How do I calculate my APR?

What is the formula to calculate APR

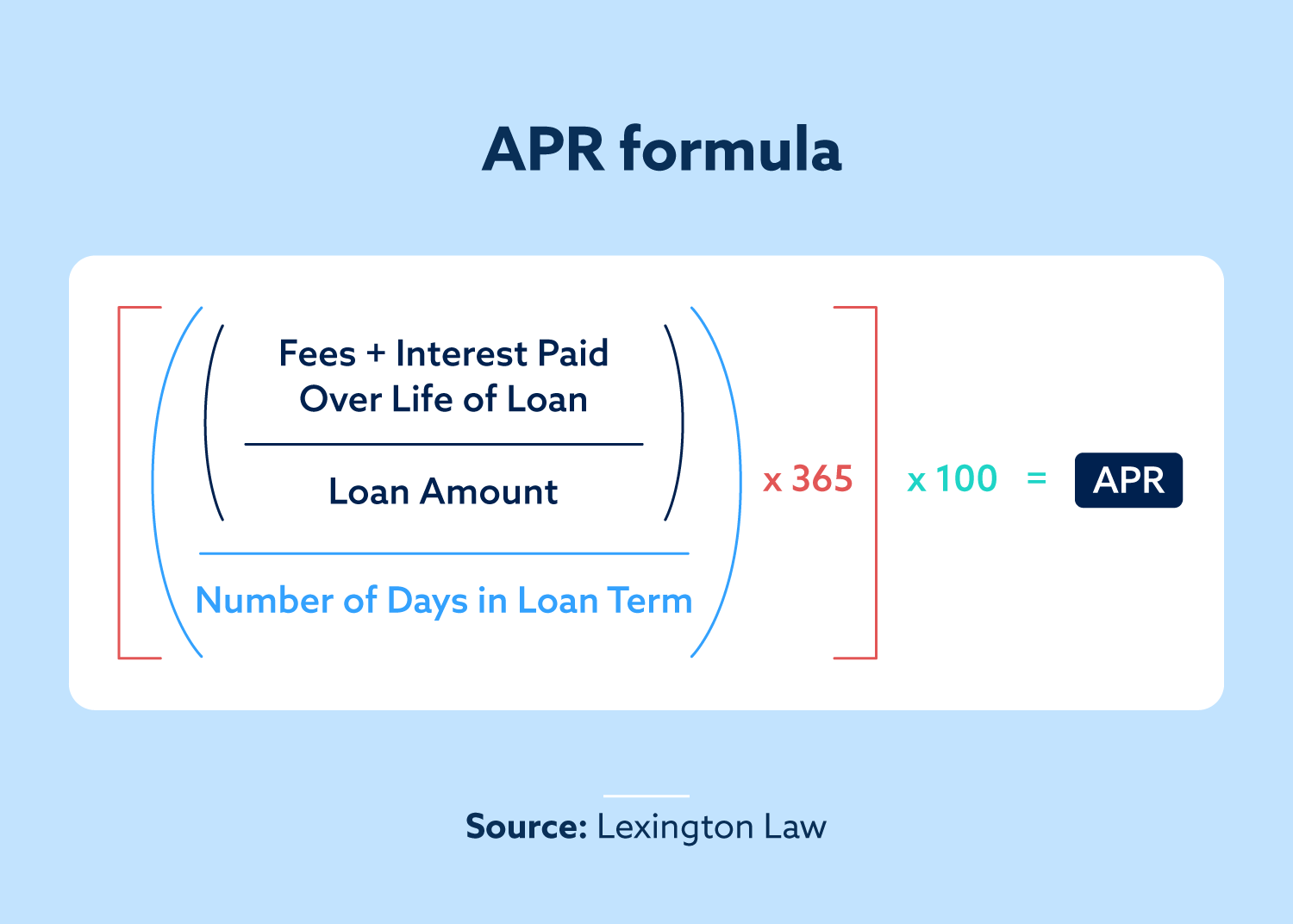

APR can be found with the formula, APR = ((Interest + Fees / Principal or Loan amount) / N or Number of days in loan term)) x 365 x 100. Is the annual percentage rate the same as the interest rate No, APR is broader than the interest rate. Interest rates are those that have to be paid in regular monthly installments.

