How do I avoid foreign transaction fees US bank?

Does U.S. Bank waive foreign transaction fees

There is a $10 exchange fee for transactions equal to or less than $250 U.S. dollars. That fee will be waived for transactions greater than $250 U.S. dollars.

Does my U.S. Bank card have foreign transaction fees

Using your card outside the U.S.

International Transaction 0% This is our fee which applies when you use your card for purchases at foreign merchants and for cash withdrawals from foreign ATMs and is a percentage of the transaction dollar amount, after any currency conversion.

Which US banks do not charge international fees

American Express ®only.Bank Of America ®only.Barclays ®only.Capital One ®only.Chase ®only.Citibank ®only.Discover ®only.First National Bank ®only.

Can I use my U.S. Bank debit card internationally

Yes. Cards issued by U.S. Bank can be used in most foreign countries for transactions. If you're planning to travel and want to use your card, let us know. Call us at the number on the back of your card, or add a travel note to your account digitally.

Where can I use my U.S. Bank debit card without fees

Bank Teller: Go into any Visa/MasterCard bank and ask the teller for a cash withdrawal for up to the full amount available on your card. There are no fees associated with withdrawing cash at any Visa/MasterCard bank. In-Network ATMs: Withdraw cash for free at any U.S. Bank or MoneyPass® ATM.

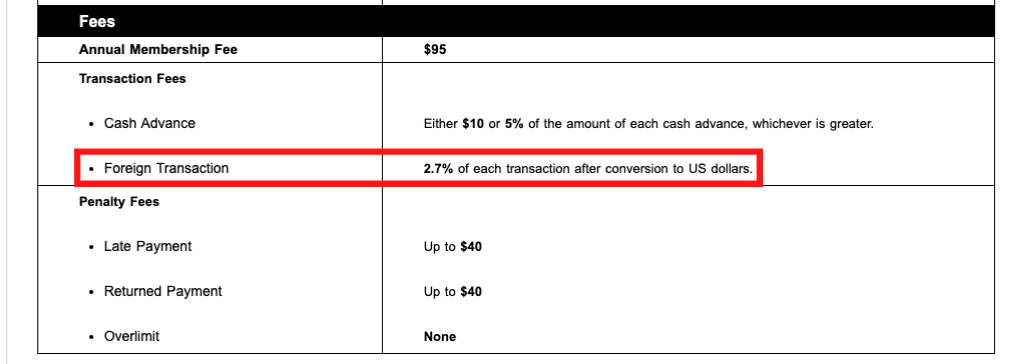

How much does U.S. Bank charge for foreign transaction fees

The U.S. Bank foreign transaction fee is either 0% or 3% of the purchase amount or foreign ATM cash advance transaction, depending on the card. Plus, if you want to withdraw cash abroad, be prepared to pay a $2.50 non-U.S. Bank ATM fee as well.

Which card is best for international transactions

Best International Debit Cards Offered by Indian BanksSBI Global International Debit Card.ICICI Bank Sapphiro International Debit Card.Axis Bank Burgundy Debit Card.HDFC EasyShop Platinum Debit Card.Yes World Debit Card.HSBC Premier Platinum Debit Card.

What debit cards are free to use abroad

Top pick travel credit and debit cardsChase – fee-free spending & withdrawals + 1% cashback.Starling – fee-free spending & cash withdrawals.Virgin Money – fee-free spending & withdrawals.Currensea – links to your existing bank account.

Is it better to use a debit or credit card internationally

Yes, using a credit card internationally is the best way to go about paying for things when you're abroad. It's safer because you don't have to carry as much cash, and all major credit card companies offer $0 fraud liability guarantees.

What happens if I use my debit card internationally

While you can typically use a debit cards in another country, you may have to pay a foreign transaction fee. Though these fees vary by bank and card issuer, they are usually around 3% of any transaction abroad.

What ATM can I use my U.S. Bank card for free

MoneyPass® ATM

There are no fees associated with withdrawing cash at any Visa/MasterCard bank. In-Network ATMs: Withdraw cash for free at any U.S. Bank or MoneyPass® ATM. You can check your balance for free using any or all of the following methods: Online – View account online at www.usbankfocus.com.

What debit card can I use abroad without charges

The best debit cards to use abroadStarling Bank current account.Metro Bank Current Account.Virgin Money M Plus Account.TSB Spend & Save Plus.The Nationwide FlexPlus account.Monzo current account.Halifax Clarity Credit Card Mastercard.Barclaycard Rewards Visa.

Is it better to exchange money or use credit card

Credit cards typically provide better exchange rates than what you'll get from ATM machines and currency stands. Depending on your card issuer, your purchases might automatically qualify for insurance. This coverage doesn't simply apply to consumer goods — it also covers travel delays and lost luggage.

Which debit card is free to use abroad

Top travel debit cardsChase – fee-free spending & withdrawals + 1% cashback.Starling – fee-free spending & cash withdrawals.Virgin Money – fee-free spending & withdrawals.Currensea – links to your existing bank account.

Which is better for international transactions Visa or Mastercard

Which is more popular, Mastercard or Visa Both Visa and Mastercard are accepted globally. However, Visa cards at the most basic level offer more benefits and features as compared to Mastercard.

What is the best debit card for travelling overseas

The following travel debit cards stood out as offering Outstanding Value:86 400 Spend Account.Citi Global Currency Account.Great Southern Bank Everyday Edge Account.HSBC Everyday Global Account.ING Orange Everyday.Macquarie Transaction Account.Suncorp Bank Everyday Options Account.UBank USpend.

How do I avoid international fees on my debit card

These fees can be avoided by choosing a bank account that doesn't charge fees and reimburses out-of-network ATM fees and by always withdrawing local currency from ATMs. Account holders can also ask their home bank if there are partner branches or in-network ATMs in the destination country or countries.

What is the best debit card for Travelling overseas

The following travel debit cards stood out as offering Outstanding Value:86 400 Spend Account.Citi Global Currency Account.Great Southern Bank Everyday Edge Account.HSBC Everyday Global Account.ING Orange Everyday.Macquarie Transaction Account.Suncorp Bank Everyday Options Account.UBank USpend.

Is it worth using debit card abroad

Advantages of an overseas card

The main advantage of using a debit or credit card overseas is that you won't pay foreign transaction fees every time you spend. While many also won't charge fees for cash withdrawals, you will still usually be charged interest from the date of the transaction if you use a credit card.

Is it better to use credit card or debit card abroad

Credit cards are widely accepted around the world and can also serve as a deposit, e.g., when renting a car. Credit card transaction fees are typically higher than debit cards. Most banks charge an average conversion fee of 2% for a credit card payment, that's 1% more than for a debit card payment.