How do I check my Toyota Financial account online?

How do I check my Toyota Financial

Log in to your account. From your Dashboard, scroll down the page and click “Billing Statements”

Cached

Is there an app for Toyota payments

Make a Payment

Link the Toyota App with your Toyota Financial Services online account.

Where can I find my Toyota Finance account number

It's packed with useful features to make your life easier. It's a quick and simple process to register for My Finance. You can register for My Finance in 3 easy steps using your agreement number which can be found within your Welcome Pack and My Finance email.

How do I set up payment on my Toyota car

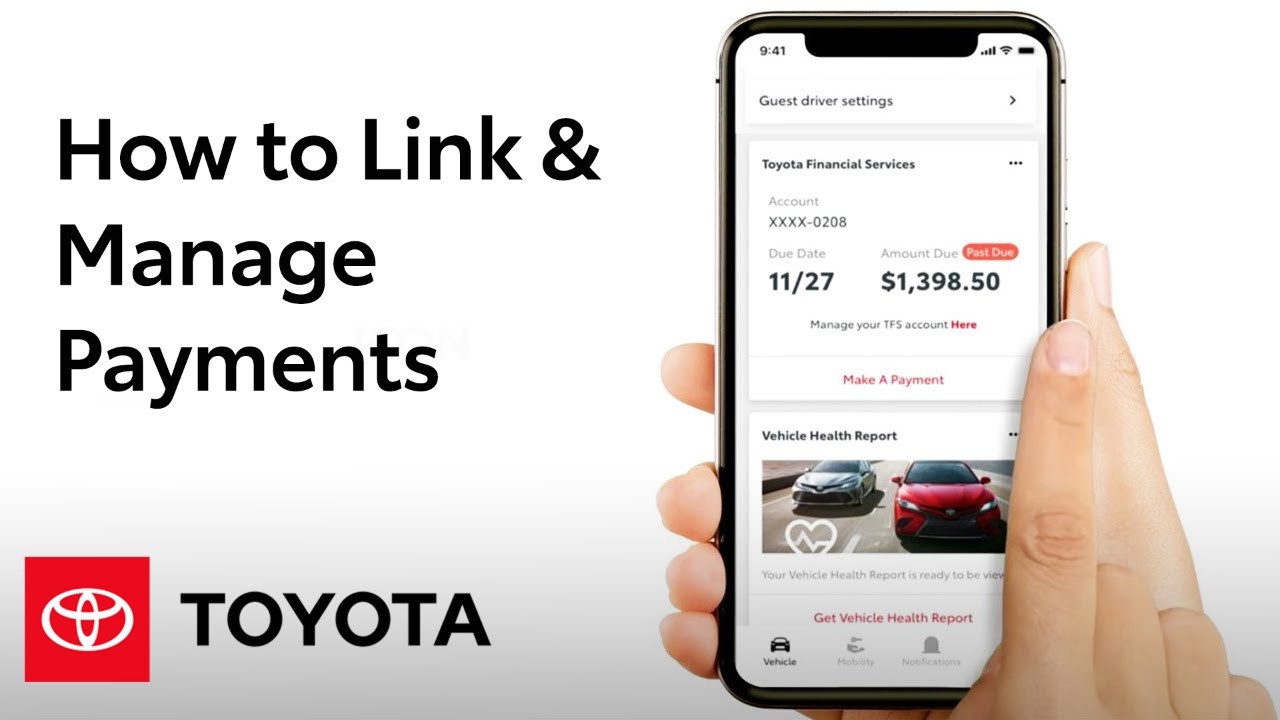

App you can conveniently link and manage your monthly toyota financial service payments all from the palm of your hand scroll to the toyota financial services tile to start the setup process and link

How do I check my auto finance

The first step is to visit the website of the bank or financial institution where you applied for the loan. Look for the section that allows you to check your loan status, which may be called something like “Loan Tracker” or “Loan Status”.

Can you skip a car payment with Toyota Financial

We do offer deferrals, but they require evaluation and approval, and may come with additional fees. Please contact our Customer Service Team to discuss your situation and make arrangements.

Can you skip a payment with Toyota Financial

We do offer deferrals, but they require evaluation and approval, and may come with additional fees. Please contact our Customer Service Team to discuss your situation and make arrangements.

Is there a grace period for Toyota car payments

Toyota Financial Services does have grace periods for car payments, but the length varies by contract. You'll want to review your TFS contract for details on your specific grace period agreement.

How do I find my auto loan account number online

The first place to check is your monthly statement. If you can't find your statement, try logging into your account, where the number should be in the account information section. Alternatively, your credit report should list your open and active lines of credit, including your car loan.

Is my loan number my account number

Note: Your Loan ID is not your Account Number.

You can find your Loan ID in your new loan letter – which is mailed or emailed to you the day after the loan is funded – or found through online and mobile banking.

How do I manage my car payments

4 ways to lower your current car paymentRenegotiate your loan terms. Lenders often allow you to defer a payment when you're facing financial hardship.Refinance your car loan. There are two ways refinancing your car loan can help lower your monthly payment.Sell or trade in your car.Make extra payments when possible.

How do I make my car payment

You have many options for making payments.Set up automatic payments. You decide which savings or checking account you would like the money to come from each month.Pay online. Sign on and select your auto loan from Account Summary.Pay by phone.Pay by mail.Pay in person.Other ways to pay.Additional principal payments.

How do I find my outstanding loan balance

You can visit the nearest branch of the bank from whom you availed the personal loan to get your personal loan statement. Make sure you carry all the relevant documents with you to the bank. A representative from the bank will help you with the process and will provide you with your personal loan statement.

What is the 20 4 10 rule for cars

The short version is that it recommends making a 20% down payment on the car, taking four years to return the money to the lender, and keeping transportation costs just under 10% of your monthly income.

How many car payments can you miss Toyota

If you've missed a payment on your car loan, don't panic — but do act fast. Two or three consecutive missed payments can lead to repossession, which damages your credit score.

What is the grace period for Toyota Financial

Accounts enrolled through the Auto-Debit Payment method will not be charged within the 60-day grace period. However, accounts will be automatically debited for the regular monthly payment after the 60-day extension period.

How many days late can you be on car payment

Most auto loans typically have a 10- to 15-day grace period, during which you won't be charged a late fee. This applies to first car payments as well as subsequent payments. So you won't be penalized if you miss your payment by a few days, as long as you pay it within a lender's grace period.

How many times can you be late on car payment

If you've missed a payment on your car loan, don't panic — but do act fast. Two or three consecutive missed payments can lead to repossession, which damages your credit score. And some lenders have adopted technology to remotely disable cars after even one missed payment.

How late is too late on a car payment

Typically, a payment will be reported as late to the credit bureau when it hits 30 days past due. Ask your lender if there is a late car payment grace period. Some lenders provide a 10-day grace period for example.

How can I check my auto loan balance

Yes, most banks and financial institutions allow you to request a statement of your car loan balance. You can usually do this by visiting your bank's website, logging into your account, and navigating to the loan section. Alternatively, you can visit your bank and request a statement in person.