How do I get 2023 Recovery Rebate credit?

Can you claim the recovery rebate credit in 2023

If you're one of the many U.S. expats who are owed stimulus money, you can still claim it through Recovery Rebate Credit. As the matter of fact, 2023 is the last year to get all the stimulus checks you might have missed! It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS.

Cached

How do I get a 2023 stimulus check

You will need to file a 2023 tax return to get the first and second stimulus checks and a 2023 tax return to get the third stimulus check. To claim your first, second, or third stimulus checks, wait until the 2023 tax season begins to get help filing your 2023 or 2023 tax return.

Can I still claim my stimulus check in 2023

You also may be able to claim missed stimulus checks through GetYourRefund.org which opens on January 31, 2023. If you didn't get your first, second, or third stimulus check, don't worry — you can still claim the payments as a tax credit and get the money as part of your tax refund .

How do I claim my stimulus recovery rebate

How do I complete the Recovery Rebate Credit (Stimulus)Go to the Federal Section (on left side navigation panel)Select COVID-19 Relief (on left side navigation panel)Select Recovery Rebate Credit.

Cached

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

Does everyone get recovery rebate credit

Generally, you are eligible to claim the Recovery Rebate Credit if: You were a U.S. citizen or U.S. resident alien in 2023. You are not a dependent of another taxpayer for tax year 2023.

Are people on SSI getting a stimulus check in 2023

Although the federal government has not authorized stimulus payments, if you receive an SSI check 2023, you may be entitled to money from the state where you live.

Who qualifies for the $1600 stimulus check

Single people making less than $75,000, heads of household making less than $112,500, and married couples filing jointly making less than $150,000 qualify for stimulus checks. People making up to $80,000 will receive partial payments.

What are the IRS changes for 2023

The standard deduction also increased by nearly 7% for 2023, rising to $27,700 for married couples filing jointly, up from $25,900 in 2023. Single filers may claim $13,850, an increase from $12,950.

What is the IRS exemption for 2023

The personal exemption for tax year 2023 remains at 0, as it was for 2023, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

How do I qualify for recovery rebate credit

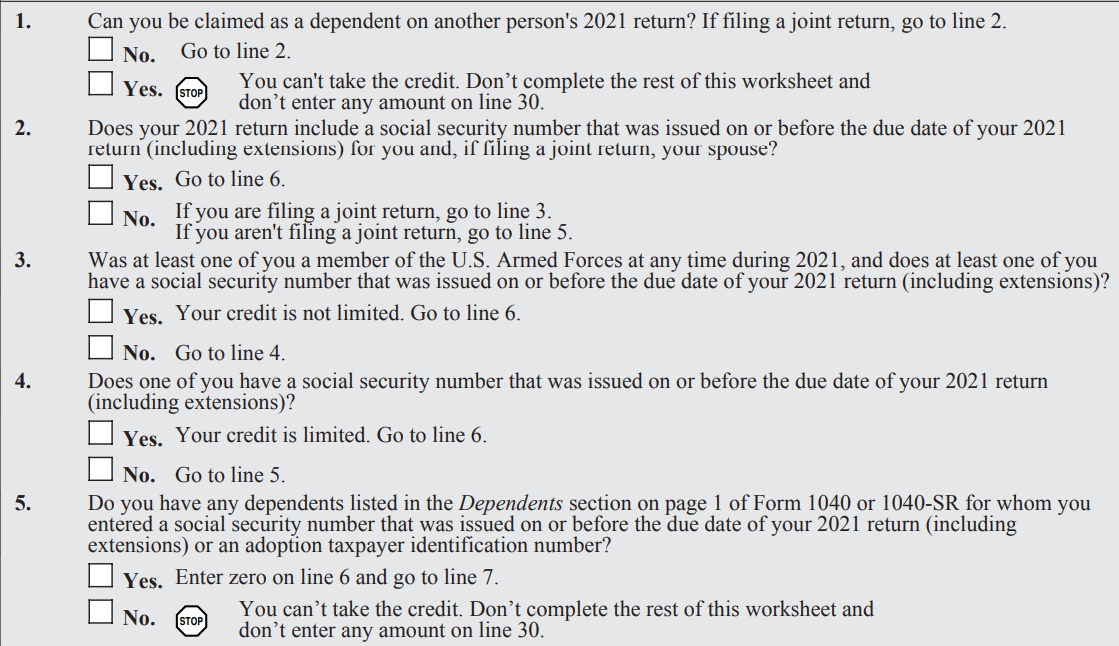

Generally, if you were a U.S. citizen or U.S. resident alien in 2023, you were not a dependent of another taxpayer, and you either have a valid SSN or claim a dependent who has a valid SSN or ATIN, you are eligible to claim the 2023 Recovery Rebate Credit.

When to expect tax refund 2023 with EITC

The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if they chose direct deposit and there are no other issues with their tax return.

Will we get a bigger tax refund in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.

Why am I not eligible for recovery rebate credit

You aren't eligible to claim the 2023 Recovery Rebate Credit if any of the following apply: You could be claimed as a dependent on another taxpayer's 2023 tax return. You're a nonresident alien.

What if I never received my recovery rebate credit

If you never got your payments or did not get all of the money you thought you should, you must file a 2023 tax return. On your return, provide your current bank account information (if you have one) and current address, and claim the Recovery Rebate Credit.

How much will SSI checks be in 2023 for one person

$914

Generally, the maximum Federal SSI benefit amount changes yearly. SSI benefits increased in 2023 because there was an increase in the Consumer Price Index from the third quarter of 2023 to the third quarter of 2023. Effective January 1, 2023 the Federal benefit rate is $914 for an individual and $1,371 for a couple.

Will SSI get a 4th stimulus check 2023

SSI and veterans will get this payment in the same way they got their first stimulus check.

How do you qualify for the upcoming stimulus

To qualify, you must have:Filed your 2023 taxes by October 15, 2023.Had a California Adjusted Gross Income (CA AGI) of $1 to $75,000 for the 2023 tax year.Had wages of $0 to $75,000 for the 2023 tax year.Been a California resident for more than half of the 2023 tax year.

What tax credits are available for 2023

Changes for 2023

The 2023 changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Credit. Those who got $3,600 per dependent in 2023 for the CTC will, if eligible, get $2,000 for the 2023 tax year.

What is the new IRS rule 2023

Standard deduction increase: The standard deduction for 2023 (which'll be useful when you file in 2024) increases to $13,850 for single filers and $27,700 for married couples filing jointly. Tax brackets increase: The income tax brackets will also increase in 2023.