How do I build credit with Zip pay?

Does ZipPay help build credit score

Yes, ZipPay can affect your credit score. You can use ZipPay without impacting your credit report or credit history, provided you make all payments on time. This means that you can shop now and pay later without affecting your ability to get loans in the future.

Cached

How do I increase my credit on Zip

To request an increase of up to $5000:Login to your Digital Wallet.Click on the Zip Money account tile.Click the settings tab (located top right-hand corner) > 'Account limit increase'We'll be in touch with you shortly to advise if your request was successful.

How much credit does Zip give you

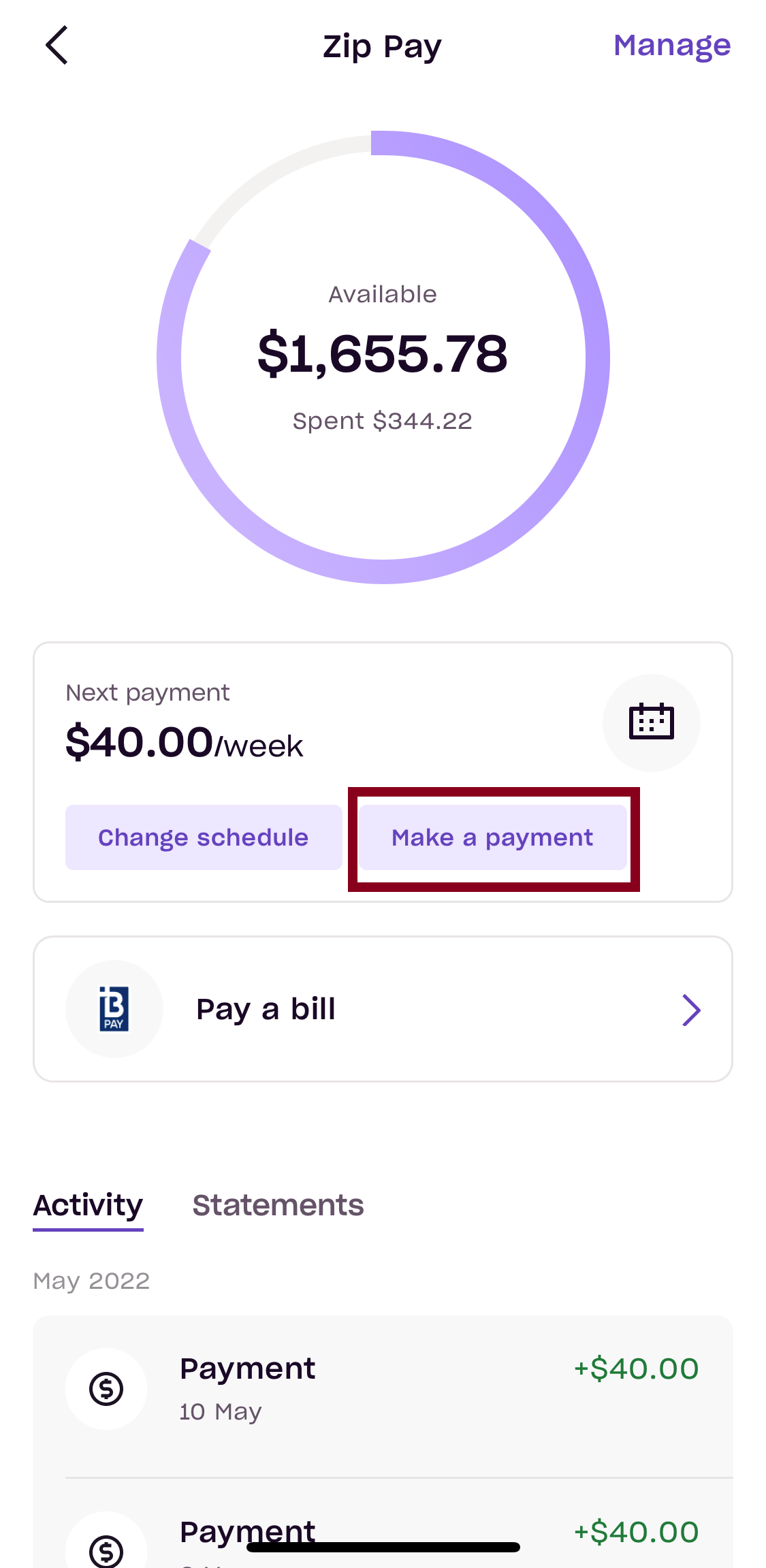

Zip Pay is an interest-free online shopping wallet with a credit limit of up to $1000, offering you the ability to buy now and pay later, on your terms. Repayments start from as little as $10 a week. To apply for a Zip Pay account please click here. Zip Money is a line of credit with credit limits over $1,000.

