How do I ask a bank to waive a fee?

How do I get my bank fees removed

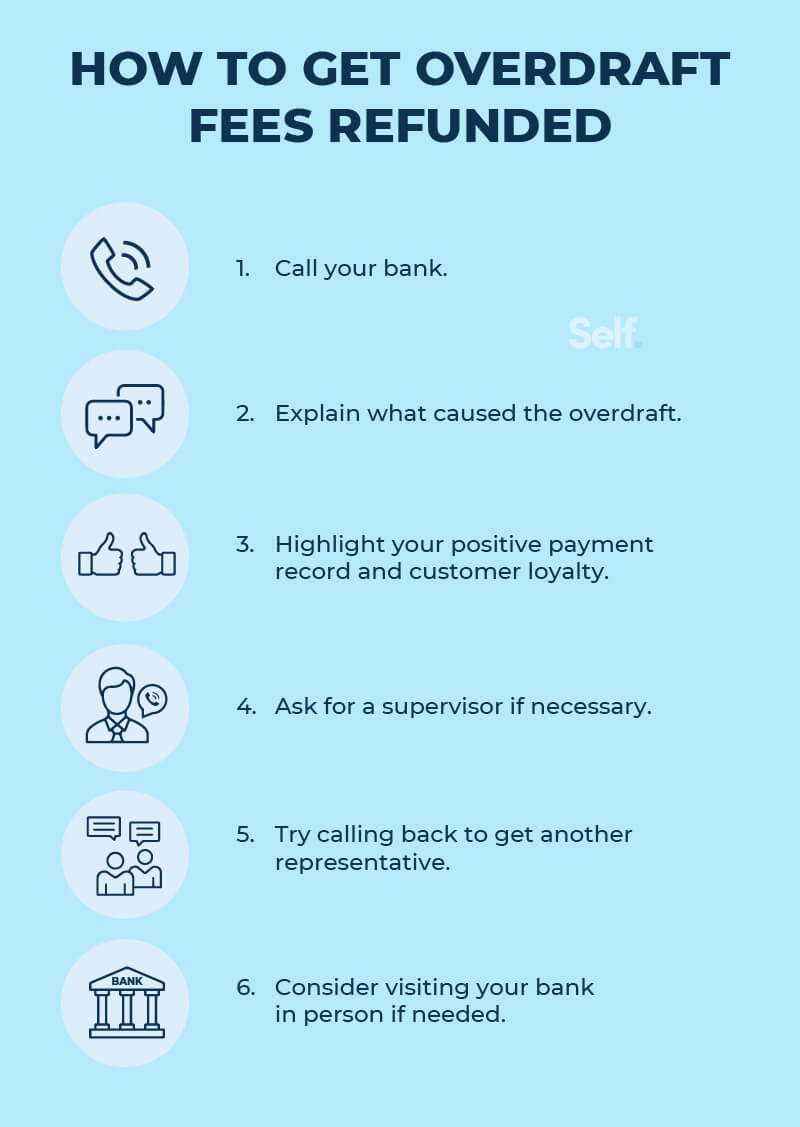

Yes, it's possible to get your bank to refund overdraft fees. It's often as simple as contacting your bank and asking them to refund the fees, though it likely helps to have a good relationship with the bank, such as making your payments on time and rarely having overdraft fees.

Can you negotiate bank fees

All bank fees can be negotiated, but the margins are smaller on some fees. Fees tied to employee labor or brick-and-mortar branches can be negotiated but not to the same degree as other automated/electronic transactions.

How do I request a waiver letter for bank charges

Dear Sir/ Madam, I, Richard Brown, am writing this letter to request you to kindly consider my request to waive off the bank charges that my account (Account number: 568923) has been charged with for one day late payment of the installment of car loan that I had taken from your bank.

How do I dispute a bank fee

Connect with Customer ServiceSpeak in a calm, professional manner.Be specific about your dispute, using the exact date, time, and cash amount.Explain your situation and refer to your clean track record if possible.If you've been a long-time bank member with few or no prior fees, mention that.

Do banks waive fees

Banks can charge a monthly fee to maintain deposit accounts. These fees may be lower or waived in certain situations, such as when you have direct deposit, maintain a minimum balance, or make a certain number of transactions each month.

Will banks waive stop payment fees

Issuing a stop payment for a check can cost money, but it's worth it. Typically, banks charge anywhere from $20 to $30 for canceling a check, though fees can vary. Some banks will reduce or even waive the stop payment fee for higher-tiered accounts.

Can a bank waive a fee

Banks can charge a monthly fee to maintain deposit accounts. These fees may be lower or waived in certain situations, such as when you have direct deposit, maintain a minimum balance, or make a certain number of transactions each month.

How do I get around bank fees

Here are some proven tips:Utilize free checking and savings accounts. Many banks still offer them.Sign up for direct deposit.Keep a minimum balance.Keep multiple accounts at your bank.Use only your bank's ATMs.Don't spend more money than you have.Sign Up for Email or Text Alerts.

How do you write a good waiver letter

Components of a waiverGet help. Writing a waiver should not be complicated.Use the correct structure. Waivers should be written in a certain structure.Proper formatting.Include a subject line.Include a caution!Talk about the activity risks.Do not forget an assumption of risk.Hold harmless.

Can a bank refuse to dispute a charge

After conducting an investigation, your card issuer may deny your dispute. For example, if the issuer may not find evidence that the transaction you disputed was unauthorized.

Is it easy to dispute a charge with your bank

In most cases, yes, you can dispute a debit card charge by requesting a "chargeback" through the bank. The bank will investigate the transaction and if they find the transaction to be incorrect or due to fraud, they will issue a refund to your card.

How do I ask my bank to waive late fees

Many issuers will waive late fees as a courtesy to customers with good payment records. Call your issuer, explain the situation and ask a customer service representative if they can waive the fee. If you're also subject to a penalty APR, you can ask for its removal as well.

How do I waive a stop payment fee

Find out if you have a qualified account

You may be able to get the stop payment fee waived if you have one of several accounts with stop payment benefits. If you do not have a qualified account when you call customer service, inquire about opening an eligible account and getting the fee waived simultaneously.

Why do banks charge fees for everything

Banks charge fees to help make a profit. Bank fees allow financial institutions to recoup operating expenses. Banks also make money on loans, via interest and other fees.

What is a waiver example

Examples of waivers include the waiving of parental rights, waiving liability, tangible goods waivers, and waivers for grounds of inadmissibility. Waivers are common when finalizing lawsuits, as one party does not want the other pursuing them after a settlement is transferred.

What should a waiver say

Activity risks: The waiver should describe in detail the risks surrounding the activity or service provided by your company. The participant must be made fully informed of potential risks before they can take part in the activity. They must also be made aware that your company will not cover their insurance costs.

Can you dispute a charge you willingly made

Disputing a credit card charge

Bad service and service not rendered are also eligible reasons to dispute a charge, even if you willingly made the purchase. For example, if you purchase something online that shows up broken, your credit card issuer can assist with getting your money back.

What happens when I dispute a charge with my bank

A chargeback takes place when you contact your credit card issuer and dispute a charge. In this case, the money you paid is refunded back to you temporarily, at which point your card issuer will conduct an investigation to determine who is liable for the transaction.

Can you waive bank fees

Banks often waive their fee if you keep a minimum amount in your account or meet other requirements such as linking checking and savings accounts.

How do I get rid of monthly maintenance fees

You could waive the fee if you keep a minimum daily balance or an average daily balance over the course of the month. Some checking accounts let you waive the charge if you make a minimum number of purchases with your debit card each month. Others waive it if you make a certain amount in direct deposits.