How do I claim medical expenses on my taxes 2023?

How much medical expenses are deductible for 2023

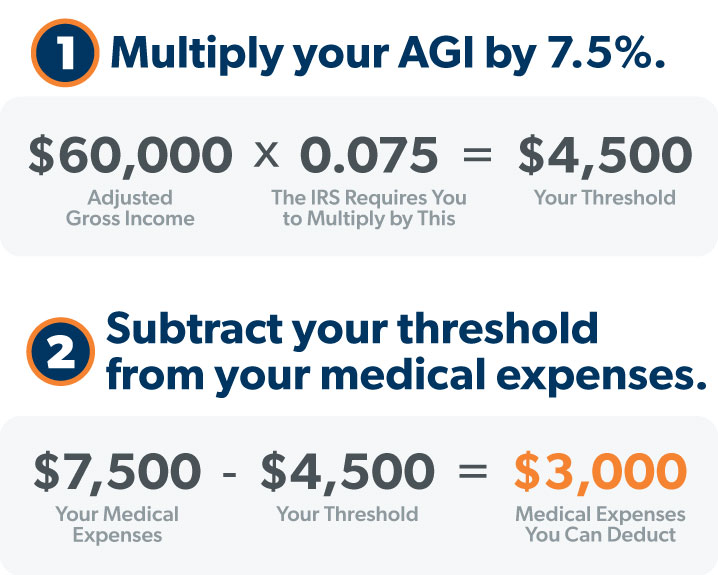

For tax returns filed in 2023, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. So if your adjusted gross income is $40,000, anything beyond the first $3,000 of medical bills — or 7.5% of your AGI — could be deductible.

Cached

Are health insurance premiums tax deductible in 2023

The short answer is yes, Medicare premiums can be tax-deductible. However, the amount you can deduct depends on your income and tax filing status. The IRS allows you to deduct medical and dental expenses that exceed 7.5% of your adjusted gross income on form 1040 or 1040 senior.

Cached

What are the deductions for 2023 income tax

Standard deduction 2023 (taxes due April 2024)

| Filing status | 2023 standard deduction |

|---|---|

| Single | $13,850. |

| Married, filing separately | $13,850. |

| Married, filing jointly; qualified widow/er | $27,700. |

| Head of household | $20,800. |

May 3, 2023

What are the rules for claiming medical expenses on taxes

You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (AGI). This publication also explains how to treat impairment-related work expenses and health insurance premiums if you are self-employed.

What will the Medicare Part D deductible be in 2023

Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $505 in 2023. Some Medicare drug plans don't have a deductible. In some plans that do have a deductible, drugs on some tiers are covered before the deductible.

What is the IRS penalty for not having health insurance in 2023

As of 2023, there is currently no federal fine for not enrolling in health insurance. The federal government eliminated the fine in 2023.

Will there be healthcare subsidies in 2023

It depends on how much you earn. In 2023, you're eligible for Obamacare subsidies if the cost of the “benchmark plan” (the second-lowest-cost silver plan on the exchange) costs more than a given percent of your income, up to a maximum of 8.5%. The cut-off threshold increases on a sliding scale depending on your income.

What is the standard deduction for 2023 for elderly

The standard deduction for those over age 65 in 2023 (filing tax year 2023) is $14,700 for singles, $27,300 for married filing jointly if only one partner is over 65 (or $28,700 if both are), and $21,150 for head of household.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

How much out of pocket medical expenses can you claim on taxes

2023 Standard Deduction

In addition, in 2023, you can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI), found on line 11 of your 2023 Form 1040. For example, if your AGI is $50,000, the first $3,750 of qualified expenses (7.5% of $50,000) don't count.

Can you write off out of pocket medical expenses on your taxes

You can only include the medical expenses you paid during the year. You must reduce your total deductible medical expenses for the year by any amount compensated for by insurance or any other reimbursement of deductible medical expenses, and by expenses used when figuring other credits or deductions.

How much is the Medicare Part D premium for 2023

2023 Part D national base beneficiary premium — $32.74

It can change each year. If you pay a late enrollment penalty, these amounts may be higher. See your Medicare & You handbook or visit Medicare.gov for more information.

How much will Medicare Part B reimburse in 2023

$164.90

If you are a new Medicare Part B enrollee in 2023, you will be reimbursed the standard monthly premium of $164.90 and will only need to provide a copy of your Medicare card.

Is the Affordable Care Act still in effect for 2023

2023 Open Enrollment is over, but you may still be able to enroll in 2023 health insurance through a Special Enrollment Period.

What is the minimum deductible for ACA 2023

For the 2023 plan year: The out-of-pocket limit for a Marketplace plan can't be more than $9,100 for an individual and $18,200 for a family. For the 2023 plan year: The out-of-pocket limit for a Marketplace plan can't be more than $8,700 for an individual and $17,400 for a family.

Who qualifies for ACA subsidies 2023

Qualifying for Subsidies

To qualify for the premium tax credit, individuals or families must have a net income between 100 percent and 400 percent of the federal poverty line.

What to expect in 2023 in healthcare

We expect increased labor costs and administrative expenses to reduce payer EBITDA by about 60 basis points in 2023 and 2023 combined. In addition, providers premium rate increases and accelerated Medicare Advantage penetration.

What is the IRS deduction for seniors over 65

The standard deduction for seniors this year is actually the 2023 amount, filed by April 2023. For the 2023 tax year, seniors filing single or married filing separately get a standard deduction of $14,700. For those who are married and filing jointly, the standard deduction for 65 and older is $25,900.

What is the extra standard deduction for seniors over 65

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you are legally blind, your standard deduction increases by $1,700 as well. If you are married filing jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,350.

Is IRS offsetting refunds 2023

(updated May 16, 2023) All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans.