How do I check my gas stimulus status?

How do I know if I’m going to get a gas stimulus check

Check if you qualify for the Golden State Stimulus IIFiled your 2023 taxes by October 15, 2023.Had a California Adjusted Gross Income (CA AGI) of $1 to $75,000 for the 2023 tax year.Had wages of $0 to $75,000 for the 2023 tax year.Been a California resident for more than half of the 2023 tax year.

Where is my inflation relief check

If you believe you should have received your payment already but haven't, the FTB suggests contacting customer service at 1-800-542-9332. A customer service agent will help you confirm you qualify, explain what payment you'll receive and when.

Cached

When am I getting my inflation check

When will I get my inflation relief debit card Debit card recipients should allow up to two weeks from the issue date to receive their payment in the mail.

How do we get the gas stimulus check

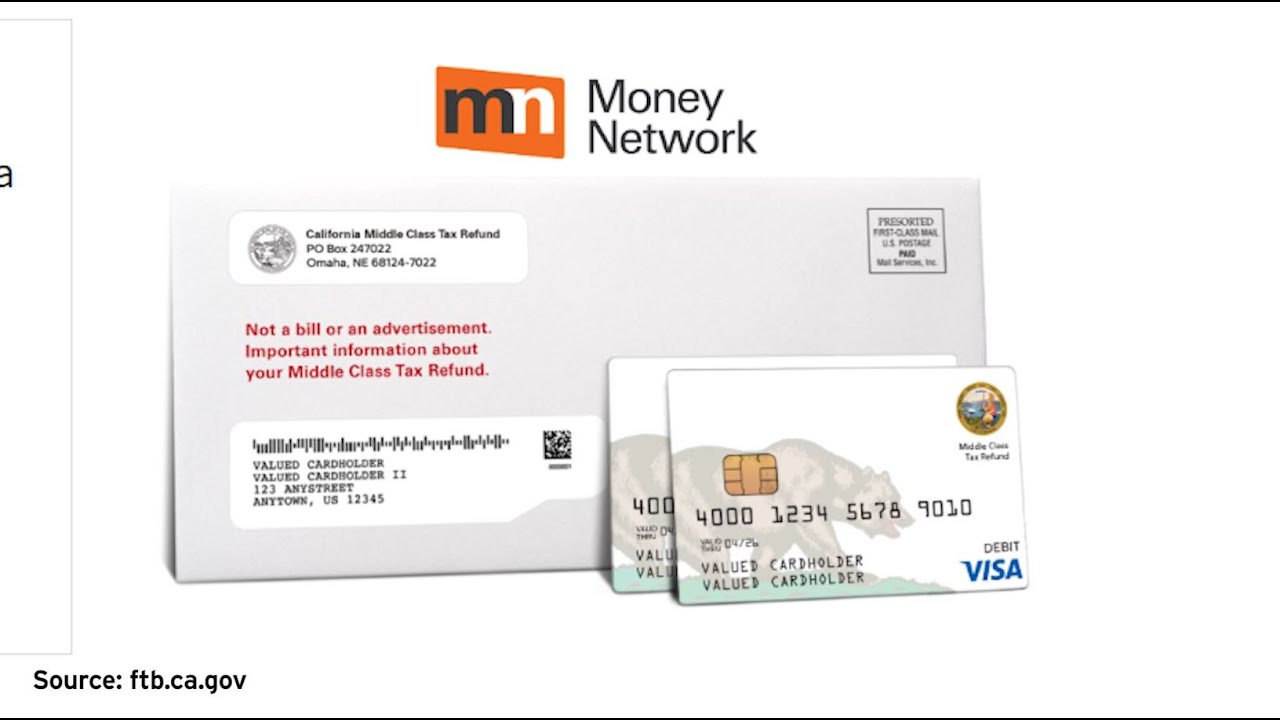

People who are eligible for the payment will get it either via a direct deposit to their bank account or by mailed debit card, according to the tax board. Generally, people who filed their 2023 tax return online and received their state tax refund via direct deposit will get a direct deposit.

