How do I get a credit card without credit?

Can I get a credit card if I have no credit

It is possible for those with no credit history to open credit cards and earn rewards for their purchases. In general, it is easiest to qualify for secured credit cards, which require you to make a deposit in order to access a credit limit.

How do you get credit if you have none

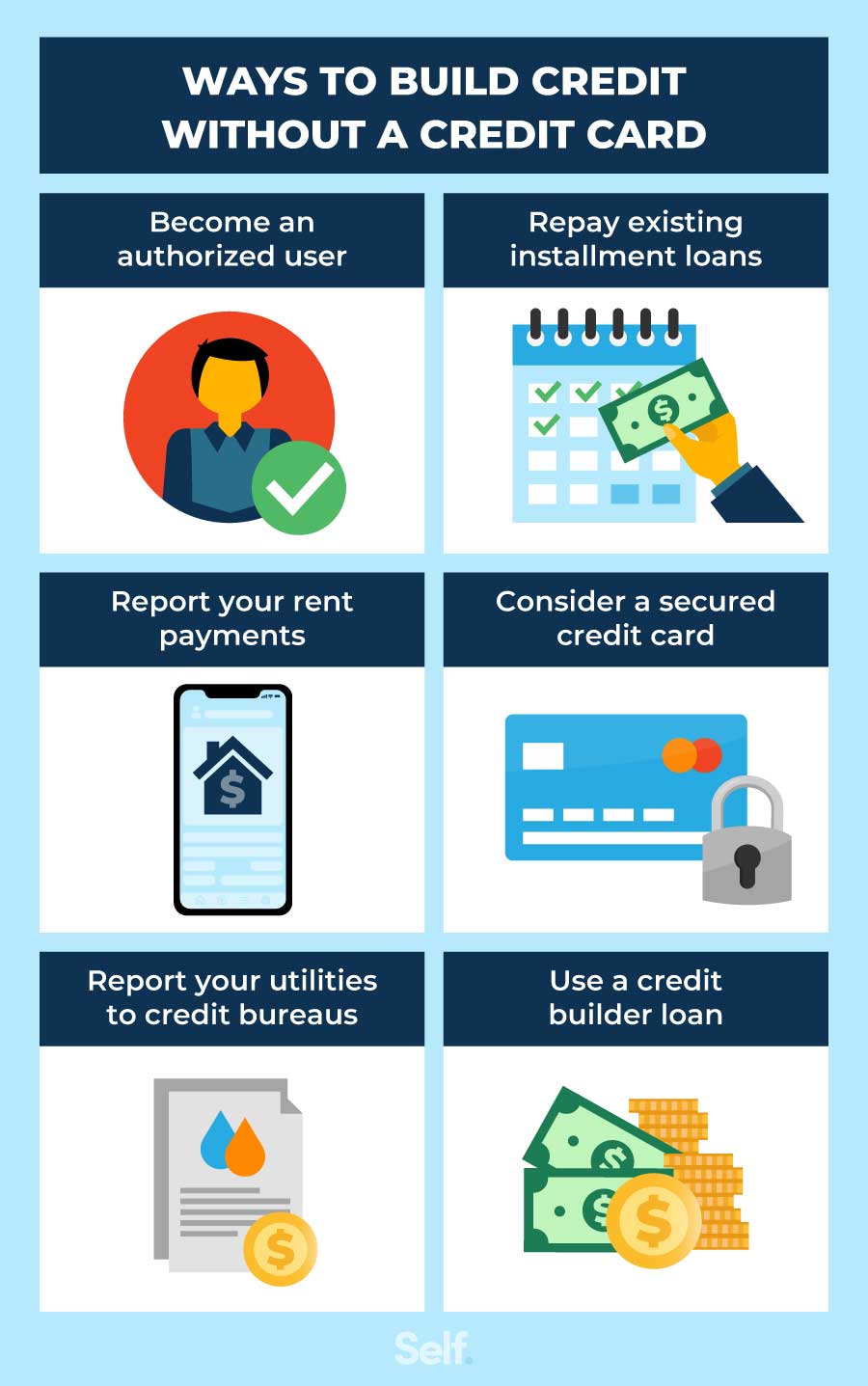

Here are the best ways to build credit:Get a Store Card.Apply for a Secured Credit Card at a Bank.Apply for a Credit-Builder Loan.Find a Co-Signer.Become an Authorized User on Another Person's Credit Card.Report Rent and Utility Payments to Credit Bureaus.Consider a Student Credit Card.Make On-Time Payments Every Month.

