How do I change bank details for child tax credits?

How do I change my bank account for child tax credit

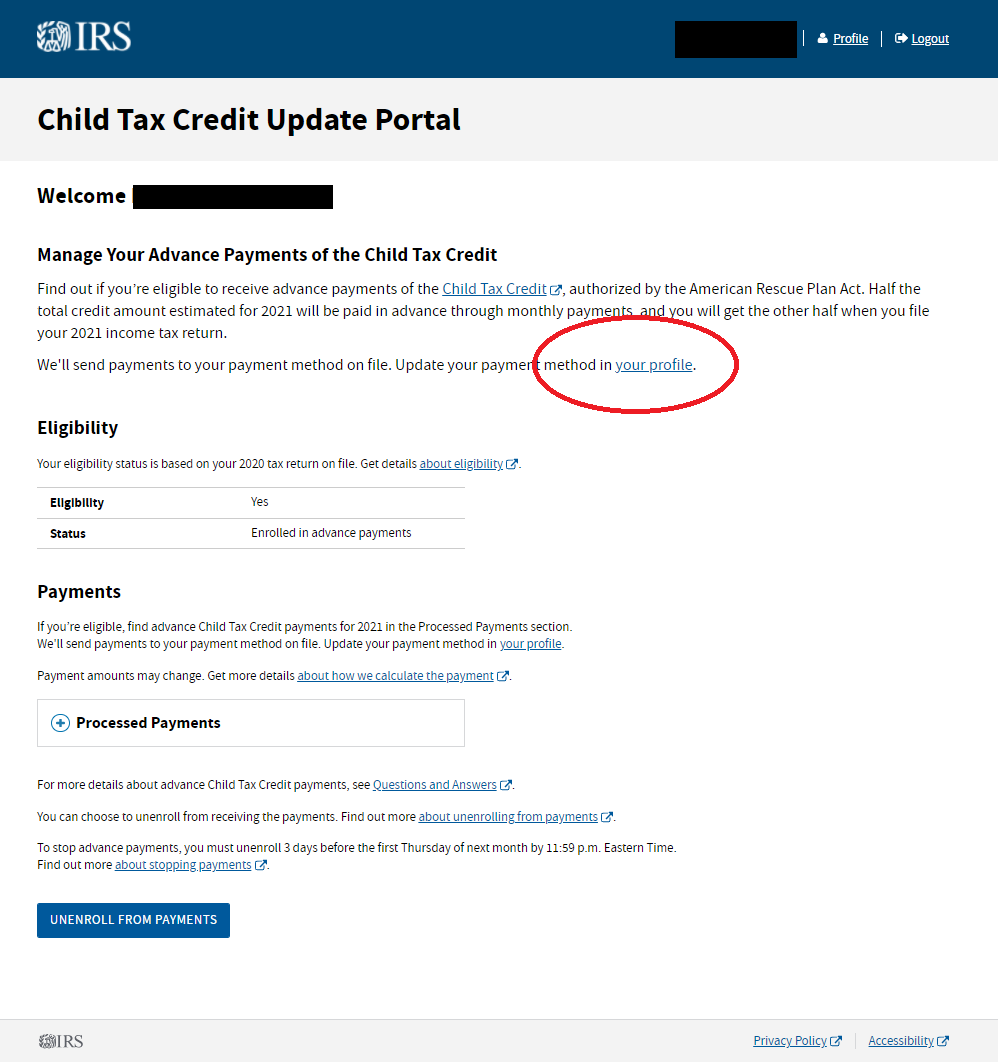

You can add or change your bank account information through the IRS's Child Tax Credit Update Portal. Due to processing times, changes might not be reflected immediately on your next payment.

Cached

How do I change my direct deposit information with the IRS after filing

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040.

Cached

Can I change payment method on child tax credit

Now, through the Child Tax Credit Update Portal, families can change the information the IRS has on file by "updating the routing number and account number, and indicating whether it is a savings or checking account," according to a news release.

Can I change my direct deposit information with the IRS online

People who need to update their bank account information should go directly to the IRS.gov site and not click on links received by email, text or phone.

How do I change my bank account for IRS payments

If changes are needed, the only option is to cancel the payment and choose another payment method. Call IRS e-file Payment Services 24/7 at 888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

Can I change my bank account number

Unfortunately, you can't change the account number for your bank, as that number tells payers and payees where to withdraw or deposit money in your name. But if your account has been compromised, you can open a new bank account.

What happens if the IRS sends money to a closed bank account

For security reasons, we cannot modify the routing number, account number, or the type of account from what was entered when you filed your return. If the account is closed or incorrect banking information is provided to us, the bank will reject the refund.

What form do I need to change my banking information with the IRS

Use Form 8888 if: You want us to directly deposit your refund (or part of it) to either two or three accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States, or.

What if I didn’t get my child tax credit payment

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

How long does it take IRS to send refund rejected by bank

Banks usually release rejected refunds back to the IRS. The IRS then sends a paper check within six to eight weeks.

Why can’t i update my bank info with IRS

You cannot change banking information while your return is in pending, nor can you change it after the return is accepted. The IRS does not allow it. If you entered incorrect banking information for your refund, you can change it if your return is rejected. If it is accepted, however, it is too late to change it.

How do I change my direct deposit from one bank to another

If you have direct deposit, fill out the papers directing your employer to reroute your paychecks to your new account. Do the same for any other direct deposit, such as Social Security payments. Find out the date your direct deposits will transfer.

How do I change my direct debit from one bank to another

If you wish to switch a direct debit from one bank to another you would need to contact the originator of the funds to ensure they have the correct and most up to date account details.

How long does it take for IRS to send check if bank account is closed

If you were set up for a direct deposit of your refund and your bank account closed before the funds were direct deposited, your bank will return the funds to the IRS. The IRS will then issue you a paper check, resulting in a tax refund delay of up to 10 weeks.

How long does it take the IRS to send a check after bank rejected

Banks usually release rejected refunds back to the IRS. The IRS then sends a paper check within six to eight weeks. Keep a thorough record of your tax return and refund process.

How do I change my bank account on e filing

If you want to update the Bank Account Number for a refund failure case, go to 'My Account' 'Refund reissue request' on the Income Tax e-Filing website. Choose between ECS and Cheque as the method for receiving your return. Fill in the new Bank Account Number and your address information. Send in your request.

What happens if my direct deposit is returned to the IRS

You incorrectly enter an account or routing number and your designated financial institution rejects and returns the deposit to the IRS, the IRS will issue a paper check for that portion of your refund; or.

How long does it take to change direct deposit to another bank

Setting up direct deposit can take anywhere from one day to a few weeks, depending on the provider.

Can I change my direct deposit over the phone

Use our automated phone assistance

say "direct deposit." You will need to provide your current direct deposit routing number and account number to change your information over the phone. Call TTY +1 800-325-0778 if you're deaf or hard of hearing.

Can I change a Direct Debit online

A Direct Debit is set up by the company you're paying, so you can't set them up yourself or amend them online. If you're registered, you can view all the Direct Debits that have been set up on your account in Online Banking – and you can cancel them too.