How do I get a stimulus check for my dependent child?

How do I claim my child’s stimulus check

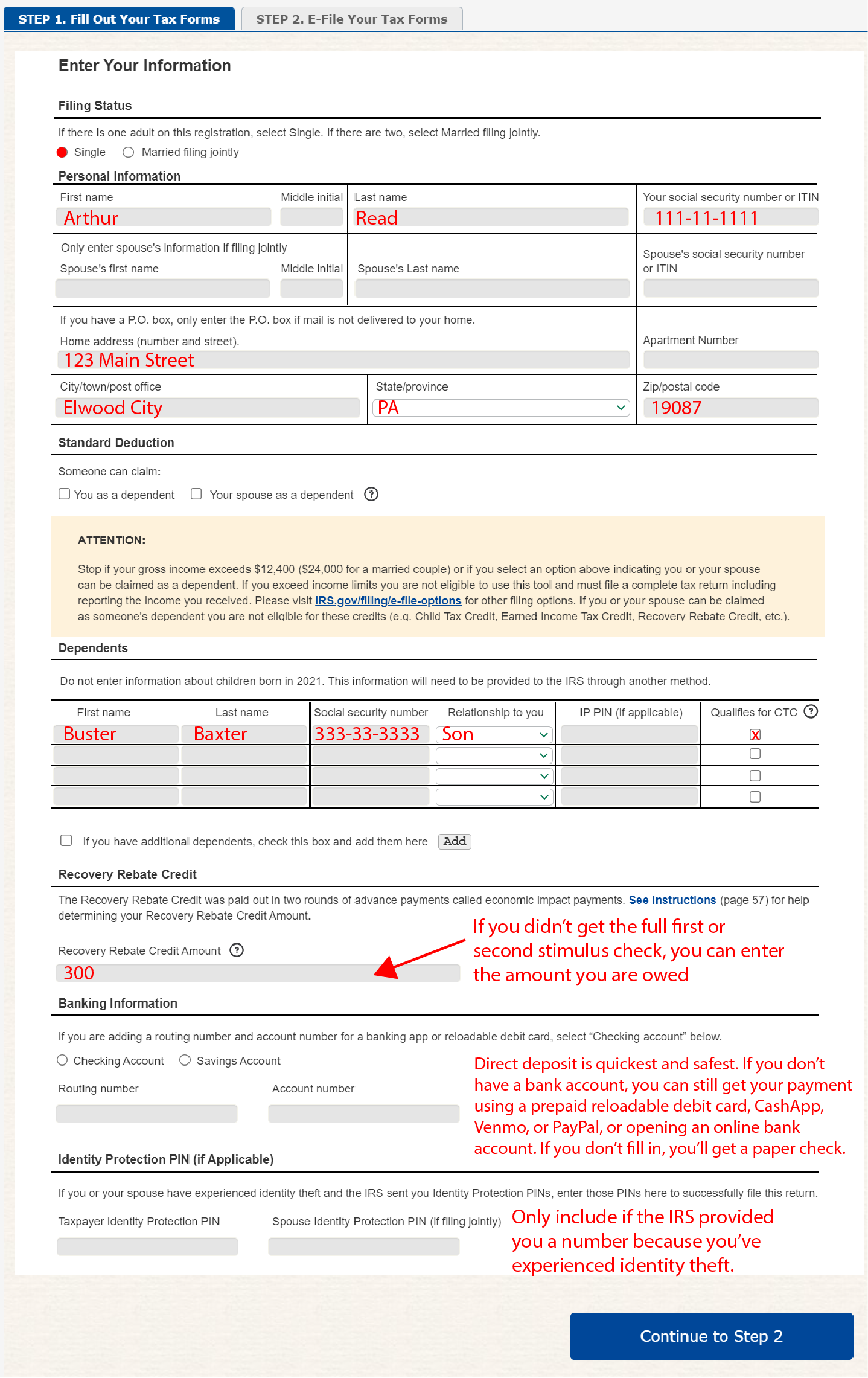

If you had a child in 2023 and don't file taxes, you can claim your child, along with any other qualifying dependents, through the IRS Non-Filers: Enter Payment Info Here tool . You have until October 15, 2023, to submit basic information about yourself and your dependents.

Cached

What if my dependent child did not receive a stimulus check

If you didn't get the full amount of one or more of these for your eligible children, you can claim the amounts as the Recovery Rebate Credit when you file your 2023 and/or 2023 federal tax return . You can file a 2023 tax return to claim the first and second stimulus checks through April 15, 2024.

