How do I find out if my child tax credit was mailed?

How long does it take for Child Tax Credit to be mailed

The 80% who get their refunds from the IRS through direct deposit will get these payments in their bank account on the 15th of every month until the end of 2023. People who don't use direct deposit will receive their payment by mail around the same time.

Cached

Where to find my 6419 letter

Visit IRS.gov to review sample copies of Letter 6419PDF or view the Advance Child Tax Credit Payments in 2023 webpage.

What to do if you haven t received your Child Tax Credit

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

Cached

Will Child Tax Credit payments be mailed

If you don't have a bank account or you would prefer to receive a check instead of direct deposit, payments can be mailed to your address. What if I don't have a permanent address You can receive monthly Child Tax Credit payments even if you don't have a permanent address.

Cached

Are IRS checks mailed first class

@Saintluver1 The IRS mails refund checks by first class mail without tracking. So, sorry, you are at the mercy of the U.S. postal system, which can take 7-10 business days to deliver a piece of mail. If you chose direct deposit, you are not waiting for an envelope.

Why was child tax credit mailed

The IRS sent your advance Child Tax Credit payment as a paper check by mail if we did not have your bank account information to send you a payment by direct deposit. Also, if you had a closed or invalid bank account on file, the IRS reissued your payment as a paper check by mail.

What happens if I didn’t receive my 6419 letter

The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out. You can also use the IRS' CTC Update Portal or create and check your IRS account for a record of your advance CTC payments.

Can I find my child tax credit letter online

If you accidentally disposed of Letter 6419, lost it or never got it, you can still claim the rest of your money. Your child tax credit information is available via the IRS website, but you'll need to create an online IRS account to access it.

How long does it take to get CTC check from IRS

We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return.

How is child tax credit disbursed

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2023 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

How long does IRS check take in mail once mailed

(updated May 16, 2023) We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return.

How do I track a mailed check from the IRS

You can get fast answers about your refund by using the Where's My Refund tool available on IRS.gov and through the IRS2Go mobile app. All you need is your Social Security number, tax filing status and the exact amount of your refund.

What if i didn t get letter 6419 for child tax credit payments

What Happens if You Didn't Get Letter 6419 or Lost It The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out.

Can I access IRS letter 6419 online

2023 Tax Filing Information

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

Can you view IRS Letter 6419 online

2023 Tax Filing Information

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

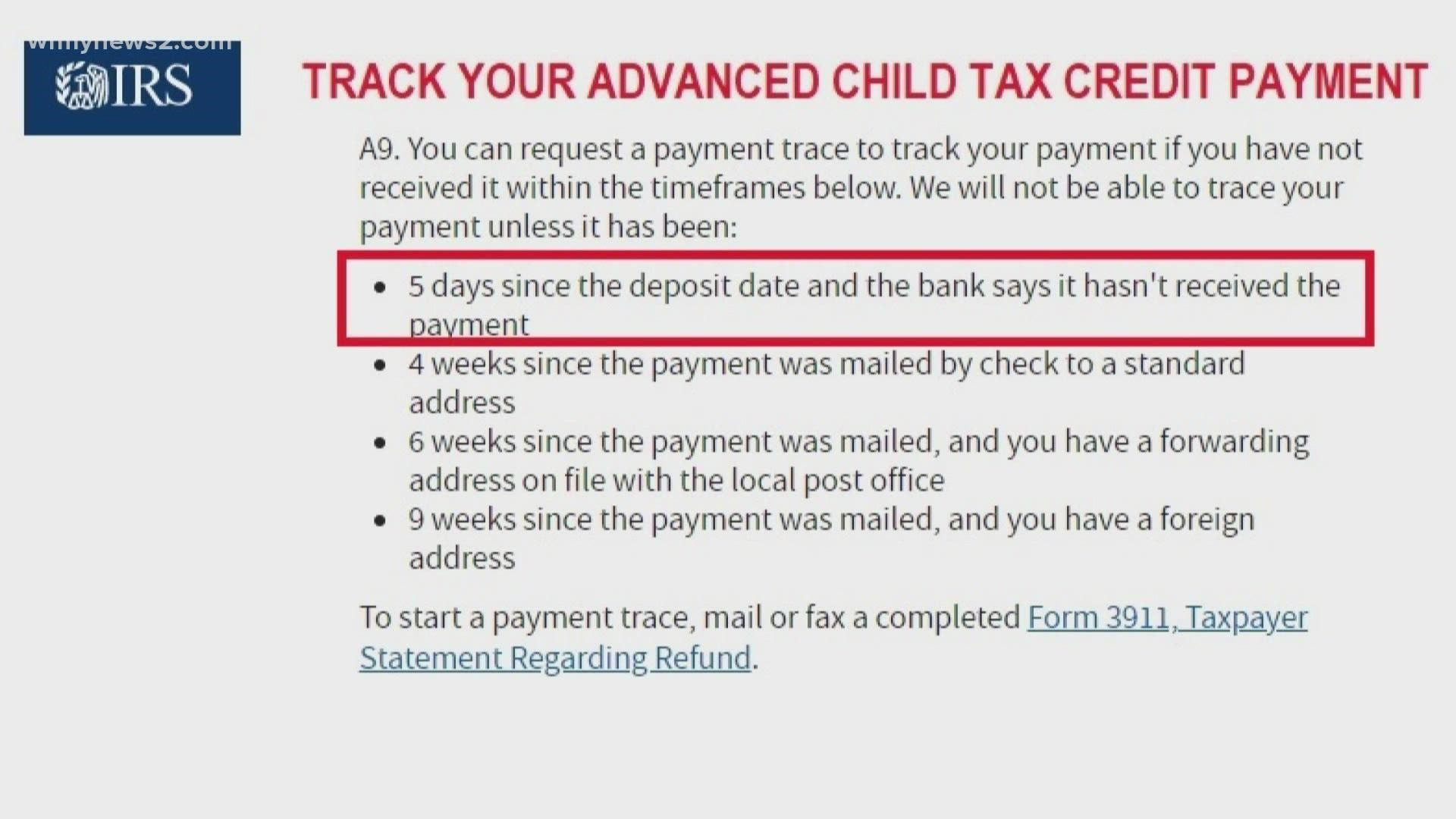

Can you track your CTC check

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

Will CTC be deposited on the 15th

Families who got their refunds from the IRS through direct deposit will get these payments in their bank account around the 15th of every month until the end of 2023. People who don't use direct deposit will receive their payment by mail around the same time.

Why did I get $250 from the IRS

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

Who sends out Child Tax Credit payments

the IRS

To get money to families sooner, the IRS began sending the first-ever monthly payments (up to half of your total amount) starting in July 2023.

How do I find out if my IRS check has been mailed

Tracking the status of a tax refund is easy with the Where's My Refund tool. It's available anytime on IRS.gov or through the IRS2Go App. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.