How do I avoid paying finance charges on my credit card?

What is the best way to avoid finance charges

The best way to avoid finance charges is by paying your balances in full and on time each month. As long as you pay your full balance within the grace period each month (that period between the end of your billing cycle and the payment due date), no interest will accrue on your balance.

Cached

Why am I getting finance charges on my credit card

Key points about: the different types of finance charges on a credit card. Any fee you incur from using your credit card is considered a finance charge. Interest, penalty fees, annual fees, foreign transaction fees, cash advance fees, and balance transfer fees are all finance charges.

Cached

How do you solve finance charges

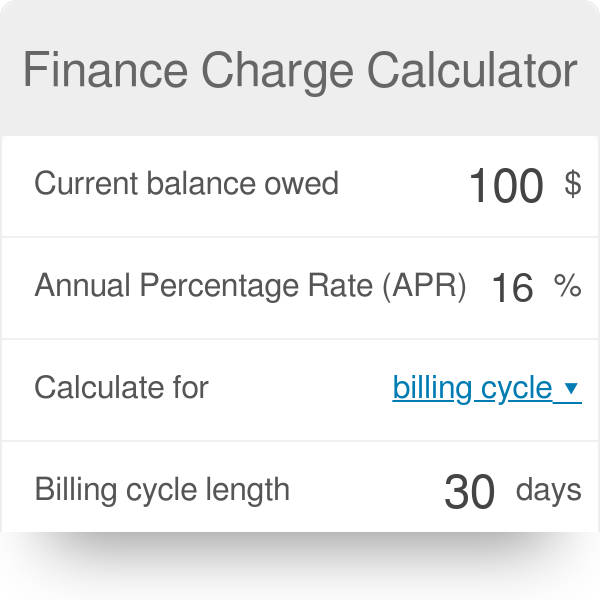

To sum up, the finance charge formula is the following: Finance charge = Carried unpaid balance × Annual Percentage Rate (APR) / 365 × Number of Days in Billing Cycle .

Is finance charge bad for credit

Paying the finance charge is like paying more towards your balance that will shorten the life of your debt but it will not affect the credit score.

Can finance charges on credit card reversed

In some cases, banks may offer to waive or reduce the charges if the customer has a good payment history and is requesting a reversal for the first time. To request a reversal, you can contact your bank's customer service department and explain the situation.

Do finance charges hurt credit score

Paying the finance charge is like paying more towards your balance that will shorten the life of your debt but it will not affect the credit score.

Are finance charges negotiable

Which loan fees can you negotiate Pretty much every fee associated with a loan — from interest rates to origination fees — is negotiable. The exceptions are fees set by your local or state government, like taxes or title and registration fees.

Are finance charges normal

The most common type of finance charge is the amount of interest charged on the amount of money borrowed. However, finance charges also include any other fees related to borrowing, such as late fees, account maintenance fees, or the annual fee charged for holding a credit card.

Can I negotiate finance charges

Pretty much every fee associated with a loan — from interest rates to origination fees — is negotiable. The exceptions are fees set by your local or state government, like taxes or title and registration fees.

Do I have to pay finance charge

First, if you pay your credit card balance in full every month you won't have to pay any finance charges. You'll need to pay before your credit card's grace period runs out. Most credit cards' grace periods are between 21 and 25 days, and you should be able to easily locate yours on your billing statement.

Can I ask my credit card company to reverse a payment

If you're not satisfied with the merchant's response, you may be able to dispute the charge with your credit card company and have the charge reversed. This is sometimes called a chargeback. Contact your credit card company to see whether you can dispute a charge.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

What hurts credit score the most

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you.

What is always considered a finance charge

The finance charge is the cost of consumer credit as a dollar amount. It includes any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension of credit.

Are finance charges the same as interest paid

In personal finance, a finance charge may be considered simply the dollar amount paid to borrow money, while interest is a percentage amount paid such as annual percentage rate (APR).

Can I waive finance charge

Requests to reverse finance charges may be evaluated. “For clients who pay their dues in full (consistent for the past six months), both finance charges and late payment charges can be waived.

What happens if you don’t pay financing

When you don't pay back a personal loan, you could face negative effects including: Fees and penalties, defaulting on your loan, your account going to collections, lawsuits against you and a severe drop in your credit score.

Can I dispute a credit card charge that I willingly paid for

Disputing a credit card charge

Bad service and service not rendered are also eligible reasons to dispute a charge, even if you willingly made the purchase. For example, if you purchase something online that shows up broken, your credit card issuer can assist with getting your money back.

Can I block a merchant on my credit card

Contact Card Issuer

If the vendor in question continues to take money from your account despite your request that it stop, you'll need to get in touch with your card issuer and ask that they block the company from charging your credit card.

What is the 15 3 rule

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.