How do I claim my Ertc 2023?

Has anyone received ERC refund 2023

You could receive your refund 21 days after filing your 2023 taxes in 2023. This means you could receive your refund three weeks after the IRS receives your return. It may take several days for your bank to have these funds available to you.

Is March 12th 2023 the deadline for ERTC

Another proposed deadline was March 12, 2023, or three years after the program's initial start date of March 12, 2023. The third most often touted ERC application deadline is simply a three-year window from the date of tax filing.

How will I receive my ERTC refund

The ERC is a refundable tax credit that was designed to encourage employers to keep their employees on payroll during the pandemic. ERC refunds are claimed via an amended payroll tax return, Form 941-X, for each applicable qualifying quarter in 2023 and 2023.

Cached

How do I claim my ERC credit retroactively

Eligible employers can claim the ERTC retroactively by filing Form 941-X for each quarter they paid qualifying wages. They can file this form up to three years after the original payroll taxes were due.

Cached

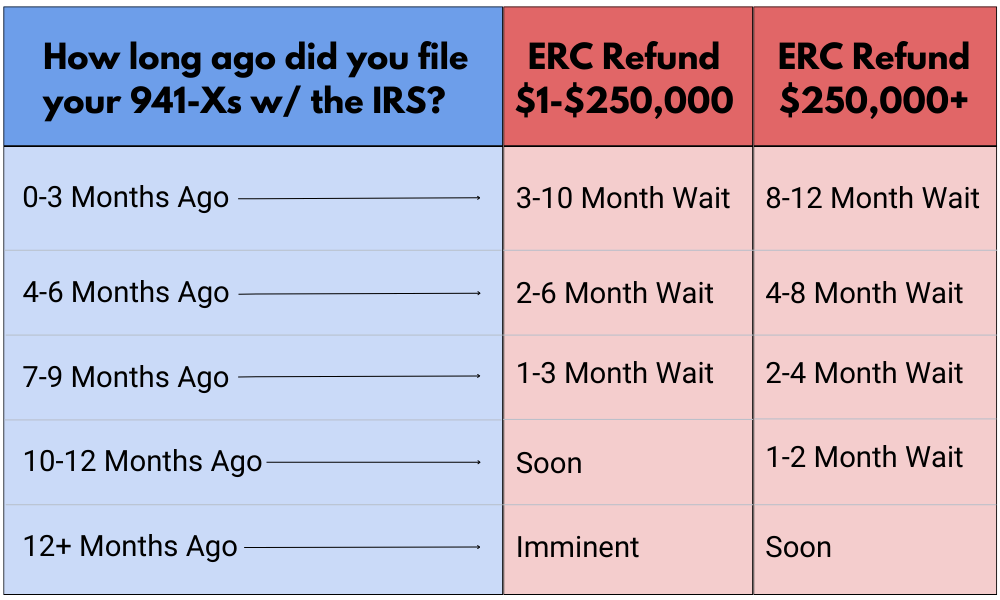

When should I expect my ERC money

Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In some cases, the delay in receiving their expected refund has been even longer.

When can I expect my ERC refund

Most employers can expect to receive their ERTC refund within six months to a year after filing their return.

Can I still apply for ERC in 2023

You can file for the employee retention tax credit in 2023 if you haven't already. This is known as filing for the ERC “retroactively.” You can do this by submitting an Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, Form 941-X.

Is it too late to apply for ERTC

It isn't too late to claim this valuable credit, but there is limited time to begin the process of applying and getting the funds that your business may be entitled to receive. For all quarters in 2023, the deadline to apply for the ERC is April 15, 2024.

When should I expect my ERC refund

Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In some cases, the delay in receiving their expected refund has been even longer.

Can I track my employee retention credit refund

To check the status of your ERTC refund, you will need to contact the IRS. You can do this by calling the IRS helpline or by visiting the IRS website.

Is it too late to claim the ERC credit

It isn't too late to claim this valuable credit, but there is limited time to begin the process of applying and getting the funds that your business may be entitled to receive. For all quarters in 2023, the deadline to apply for the ERC is April 15, 2024. For all quarters in 2023, the deadline is April 15, 2025.

Is there a deadline to claim employee retention credit

Employee Retention Tax Credit Deadline

The deadline for qualified firms to claim the ERTC is July 31, October 31, and December 31, 2023, with their Employee per quarter Form 941 tax filings. To file for the ERTC with their quarterly returns, business taxpayers will require extra payroll data and other papers.

How is ERC money paid out

The ERC credit is a tax refund paid to businesses through a paper check mailed from the IRS.

How do I check the status of my ERC

The best way to check the status of your ERC refund is by calling the IRS at 1-877-777-4778.

How is the ERC paid out

The ERC credit is a tax refund paid to businesses through a paper check mailed from the IRS.

Is there a deadline for claiming employee retention credit

There is still time. For all quarters in 2023, the deadline to apply for ERC is April 15th, 2024. For all quarters in 2023, the deadline to apply for ERC credit is April 15th, 2025. If you have not already filed, you can still claim the employee retention credit retroactively in 2023, 2024, and 2025.

Is there a deadline for the ERC credit

Similarly, the ERC deadline to claim ERC funds for eligible quarters in 2023 must be submitted by April 15, 2025.

Is it too late to claim ERC credit

It isn't too late to claim this valuable credit, but there is limited time to begin the process of applying and getting the funds that your business may be entitled to receive. For all quarters in 2023, the deadline to apply for the ERC is April 15, 2024. For all quarters in 2023, the deadline is April 15, 2025.

How long does it take to get approved for ERTC

Most employers can expect to receive their ERTC refund within six months to a year after filing their return.

How long do I have to file for ERC credit

Similarly, the ERC deadline to claim ERC funds for eligible quarters in 2023 must be submitted by April 15, 2025.