How do I increase my spending power on Zip pay

Zip Pay: There's a maximum spending (credit) limit of $350–$1,000. You can request an increase of up to $1,500 six months after your first purchase. Zip Money: You can be approved for a limit of $1,000. Additionally, if you apply for a line of credit through a merchant, you might be approved for more than $5,000.

Cached

What happens if you don’t Pay Zip Pay back

If you don't pay the minimum payment each month (or the remaining balance if less), a late fee of $5 for Zip Pay and $15 for Zip Money will be charged 21 days after your contractual due date.

How does zip credit work

Zip Money is a BNPL payment service that enables shoppers to spread the cost of their in store or online purchases. Once a customer makes a purchase, Zip Money then pays the upfront cost to the merchant. The shopper then repays Zip Money in either weekly, fortnightly or monthly instalments until the balance is cleared.

What’s the highest limit on zippay

$2,000

A strong repayment history will be beneficial to your assessment. Please note the maximum limit for a Zip Pay account is $2,000, please click here to learn more about Zip Money.

Does your zippay limit go up

Zip Money: You may be eligible for a credit limit increase once you've been using your account for at least 6 months, and demonstrate good repayment history with minimal to no missed repayments.

What’s the highest credit limit on Zip

A strong repayment history will be beneficial to your assessment. Please note the maximum limit for a Zip Pay account is $2,000, please click here to learn more about Zip Money.

Is ZipPay bad for credit

Afterpay and ZipPay are payment methods that allow you to “buy now and pay later”, similar to the lay-by process operated by many of the large department stores. They aren't loans or credit cards in the strictest sense, but they can affect your credit rating and your chances of getting a home loan.

What’s the highest limit on ZipPay

$2,000

A strong repayment history will be beneficial to your assessment. Please note the maximum limit for a Zip Pay account is $2,000, please click here to learn more about Zip Money.

What is the highest spending limit for Zip

While Zip Pay can be used on purchases between $350 and $1,000, Zip Money is focused on bigger ticket spending, with limits between $1,000 and $5,000. You aren't charged interest on Zip Pay purchases.

How long do you have to pay off Zip money

Repay your purchase within the initial period (up to 60 days) to avoid the $6 monthly fee.

How long can you do Zip pay for

Zip Money offers customers a guaranteed interest-free period of 3 months across all products and up to 36 months with some retailers3. Zip Money accounts may incur a one-off establishment fee for certain credit limits. A $7.95 monthly account fee applies.

What happens if you don’t pay Zip pay back

If you don't pay the minimum payment each month (or the remaining balance if less), a late fee of $5 for Zip Pay and $15 for Zip Money will be charged 21 days after your contractual due date.

What is the difference between Zip pay and AfterPay

But there are key differences: AfterPay requires buyers to have a valid credit or debit card upon sign up while ZipPay doesn't require users to own a card or a bank account. Afterpay collects a quarter of the purchase price payments each fortnight.

Why won’t ZipPay increase my credit limit

Zip Money: You may be eligible for a credit limit increase once you've been using your account for at least 6 months, and demonstrate good repayment history with minimal to no missed repayments. If you've applied for the wrong amount, please get in touch with our Customer Experience team below.

How long does it take to get a credit increase with Zip

6 months

Zip Money: You may be eligible for a credit limit increase once you've been using your account for at least 6 months, and demonstrate good repayment history with minimal to no missed repayments.

How many times can you use Zip pay

With Zip, you can make multiple purchases on the one account using your available credit. There is no need to change your schedule to meet your minimum monthly repayments as repayments and fees are charged for the account, not each purchase.

Can you get cash from zippay

Unfortunately, you cannot withdraw your credit as cash with Zip. But, you can shop directly with Zip partners both online or in-store, pay your bills using Zip Bills, generate a Single-use card to shop online, buy gift cards and shop in-store using our Tap to Pay Feature.