How do I claim my rebate credit?

How do I claim my recovery rebate credit on my taxes

What paperwork do I need to claim the Recovery Rebate Credit The IRS will send a Letter 6475 in late January, 2023, that lists the stimulus payment amount sent to you. The letter details your information for easy reference—you don't have to file it with your tax return.

Cached

How do I claim my stimulus recovery rebate

How do I complete the Recovery Rebate Credit (Stimulus)Go to the Federal Section (on left side navigation panel)Select COVID-19 Relief (on left side navigation panel)Select Recovery Rebate Credit.

Cached

Is it too late to claim recovery rebate credit

It's Not Too Late To Claim the 2023 Child Tax Credit or the 2023 & 2023 Recovery Rebate Credit.

How do I find my recovery rebate credit amount

You can also refer to Letter 6475, Your 2023 Economic Impact Payment(s), or notices the IRS mailed after the payments were issued. The first and second payment amounts can help you accurately calculate any 2023 Recovery Rebate Credit you may be eligible to claim on your 2023 tax return.

Is recovery rebate credit the same as stimulus check

The income requirements for the recovery rebate tax credit are the same as for the stimulus payments. So if a stimulus check missed you or you received a partial payment, you may be eligible for additional cash if you file a federal tax return and claim the credit.

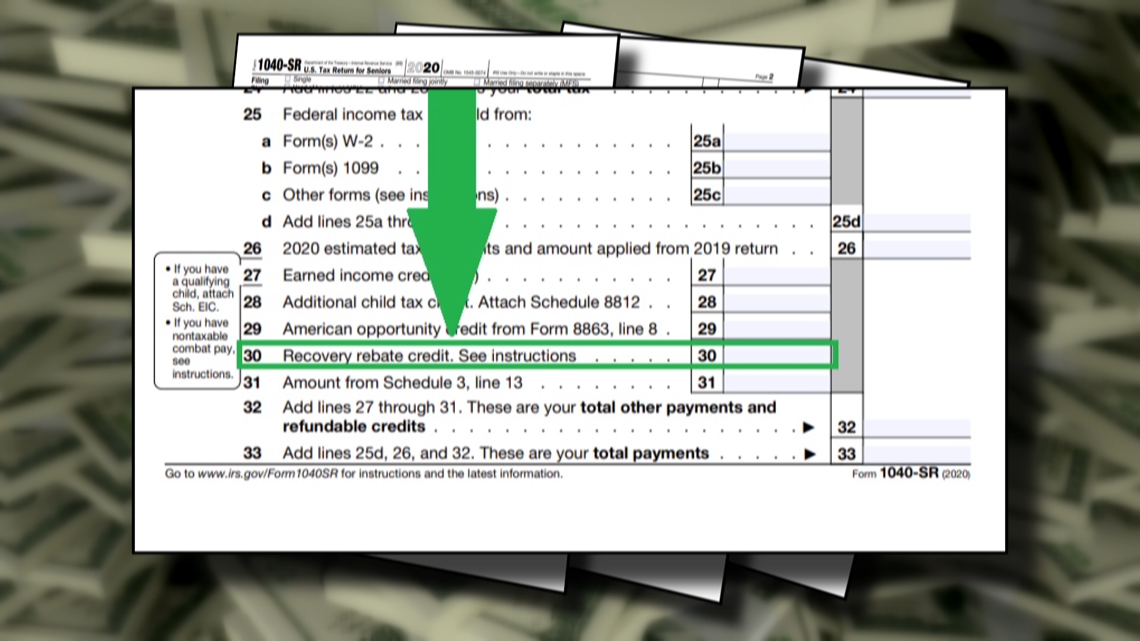

How do I enter recovery rebate credit on 1040

If you're eligible, you'll need to file a 2023 tax return to claim the 2023 Recovery Rebate Credit even if you aren't required to file a tax return. Line 30 on 2023 Form 1040 and Form 1040-SR is used to claim the Recovery Rebate Credit.

What if I never received my recovery rebate credit

If you never got your payments or did not get all of the money you thought you should, you must file a 2023 tax return. On your return, provide your current bank account information (if you have one) and current address, and claim the Recovery Rebate Credit.

Why can’t i get the Recovery Rebate credit

You aren't eligible to claim the 2023 Recovery Rebate Credit if any of the following apply: You could be claimed as a dependent on another taxpayer's 2023 tax return. You're a nonresident alien.

How do I know if I received a recovery rebate

Your Online Account: Securely access your IRS online account to view the total amount of your first, second and third Economic Impact Payment amounts under the Tax Records page. IRS Notices : We mailed these notices to the address we have on file.

How much was the recovery rebate credit

Yes, if you meet the eligibility requirements to claim the 2023 Recovery Rebate Credit. The amount of your credit may include up to $1,400 for a qualifying dependent you are claiming on your 2023 return.

Is the recovery rebate credit the same as a stimulus check

The income requirements for the recovery rebate tax credit are the same as for the stimulus payments. So if a stimulus check missed you or you received a partial payment, you may be eligible for additional cash if you file a federal tax return and claim the credit.

Where do I claim my recovery rebate credit on Turbotax

That information is used to fill out the correct tax forms and claim any credit that you are eligible for on your tax return. If you're completing your tax return on your own, the credit can be claimed on line 30 of Form 1040 or Form 1040-SR.

How much was the 3rd stimulus check

$1,400

Third round of stimulus checks: March 2023

The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800.

How do I claim my 2023 stimulus check

You will need to file a 2023 tax return to get the first and second stimulus checks and a 2023 tax return to get the third stimulus check. To claim your first, second, or third stimulus checks, wait until the 2023 tax season begins to get help filing your 2023 or 2023 tax return.

How to get a $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

Can you claim recovery rebate credit 2023

If you're one of the many U.S. expats who are owed stimulus money, you can still claim it through Recovery Rebate Credit. As the matter of fact, 2023 is the last year to get all the stimulus checks you might have missed! It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS.

How much was the first recovery rebate credit

$1,200

You were issued the full amount of the 2023 Recovery Rebate Credit if: the first Economic Impact Payment was $1,200 ($2,400 if married filing jointly) plus $500 for each qualifying child you had in 2023; and.

Why do I not get the recovery rebate credit

You qualify for the recovery rebate credit only if the IRS didn't give you a stimulus payment, or if you received a partial payment. To find out you whether you missed out on money you were entitled to, you can contact the IRS, review your IRS online account or use the tax agency's Get My Payment tool.

When was the recovery rebate credit given

2023 Recovery Rebate Credit: The first two rounds of Economic Impact Payments were advance payments of 2023 Recovery Rebate Credits claimed on a 2023 tax return. The IRS issued the first and second rounds of Economic Impact Payments in 2023 and in early 2023. See 2023 Recovery Rebate Credit Questions and Answers.

How do I know if I got my 3rd stimulus check

Find Out Which Payments You Received

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page.