How do I find my advance child tax credit payment?

Can you track your advance child tax credit

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal.

How do I get my 6419 letter online

What if I can't find my Letter 6419Click the “Sign in to Your Online Account” button.Click “ID.me Create New Account” on the next page.Follow the on-screen instructions to provide information to set up the secure ID.me account.

How much were the advance child tax credit payments

Starting July 15, 2023, eligible families will automatically begin to receive the first half of the CTC through advance monthly payments of $250 to $300 per child that will be paid directly by the Internal Revenue Service (IRS) through the end of the year.

Cached

Why haven t i got my child tax credit yet

If you're one of the many eligible people still waiting for checks from prior months or who haven't received any money at all, there could be a number of reasons. One problem could be inaccurate or outdated information on your 2023 tax return. Or perhaps the IRS doesn't know you're eligible.

How can I check if IRS received my payment

If it's been at least two weeks since you sent the payment to the IRS and your financial institution verifies that the check hasn't cleared your account, call the IRS at 800-829-1040 to ask if the payment has been credited to your tax account.

What if I can’t find letter 6419

The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out. You can also use the IRS' CTC Update Portal or create and check your IRS account for a record of your advance CTC payments.

Can I find my child tax credit letter online

If you accidentally disposed of Letter 6419, lost it or never got it, you can still claim the rest of your money. Your child tax credit information is available via the IRS website, but you'll need to create an online IRS account to access it.

How much was the 3rd stimulus check

$1,400

Third round of stimulus checks: March 2023

The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800.

What is the schedule 8812

Use Schedule 8812 (Form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2023, and to figure any additional tax owed if you received excess advance child tax credit payments during 2023.

How do I find my IRS payment confirmation number

You can easily keep track of your payment by signing up for email notifications about your tax payment, each time you use IRS Direct Pay. Email notification will contain the confirmation number you receive at the end of a payment transaction.

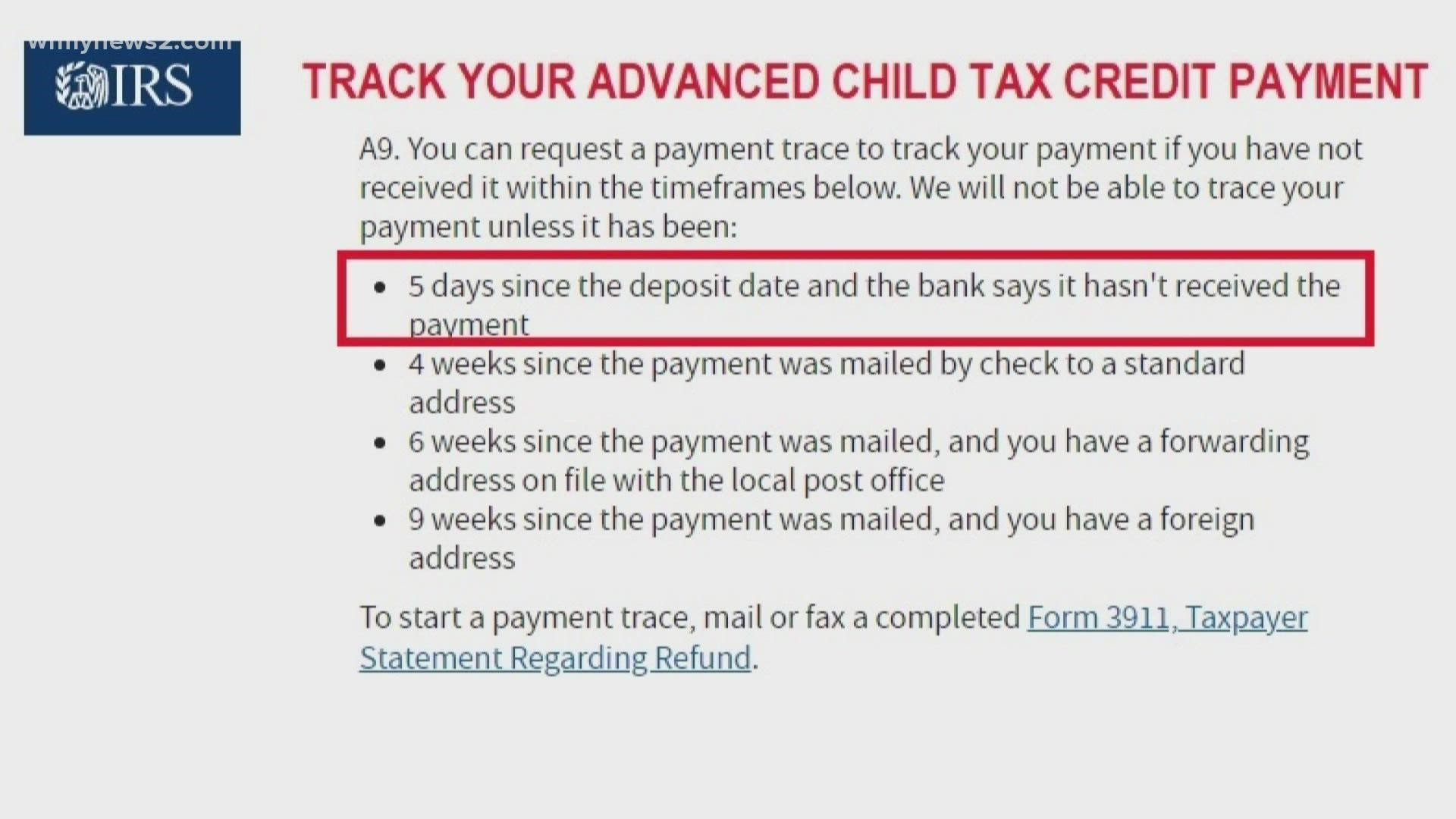

How long does it take the IRS to do a payment trace

within six weeks

If your refund was direct deposited, the financial institution will get a letter within six weeks from the Bureau of the Fiscal Service in the Treasury Department, to verify where the deposit went. If the check hasn't been cashed, you'll get a replacement refund check in about six weeks.

How do I find out how much stimulus I received

To find the amounts of your Economic Impact Payments, check: Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page.

When was the 3rd stimulus check and how much

Third round of stimulus checks: March 2023

The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800.

How much is the 8812 child tax credit

The American Rescue Plan raised the maximum Child Tax Credit in 2023 to $3,600 for qualifying children under the age of 6 and to $3,000 per child for qualifying children ages 6 through 17. Before 2023, the credit was worth up to $2,000 per eligible child, and 17 year-olds were not eligible for the credit.

Where is Schedule 8812 on Turbotax

Schedule 8812In the Federal section of your return, go to Deductions & Credits.Scroll down to You and Your Family and click Revisit/Start next to Advance payments, Child and Other Dependent Tax Credits.Click Continue.Answer Let's start with where you spent the most time in 2023.

Can I view my IRS payment history online

You can access your federal tax account through a secure login at IRS.gov/account. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return.

How do I trace a payment with the IRS

Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation). However, if you filed a married filing jointly return, you can't initiate a trace using the automated systems.

What happens if I didn’t receive my advance Child Tax Credit

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

Why isn’t my Child Tax Credit showing up

Your family never filed a 2023 or 2023 tax return, so the IRS doesn't know that you qualify. You'll need to file your taxes in 2023 to update your information. You lived in the US less than half the year in 2023 or 2023, and the IRS doesn't think you qualify, even if you now have a primary residence in the US.

How much is the 1st 2nd and 3rd stimulus check

The U.S. government has sent out three rounds of stimulus checks — for up to $1,200, $600 and $1,400 — over the past year in response to the coronavirus pandemic.