How do I cancel my Macy’s credit card?

Can you cancel Macys credit card online

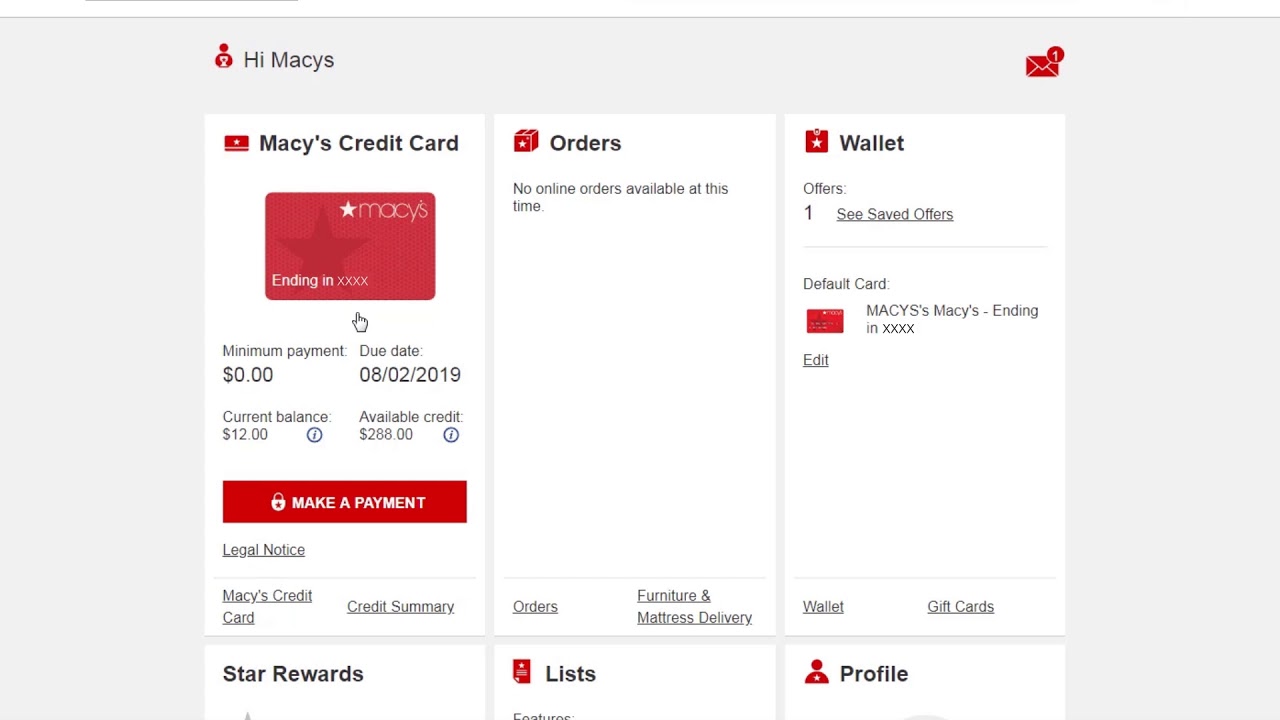

You can close your Macy's Credit Card account by calling customer service at (888) 257-6757. Just state your request and provide the information necessary to confirm your identity. This is the way to cancel your Macy's Store Card, too. At the moment, there is no way to cancel your Macy's Credit Card online.

Cached

Is it better to cancel unused credit cards or keep them

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

How do I cancel my Macy’s account

How to cancel Macy'sLog into your account.Go to your profile in the top right corner.Select 'My Service' from the dropdown.Scroll down to the 'Service Options' area.Click on 'Cancel Your Service' and answer the prompt to confirm.

How do I close or deactivate my credit card

You can call the credit card customer care of the respective bank and request them to cancel the credit card that is in your name. Once the request has been raised with customer care, the bank will get back to you and discuss the details for the cancellation of the credit card.

Does Cancelling a store credit card hurt your credit

Yes, closing credit cards, including a store credit card, can hurt your credit score. This is due to the fact that your score considers a few key factors, including your credit mix, credit utilization ratio and credit age.

Does closing a credit card lower your score

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Does Cancelling card hurt credit

Your score is based on the average age of all your accounts, so closing the one that's been open the longest could lower your score the most. Closing a new account will have less of an impact.

Will it hurt my credit score if I don’t use my credit card

If you don't use your credit card, your card issuer can close or reduce your credit limit. Both actions have the potential to lower your credit score.

What happens if you don’t use your credit card at all

Your Card May Be Closed or Limited for Inactivity

Without notice, your credit card company can reduce your credit limit or shut down your account when you don't use your card for a period of time. What period of time, you ask There's no predefined time limit for inactivity that triggers an account closure.

Does canceling a credit card hurt your credit

A credit card can be canceled without harming your credit score. To avoid damage to your credit score, paying down credit card balances first (not just the one you're canceling) is key. Closing a charge card won't affect your credit history (history is a factor in your overall credit score).

Does closing a credit card hurt your account

The average age of your accounts will decrease

The longer you've had credit, the better it is for your credit score. Your score is based on the average age of all your accounts, so closing the one that's been open the longest could lower your score the most.

How to cancel a credit card without destroying your credit score

A credit card can be canceled without harming your credit score. To avoid damage to your credit score, paying down credit card balances first (not just the one you're canceling) is key. Closing a charge card won't affect your credit history (history is a factor in your overall credit score).

How much does your credit drop if you close a credit card

Lower total credit available

For example, if the available credit for all your cards combined is $10,000 and you have a total of $2,000 in charges, your utilization ratio is 20 percent (2,000/10,000=. 20). If the card you cancel has a credit limit of $3,000, your total credit available goes down to $7,000.

What happens when you close a credit card with zero balance

By closing a credit card account with zero balance, you're removing all of that card's available balance from the ratio, in turn, increasing your utilization percentage. The higher your balance-to-limit ratio, the more it can hurt your credit.

What happens when you cancel a credit card

When you close a credit card, you'll no longer be able to use it. You're still responsible for making payments on the outstanding balance of the card. Depending on the type of rewards earned from the card, you may lose access to them. It's important to consider your rewards before closing an account.

How many points will I lose if I close a credit card

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points. Two-thirds of people who open a credit card increase their overall balance within a month of getting that card.

Is it OK if I never use my credit card

Your credit card account may be closed due to inactivity if you don't use it. You could overlook fraudulent charges if you're not regularly reviewing your account. If your credit card account is closed, it could impact your credit score.

Is it bad to not use your credit card

Credit card inactivity will eventually result in your account being closed, so it's a good idea to maintain at least a small amount of activity on each of your cards. A closed account can have a negative impact on your credit score so consider keeping your cards open and active whenever possible.

Will my credit card get Cancelled if I don’t use it

If you don't use a credit card for a year or more, the issuer may decide to close the account. In fact, inactivity is one of the most common reasons for account cancellations. When your account is idle, the card issuer makes no money from transaction fees paid by merchants or from interest if you carry a balance.

How many points will my credit score drop if I close a credit card

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.