Cached

How do I get the $500 stimulus for my child

Parents with children ages 18 and older are not eligible for the recurring monthly advance payments but they could be in line for a credit of $500 in 2023. To qualify, people who are 18 or older must be claimed as a dependent. Dependents ages 19-24 must be attending college full-time to qualify.

Are dependent children getting $1,400 stimulus

Often referred to as stimulus payments, this credit can also help eligible people whose EIP3 was less than the full amount, including those who welcomed a child in 2023. The maximum credit is $1,400 for each qualifying adult, plus $1,400 for each eligible child or adult dependent.

What is the $450 per child

First Lady Casey DeSantis announced last week that $35.5 million in DeSantis' budget will "support nearly 59,000 Florida families with a one-time payment of $450 per child, which includes foster families."The American Rescue Plan Act created a $1 billion fund to assist needy families affected by the pandemic within the …

Can you get stimulus check for children

Families with children 5 and younger are eligible for credits of as much as $3,600 per child, with up to $300 received monthly in advance; those with children ages 6 to 17 are eligible for up to $3,000, with up to $250 a month in advance.

Who qualifies for $500 dependent stimulus check

Dependents who are age 17 or older. Dependents who have individual taxpayer identification numbers. Dependent parents or other qualifying relatives supported by the taxpayer. Dependents living with the taxpayer who aren't related to the taxpayer.

What if I didn’t get the $500 for my child stimulus

1. The IRS Used Your 2023 Return and Your Child Was Born in 2023. The IRS used either your 2023 or 2023 tax return to process your stimulus check. If they took your 2023 return and your child was born in 2023, they wouldn't have had your child's information on file, so your check would be short by $500.

Is there still stimulus checks for kids

Children (under 17) can only get the stimulus if at least one parent has an SSN. Any family member or dependent with an SSN or ATIN can get the stimulus. Dependents (any age) with SSNs or ATINs still qualify for the stimulus even if their parents don't have SSNs.

Does everyone with a child get a stimulus check

Eligibility: Most families, even those with little to no income, can receive the full amount. If you are a single parent making less than $112,500 or a married couple making less than $150,000—and have children under age 18 who will live with you for more than half of 2023—you are likely eligible for the full benefit.

Do all dependents get a stimulus check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400. This is different from the first and second stimulus checks, which only allowed child dependents (under 17) to get the additional payment.

What is the $4,200 Child Tax Credit

FSA 2.0 would replace the current child tax credit of $2,000 with a child allowance of up to $4,200 per child under age 6 and $3,000 per child ages 6 to 17. Although the child allowance would not be fully refundable, like the 2023 CTC, it would phase in more quickly than the current CTC.

Who is eligible for $450 payment

Single filers: Less than $100,000 per year. Heads of household: Less than $150,000 per year. Joint filers: Less than $200,000 per year.

Who qualifies for the$ 450 check in Florida

Eligible recipients include: Foster Parents Relative Caregivers Non-relative Caregivers Families receiving TANF cash assistance Guardianship Assistance Program participantsOfficials explained that families do not need to apply for the payment and that checks have been mailed directly to the recipients and should arrive …

Did kids under 18 get stimulus

That's because the massive $2 trillion stimulus package, the Coronavirus Aid, Relief, and Security (CARES) Act, excludes some Americans from receiving the one-time payments, which are set at $1,200 for adults and $500 for children. Here's who won't get a stimulus check: Children who are 17 or 18 years old.

Who gets the $300 child stimulus

For every child 6-17 years old, families will get a monthly payment of $250, and for children under 6 years old, families will get $300 each month.

What are the 6 requirements for claiming a child as a dependent

There are seven qualifying tests to determine eligibility for the Child Tax Credit: age, relationship, support, dependent status, citizenship, length of residency and family income. If you aren't able to claim the Child Tax Credit for a dependent, they might be eligible for the Credit for Other Dependent.

Does every kid get a stimulus check

Children (under 17) can only get the stimulus if at least one parent has an SSN. Any family member or dependent with an SSN or ATIN can get the stimulus. Dependents (any age) with SSNs or ATINs still qualify for the stimulus even if their parents don't have SSNs.

Is it too late to claim stimulus money

It's not too late to claim any stimulus checks you might have missed! You will need to file a 2023 tax return to get the first and second stimulus checks and a 2023 tax return to get the third one.

Who qualifies for the $300 child payment

Nearly all families with children qualify. Families will get the full amount of the Child Tax Credit if they make less than $150,000 (two parents) or $112,500 (single parent). There is no minimum income, so families who had little or no income in the past two years and have not filed taxes are eligible.