CachedSimilar

Which card is easiest to get approved for

FULL LIST OF EDITORIAL PICKS: EASIEST CREDIT CARDS TO GETOpenSky® Plus Secured Visa® Credit Card. Our pick for: No credit check and no bank account required.Chime Credit Builder Visa® Credit Card.Petal® 2 "Cash Back, No Fees" Visa® Credit Card.Mission Lane Visa® Credit Card.Self Visa® Secured Card.Grow Credit Mastercard.

What if I have never had a credit card

It's completely acceptable to avoid getting a credit card. Consumers can pay entirely with cash, check or debit card and still build a positive credit history through other types of loans.

How fast can you build credit

It usually takes a minimum of six months to generate your first credit score. Establishing good or excellent credit takes longer. If you follow the tips above for building good credit and avoid the potential pitfalls, your score should continue to improve.

What credit score do you start with

zero

Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 (the lowest possible FICO score). The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit.

How do I establish credit for the first time

Here are four ways to get started.Apply for a credit card.Become an authorized user.Set up a joint account or get a loan with a co-signer.Take out a credit-builder loan.

How much credit does someone with no credit have

That doesn't mean your credit score is zero or even that you have a bad credit score. Without any credit history, you don't fall into any credit range. You're credit invisible.

What banks give you a card instantly

Top credit cards you can use instantly after approvalBlue Cash Preferred® Card from American Express.Chase Sapphire Preferred® Card.Bank of America® Premium Rewards® credit card.Amazon Prime Rewards Visa Signature Card.United℠ Explorer Card.SoFi Credit Card.Other notable options.

What is the easiest card to get with bad credit

Best Credit Cards For Bad CreditNavy FCU nRewards® Secured Credit Card * [ jump to details ]Tomo Credit Card * [ jump to details ]OpenSky® Secured Visa® Credit Card.Discover it® Secured Credit Card.Credit One Bank® Platinum Visa® for Rebuilding Credit *Bank of America® Customized Cash Rewards Secured Credit Card *

What is the starting credit score

While the starting point of VantageScore and FICO credit scores is 300, starting this low is unlikely unless you demonstrate very poor credit management skills.

How can I build my credit fast

The quickest ways to increase your credit scoreReport your rent and utility payments.Pay off debt if you can.Get a secured credit card.Request a credit limit increase.Become an authorized user.Dispute credit report errors.

How long does it take to go from 500 to 700 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

What credit score does an 18 year old start with

The credit history you start with at 18 is a blank slate. Your credit score doesn't exist until you start building credit. To begin your credit-building journey, consider opening a secured credit card or ask a family member to add you as an authorized user on their account.

How long does it take to get a 700 credit score from 500

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How much is your credit when you first start

The base credit scores of the most popular credit-reporting models start at 300. Starting with a score of around 300 is possible only if you've managed your finances poorly. You may start to build a credit history or improve your score without using any type of credit.

How long does it take to build credit from nothing

three to six months

According to Experian — one of the three major credit reporting agencies — it can take three to six months to establish a credit history or improve your credit. If you're starting completely from scratch, it may take longer, but you can generally see significant improvements within six months.

What do you need to get approved for credit card

Solo Credit Card Applicants Must Be 21 or Older.You Must Have a Verifiable Income Source.Card Applicants Need a Physical Address.U.S.Credit Requirements Will Vary By Issuer & Card.You Shouldn't Have Too Many Recent New Accounts.Bad Brand Relationships May Impact Your Approval.

How to get a credit card in one day

How do I get a credit card fast The best way to get a credit card fast is to apply online and then request expedited shipping once you're approved. Applying online also means you could be approved instantly. In some cases, you could even receive your card number to begin making purchases right away.

What’s the lowest credit score to get a credit card

You can get a credit card with a credit score of 570, but you may find your options are more limited and you may need to get a secured credit card. Secured credit cards require an upfront deposit, which your line of credit is based on.