Will everyone get a gas check

To qualify for the proposed stimulus check, your earnings would need to be as follows: Less than $75,000 for single filers. Those earning between $75,000 and $80,000 would receive a reduced amount with payments being completely phased out for households making more than $80,000. Less than $150,000 for joint filers.

Where is my CA gas refund

You can check on refund status by phone: 1-800-338-0505 or +1 (916) 845-6500 (outside the U.S.) Weekdays, 7 a.m. to 5 p.m. You can check on refund status by chat. Sign into MyFTB to chat weekdays, 7 a.m. to 5 p.m. The refund normally takes up to two weeks to receive if you e-filed and up to four weeks for paper return.

Can you track your inflation relief check

Unfortunately, there is no way to track when the inflation check from the California Franchise Tax Board will hit your mailbox if you have not yet received it.

What happens if I haven’t received my inflation relief check

If you believe you should have received your payment already but haven't, the FTB suggests contacting customer service at 1-800-542-9332. A customer service agent will help you confirm you qualify, explain what payment you'll receive and when.

Are inflation checks being mailed

Can I track my California inflation relief check The state estimates 18 million payments will be issued by Jan. 14, meaning approximately 1.9 million payments remain. The vast majority of the remaining payments will be issued as a debit card in the mail.

Do I qualify for gas relief stimulus

To qualify, you must have filed your 2023 state tax return by October 15, 2023 and been a California resident for at least six months in 2023. You must not be listed as a dependent on someone else's return for the 2023 tax year, and you must be a California resident on the date your payment is issued.

Who all gets a gas stimulus check

To qualify for the proposed stimulus check, your earnings would need to be as follows: Less than $75,000 for single filers. Those earning between $75,000 and $80,000 would receive a reduced amount with payments being completely phased out for households making more than $80,000. Less than $150,000 for joint filers.

What happens if I didn’t get my gas relief check

If you believe you should have received your payment already but haven't, the FTB suggests contacting customer service at 1-800-542-9332. A customer service agent will help you confirm you qualify, explain what payment you'll receive and when.

Who is receiving gas checks

To qualify for the proposed stimulus check, your earnings would need to be as follows: Less than $75,000 for single filers. Those earning between $75,000 and $80,000 would receive a reduced amount with payments being completely phased out for households making more than $80,000.

How to get California inflation relief checks

Who is eligible for inflation relief payments Recipients must have filed their 2023 tax return by Oct. 15, 2023, have met certain income limits (see below), were not claimed as a dependent in the 2023 tax year, and were California residents for six months or more of the 2023 tax year.

When should I get my California stimulus check

If you are eligible, you will automatically receive a payment. Payments are expected to be issued between October 2023 and January 2023.

Can I check on my inflation relief check

If you believe you should have received your payment already but haven't, the FTB suggests contacting customer service at 1-800-542-9332.

Has anyone received inflation relief checks

So far, the only people who have received an inflation relief check are those who also received Golden State Stimulus payments back in 2023. The state has issued one round of direct deposits and one round of debit cards.

How will inflation relief checks be sent out

Direct deposits began issuing at the end of August, however, taxpayers who filed their 2023 state tax returns between July 31 and December 31, 2023 will receive direct deposit up to 10 weeks after the tax department accepts your return, or 12 weeks if you requested a physical check.

What is the $400 gas stimulus

$400 gas rebate

The majority of the $11 billion relief package, around $9 billion, has been allocated for the sending of a $400 direct payment for each vehicle a household owns. There is a two-vehicle limit and residents should be aware that the bill caps the number of times this benefit can be claimed at two.

Where is my California gas rebate

For those who electronically filed their taxes in 2023 and received a refund by direct deposit, their payment will come via direct deposit before Nov. 14. Other filers should expect to receive the money in the mail on a debit card as late as January 2023.