How do I get a credit history payment?

How do I fix my credit payment history

How to Improve Your Payment HistoryAlways pay your bills on time. The number one way to improve your payment history is to always make on-time payments.Get and stay current on any missed payments.Follow a debt management plan.Communicate with your creditors.Consider a debt consolidation loan.

Cached

How much does payment history make up credit score

35%

The five pieces of your credit score

Your payment history accounts for 35% of your score. This shows whether you make payments on time, how often you miss payments, how many days past the due date you pay your bills, and how recently payments have been missed.

CachedSimilar

What is credit payment history

Within your credit reports, your payment history shows payment information about your credit accounts and might include things like: The number of accounts you've paid on time. How long overdue your payments are or have been in the past. The number of times that past due items appear in your credit history.

Cached

How do I get my credit history

You can request and review your free report through one of the following ways: Online: Visit AnnualCreditReport.com. Phone: Call (877) 322-8228. Mail: Download and complete the Annual Credit Report Request form .

Cached

How do I clear my credit history clean

How to clean up your credit reportRequest your credit reports.Review your credit reports.Dispute credit report errors.Pay off any debts.

How long does it take to fix payment history on credit report

approximately seven years

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.

What is an example of a payment history

Your payment history typically includes payments for all your credit cards, installment loans (e.g. vehicle loans and personal loans), retail accounts (e.g. store credit cards or purchases made using store financing or credit), and home mortgage loans.

How long does it take for payment history to improve on credit report

How long does a late payment affect credit A late payment will typically fall off your credit reports seven years from the original delinquency date.

How long does payment history stay on credit

approximately seven years

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.

Who checks credit history

While the general public can't see your credit report, some groups have legal access to that personal information. Those groups include lenders, creditors, landlords, employers, insurance companies, government agencies and utility providers.

How long does it take to get credit history

History isn't instant. If you haven't used credit before, it usually takes at least six months to generate a credit score – and longer to earn a good or excellent score.

What is a good credit score to buy a house

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Can you erase bad credit history

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

How long does it take to clear a bad credit history

seven years

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can stay on your report for up to ten years.

How do I remove closed accounts from my credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

How long does payment history take

approximately seven years

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years.

How long does payment history stay

seven years

Late payments remain on your credit reports for seven years from the original date of the delinquency. Even if you repay overdue bills, the late payment won't fall off your credit report until after seven years.

How long does it take to build credit from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How to get your credit score up 100 points in 30 days

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

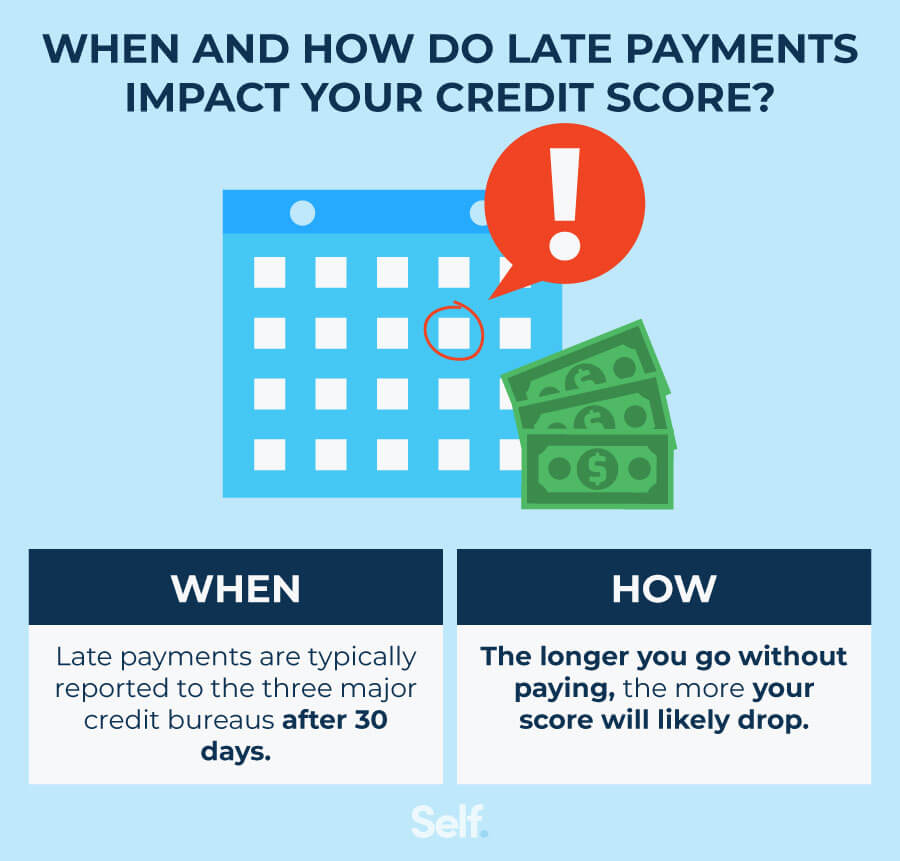

How much does 1 late payment affect credit score

Your credit score can drop by as much as 100+ points if one late payment appears on your credit report, but the impact will vary depending on the scoring model and your overall financial profile.