Cached

How do you calculate APR from monthly payments

For example, if you currently owe $500 on your credit card throughout the month and your current APR is 17.99%, you can calculate your monthly interest rate by dividing the 17.99% by 12, which is approximately 1.49%. Then multiply $500 x 0.0149 for an amount of $7.45 each month.

Cached

How is 24% APR calculated

Given that some months have more days than others, the credit card issuer will break down the APR using a daily periodic rate (DPR) to determine how much interest you'll pay for a given billing period. To get the DPR for a credit card with a 24% APR, simply divide 24% by 365. The result is a rate of 0.0658% per day.

How do you calculate APR on a credit card

Typically, you can find your credit card APR near the end of your monthly statement. There will be a section of the statement marked "Interest Charge Calculation" or a similarly worded section. The statement section also shows you how much of your balance will be used to calculate your monthly interest charge.

What is a good APR rate

A good APR is around 20%, which is the current average for credit cards. People with bad credit may only have options for higher APR credit cards around 30%. Some people with good credit may find cards with APR as low as 12%.

Is APR the same as interest rate

The APR is the cost to borrow money as a yearly percentage. It's a more complete measure of a loan's cost than the interest rate alone. It includes the interest rate plus discount points and other fees. It doesn't factor in all costs, but lenders are required to use the same costs to calculate the APR.

How do you calculate 24.99 APR

To get the DPR for a credit card with a 24.99% APR, simply divide 24.99% by 365. The result is a rate of 0.0685% per day. Daily interest charges apply until the outstanding balance is paid in full.

Is 24.9 APR good

A 24.99% APR is not good for mortgages, student loans, or auto loans, as it's far higher than what most borrowers should expect to pay and what most lenders will even offer. A 24.99% APR is reasonable for personal loans and credit cards, however, particularly for people with below-average credit.

Is 24% a lot of APR

Yes, a 24% APR is high for a credit card. While many credit cards offer a range of interest rates, you'll qualify for lower rates with a higher credit score. Improving your credit score is a simple path to getting lower rates on your credit card.

Is 24.99 a high APR

A 24.99% APR is reasonable but not ideal for credit cards. The average APR on a credit card is 22.15%. A 24.99% APR is decent for personal loans. It's far from the lowest rate you can get, though.

Is credit card APR calculated monthly

For credit cards, interest is typically expressed as a yearly rate known as the annual percentage rate, or APR. Though APR is expressed as an annual rate, credit card companies use it to calculate the interest charged during your monthly statement period.

Does APR apply if I pay on time

Does APR matter if you pay on time If you pay your credit card bill off on time and in full every month, your APR won't apply. If you pay your bill on time but not in full, you'll be charged interest on your remaining balance.

What APR will I get with a 700 credit score

3% to 6%

A credit score of 700 gets you an interest rate of 3% to 6% on car loans for new cars and about 5% to 9% for second-hand cars.

What is APR for dummies

Put simply, APR is the cost of borrowing on a credit card. It refers to the yearly interest rate you'll pay if you carry a balance, and it often varies from card to card. For example, you may have one card with an APR of 9.99% and another with an APR of 14.99%.

Is a 24.99% APR good

A 24.99% APR is not good for mortgages, student loans, or auto loans, as it's far higher than what most borrowers should expect to pay and what most lenders will even offer. A 24.99% APR is reasonable for personal loans and credit cards, however, particularly for people with below-average credit.

What does a 26.99 APR mean

Is a 26.99% APR good for a credit card No, a 26.99% APR is a high interest rate. Credit card interest rates are often based on your creditworthiness. If you're paying 26.99%, you should work on improving your credit score to qualify for a lower interest rate.

Is 30% APR too high

A 30% APR is not good for credit cards, mortgages, student loans, or auto loans, as it's far higher than what most borrowers should expect to pay and what most lenders will even offer. A 30% APR is high for personal loans, too, but it's still fair for people with bad credit.

Is APR of 24% high

Yes, a 24% APR is high for a credit card. While many credit cards offer a range of interest rates, you'll qualify for lower rates with a higher credit score. Improving your credit score is a simple path to getting lower rates on your credit card.

Is APR calculated monthly or yearly

Annual percentage rate (APR) refers to the yearly interest generated by a sum that's charged to borrowers or paid to investors. APR is expressed as a percentage that represents the actual yearly cost of funds over the term of a loan or income earned on an investment.

Does APR go down if you pay off early

Yes. By paying off your personal loans early you're bringing an end to monthly payments, which means no more interest charges. Less interest equals money saved.