How do I amend Ertc form 941 in Quickbooks?

How do I amend my 941 for employee retention credit

Eight tips to amend Form 941 for the ERC:Gather your original Form 941.Find the most recent version of Form 941-X.Use separate forms for each quarter you're amending.Make sure you qualify.Calculate wages correctly.Confirm accuracy to avoid delays.Determine if you're a recovery startup business.

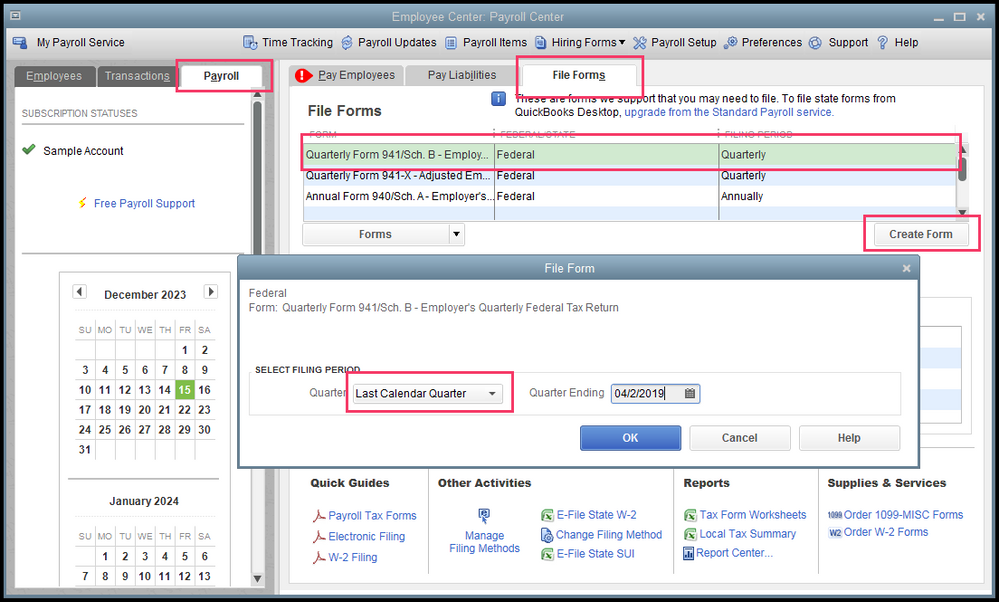

How do I correct a 941 in QuickBooks

Go to Employees, select Payroll Taxes & Liabilities. Then select Edit Payment Due Dates/Methods. Select Schedule Payments, and then select Federal 941/944/943. Check your payment frequency and change it to semiweekly if needed.

How do I record an ERTC in QuickBooks

I'll show you how.Go to Accounting.Select Chart of Accounts.Click New.Under Account Type, select Other Income Account.On the Detail Type menu, select the account type accordingly.Enter the name of your new bank account. Say Employee Retention Tax Credit.Click Save and Close.

Does QuickBooks file 941x

In QuickBooks Desktop Payroll Enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. This is the fastest and easiest way to make sure you stay compliant with the IRS.

Do you need to amend income tax return for ERC

If the business filed an income tax return deducting qualified wages before it filed an employment tax return claiming the credit, the business should file an amended income tax return to correct any overstated wage deduction.

Can you amend for employee retention credit

Form 941-X can be used to amend tax returns and make any necessary corrections. For example, if you decide to file for the Employee Retention Credit for eligible quarters in 2023 and 2023, you can complete Form 941-X to correct those returns and get your money back.

HOw do I amend form 941

When you discover an error on a previously filed Form 941, you must:Correct that error using Form 941-X;File a separate Form 941-X for each Form 941 that you're correcting; and.Generally, file Form 941-X separately. Don't file Form 941-X with Form 941.

What if there is a mistake on my 941 form

If you find that you have filed a 941 with errors, you can amend the filing with a Form 941-X. This corrects any errors that may have been overlooked when you originally filed.

How are ERC credits treated in accounting

ERC Accounting Under ASC 958

Under ASC 958, you must treat your ERC credit as a conditional contribution. That means you can recognize it on the income statement only once you've “substantially met” the conditions to earn it.

How should the employee retention credit be recorded

When recording the employee retention credit, it should be recorded as a credit to grant income and a debit to accounts receivable. If your organization received the credit as advance payments, the refundable advance liability is credited and the cash is debited.

Can you file an amended 941 electronically

The 941-X is used to correct information filed on the 941 form. You will be able to download and print the 941-X to mail into the IRS. Note: The IRS does not accept eFile of the 941-X form.

How do I correct my 941 form

For example, use Form 941-X, Adjusted Employers QUARTERLY Federal Tax Return or Claim for Refund, to correct errors on a previously filed Form 941. Taxpayers will continue to use Form 843 when requesting abatement of assessed penalties and interest.

How long does ERC take to process amended 941

The good news is the ERC refund typically takes 6-8 weeks to process after employers have filed for it.

How to treat ERC on income tax return

While the ERC refund is not taxable during the eligibility period when it is received, earnings equivalent to the ERC amount are subject to expenditure disallowance regulations with a sum of eligible wages for federal purposes.

Do you have to amend returns for ERC credit

Taxpayers that file an amended Form 941-X to claim an ERC refund must also file an amended income tax return for the tax year the ERC-eligible wages were paid to reduce their wage expense for the amount of the credit claimed.

Do I have to amend for ERTC

Applying this rule, the employer's wage deduction must be reduced in the year the qualified wages generating the ERC were paid. This generally requires filing an amended federal income tax return or administrative adjustment request (AAR), as applicable.

How do I correct an administrative error on 941

For example, use Form 941-X, Adjusted Employers QUARTERLY Federal Tax Return or Claim for Refund, to correct errors on a previously filed Form 941. Taxpayers will continue to use Form 843 when requesting abatement of assessed penalties and interest.

How long do you have to correct a 941

You have a limited amount of time to file Form 941-X. Generally, this form must be filed by the later of: 3 years from the date you filed your original return, or 2 years from the date you paid the tax.

Is the ERC treated as income

Is the ERC Considered Taxable Income The good news is that your ERC refund is not taxable income. However, the ERC will affect what payroll deductions you can claim. Businesses that receive the ERC must reduce their payroll expense deduction by the amount of the credit.

How should ERC be reported on taxes

When filing your federal tax return, the amount of your ERC refund is subtracted from your wages and salaries deduction. For example, a company that paid $100,000 in wages but received an ERC refund of $60,000 will only be able to report a wages and salaries deduction of $40,000.