to make purchases — and, in some cases, use your credit history to build their credit score.

Does adding my wife to my credit card help their credit

1. Make your spouse an authorized user on your credit card. By someone as an authorized user on your credit card account adds your credit history to their credit report. The effect is most powerful when you add someone to an account with a great record of on-time payments.

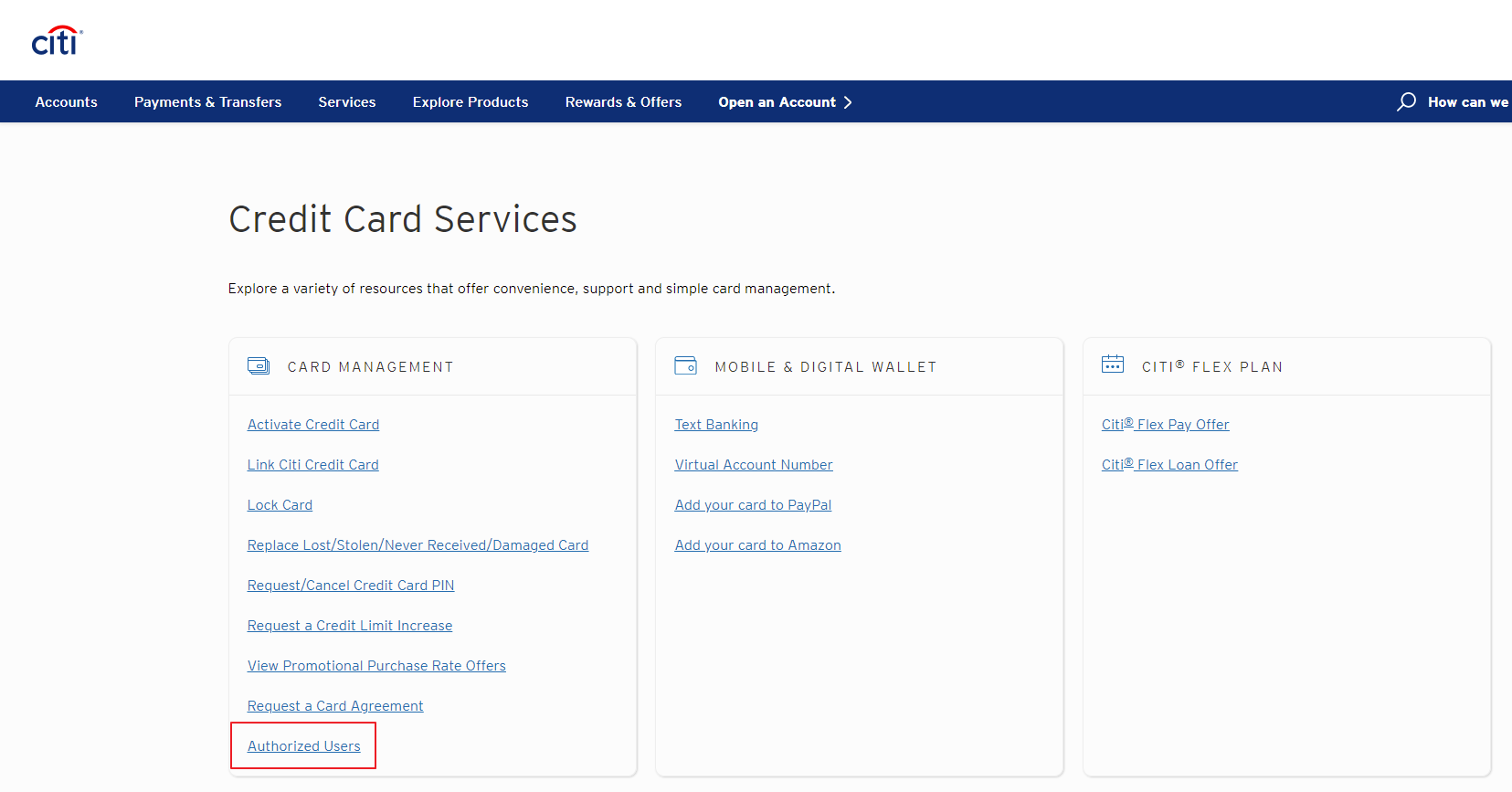

Can I add someone to my credit card online

The primary cardholder can add the authorized user by calling the card issuer or logging into the online account. Each issuer has its own requirements but may need the authorized user's name, address, birthdate and Social Security number to process the request.

Will adding my spouse to my credit card help his credit score

Sharing a credit card can help the partner with the lower credit score start to build their credit and raise their score. There are two options for sharing a card, Kuderna explains. You can open a joint card or have the spouse with the lower credit score become an authorized user on the other's credit card.

How fast does an authorized user build credit

Authorized user accounts must show up on your credit report to affect your credit score. If they do, you might see your score change as soon as the lender starts reporting that information to the credit bureaus, which can take as little as 30 days.

How much will my credit score go up if I become an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

Will adding my wife to my credit card help her credit score

Sharing a credit card can help the partner with the lower credit score start to build their credit and raise their score. There are two options for sharing a card, Kuderna explains. You can open a joint card or have the spouse with the lower credit score become an authorized user on the other's credit card.

Can unmarried couples share a credit card

You can add an authorized user to an existing credit card account already in your name, but in order to have a joint account as equal partners the account must usually be opened by both parties.

Will adding my wife to my credit card build her credit

Sharing a credit card can help the partner with the lower credit score start to build their credit and raise their score. There are two options for sharing a card, Kuderna explains. You can open a joint card or have the spouse with the lower credit score become an authorized user on the other's credit card.

Does adding someone to your credit card lower your score

If your credit card company doesn't report authorized users, adding them to your account will have no impact on their credit score. If, on the other hand, your credit card company does report authorized users, it can help them start building up credit.

Does adding someone to a credit card affect credit score

If your credit card company doesn't report authorized users, adding them to your account will have no impact on their credit score. If, on the other hand, your credit card company does report authorized users, it can help them start building up credit.

How do I add someone to my credit one credit card

To add a Credit One authorized user, log in to your Credit One account online and click the “menu” tab, or call customer service at (877) 825-3242. You will need to provide the person's full name, date of birth and address to add them as an authorized user.

Will adding someone to my credit card affect my credit score

If your credit card company doesn't report authorized users, adding them to your account will have no impact on their credit score. If, on the other hand, your credit card company does report authorized users, it can help them start building up credit.

What happens when I add someone to my credit card

What Does Adding an Authorized User to a Credit Card Do When a primary cardholder adds an authorized user to a card, that account will appear on the user's credit report and can help that person build or restore credit if the account is managed well.

Can you be denied as an authorized user

American Express authorized users can be denied if they are younger than 13 years old or if they have a bad history with Amex, such as past defaults or lawsuits with the company.

How much does your credit score go up when you re an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.