How do I buy back years of service?

How much does it cost to buy back your military time

The formula for how much the buyback will cost you would be the total amount of base pay received while in the military and not contributing to retirement, and multiplying this by 3% if in FERS, or 7% if in CSRS.

Is it worth it to buy service credit for retirement

You must decide if it's worth it to you. If it will take you just a few years to get the cost of the service credit purchase back through increased retirement allowance payments, maybe it's worth it to you. Conversely, if it will take 20 years to get the cost back, you might decide it's not worth it to you.

Cached

How does the military buy back program work

The Military Buyback Program is a benefit for all veterans with active duty military service time to receive credit for their military service time to be added to their years of civil service with the government and increases their retirement annuity.

Cached

What does it mean to buy years of service

Purchased service is the additional amount of service years that pensioners can purchase to be counted towards their pension account. Some retirement systems in the United States and Canada allow participants to purchase service time under certain conditions.

Who to contact for military buyback

For information and answers regarding your specific situation, please contact DFAS Customer Service at 1-888-332-7411 or by clicking here. For questions about the Web site or for general questions about military compensation click here.

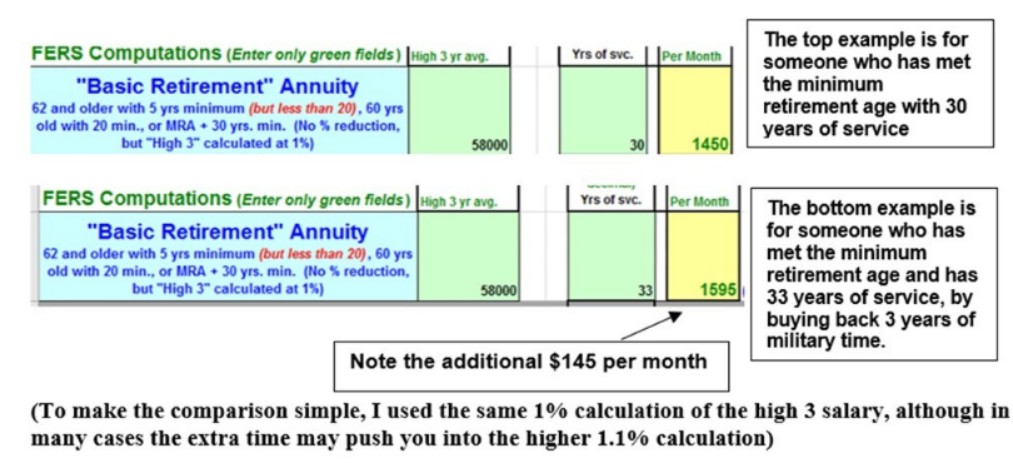

Is it worth buying back my military time

Your Federal Pension is determined by your High-3 Salary, your Years in Service and your CSRS or FERS Pension Multiplier. If you buy back your military time – it will increase your Years in Service. And the more Years in Service you have, the larger your pension will be.

Is it worth buying back retirement years

The Pros. The main benefit of buying back time is that upon retirement, it appears that the employee worked more years than they actually did. For example, if someone worked 22-years, but buys back 3-years, then their final pension calculation uses 25-years as the basis to calculate the annual pension amount.

What happens if you don’t have enough credits to retire

If you don't earn 40 quarters of coverage, you, unfortunately, won't qualify for Social Security retirement benefits. Even if you fall just one quarter short, the SSA will not pay you retirement benefits.

Can you buy back Social Security

You can withdraw your benefits, pay the money back and allow your future benefit to grow as if you never enrolled in the first place. To withdraw your benefits, you must fill out a special form from the Social Security Administration, stating the reason for your withdrawal.

Is it worth buying back military time

Your Federal Pension is determined by your High-3 Salary, your Years in Service and your CSRS or FERS Pension Multiplier. If you buy back your military time – it will increase your Years in Service. And the more Years in Service you have, the larger your pension will be.

Is 20 years in the military worth it

In fact, it's a tremendous asset with significant value. For the average retiring officer (let's say an O5 with 20 years), the military pension amount is valued at well over a million dollars. Did you know that

How do I calculate my military buyback

Take the amount of military base pay you received during your service, and multiply that amount by a percentage: CSRS use 7%, but FERS use 3%.

Is it worth serving past 20 years in military

In fact, it's a tremendous asset with significant value. For the average retiring officer (let's say an O5 with 20 years), the military pension amount is valued at well over a million dollars. Did you know that

Is 60 too late to save for retirement

The Bottom Line. It's never too late to start saving for retirement. Even if you retire in a year, saving and investing now will reduce your current spending, which will reduce how much you'll need. It will also give your new retirement investments a bit more time to compound their growth.

Is the 4 retirement rule making a comeback

There's good news for retirees: The 4% retirement rule is here again. The 4% rule helps ensure safe spending in retirement, and Morningstar researchers say that retirees can go back to taking higher initial withdrawals, The Wall Street Journal reported.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

How long does it take to get 40 credits for Social Security

10 years

You can work all year to earn four credits ($6,560), or you can earn enough for all four in a much shorter length of time. If you earn four credits a year, then you will earn 40 credits after 10 years of work. Each year the amount of earnings needed to earn one credit goes up slightly as average wages increase.

Can you pay back Social Security and start over

If you'd like to request to repay us in smaller monthly payments, please fill out the Request for Change in Overpayment Recovery Rate (Form SSA-634) and fax or mail the form to your local Social Security office.

What forms do I need to buy back my military time

How Do I Buy Back My Military TimeComplete a separate Estimated Earnings During Military Service request form, RI 20-97 for each branch of service.Note: To obtain a copy of your DD214, write to or send a military records request form, Standard Form 180(SF-180) to:National Personnel Records Center.

How much is E7 retirement pay with 20 years

$27,827 per year

What is the retirement pay for an E7 with 20 years As of 2023 the pay calculation projection an E7 retiring with exactly 20 years of service would receive $27,827 per year. It's important to note the present value of almost $800,000 for a 40 year old receiving this pension indefinitely.