How do I get approved for a business account at Chase?

Why would Chase deny my business account

If you are denied a business account, it is because of negative information on your ChexSystems report. Second chance banking options are available for folks with bad credit and banking history.

How do you qualify for a business checking account

Get documents you need to open a business bank accountEmployer Identification Number (EIN) (or a Social Security number, if you're a sole proprietorship)Your business's formation documents.Ownership agreements.Business license.

How much money does Chase require to open business account

Chase Business Complete Banking℠ at a glance

| Monthly fee: | $15 (multiple ways to waive including maintaining a minimum daily balance of $2,000). |

|---|---|

| Minimum opening deposit requirement: | $0 |

| APY: | None |

| Transactions: | Unlimited electronic deposits; 20 free teller and paper transactions per month. |

Cached

Do you need an EIN to open a Chase business account

You also need one of the following tax identification numbers to open a business checking account: Social Security number. Individual taxpayer identification number (for non-U.S. citizens) Employer Identification Number (EIN)

Cached

Why would you not be approved for a business checking account

If you have poor personal credit and you attempt to open a business account as a sole proprietor, you may not get very far. “The biggest risk is that the bank may check your credit score before opening the account, and if the bank deems the score too low, [it] may not allow you to open the account,” explained Wright.

How long does it take for Chase to approve business account

What you should know about the Chase business card approval process: After you submit your application, you may receive a decision instantly. But if Chase needs to collect or review additional information, it can take up to 30 days to get a decision.

Can I be denied opening a business bank account

You can be denied a business bank account. Banks are under no obligation to open an account for any business, and they may decline an application for various reasons. In the case of denial, the bank is usually required to provide a reason for declining the applications.

Do banks do a credit check to open a business account

The bank will check your business's credit.

If you've had problems with another bank, you will have to address those issues before opening a new bank account. “The banking institution will probably be subscribed to ChexSystems,” said Verrett.

Does Chase do a hard pull for business accounts

Chase will report your account activity to the business credit bureaus, which can help you establish a business credit history. The bank won't report anything other than the initial hard inquiry when you apply to the consumer credit bureaus, unless your account is more than 60 days delinquent.

Can I open a business account with just my EIN number

In short – no, you can't open a business bank account with only an EIN. Your EIN is the unique nine-digit identity code assigned to your business by the IRS.

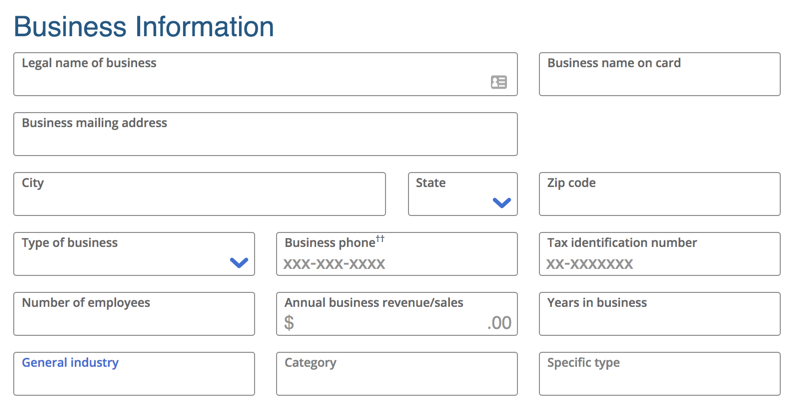

What documents are needed to set up a business bank account Chase

Information required to open account:Personal Identification: Two forms of ID are required.Tax Identification Number:Business Documentation: Filed with appropriate State Agency including State Filing Stamp.Assumed Name Certificate: May be required if your business is operating with a DBA (doing business as).

Does Chase Business report to IRS

Internal Revenue Code §6050W requires Chase Merchant Services to track the gross amount of reportable payment transactions for all merchants and report those amounts to the Internal Revenue Service (IRS) on Form 1099-K.

How long does it take to get approved for business bank account

You can typically apply in minutes for a business checking account as long as you have the right details and documents, especially if you open an account online.

Is it OK to use a personal checking account for business

Although having two bank accounts appears inconvenient, you shouldn't use a personal account for your business finances primarily because it can affect your legal liability. In fact, one of the first steps to owning a business should be opening a business bank account, in addition to a personal bank account.

What is the minimum credit score for Chase business

670 or above

What credit score do you need to get a Chase Ink business card To qualify for Chase's Ink business cards, you must have good to excellent credit, which is defined as a FICO credit score of 670 or above. Although these are business cards, Chase will use your personal credit score when considering your application.

Does Chase pull credit for business account

Beyond your credit score, Chase may request documentation to show you have a legitimate business or sole proprietorship. Usually, your credit will be pulled, and you'll have to personally guarantee the account.

Why am I not getting approved for a business bank account

If you have poor personal credit and you attempt to open a business account as a sole proprietor, you may not get very far. “The biggest risk is that the bank may check your credit score before opening the account, and if the bank deems the score too low, [it] may not allow you to open the account,” explained Wright.

Why is it difficult to open a business bank account

Increased checks on compliance and anti-money laundering procedures. Currently, numerous regulatory bodies have increased checks on compliance and anti-money laundering tools, making it hard for individuals to open bank accounts for their businesses.

Do I need an EIN for my LLC to open a bank account

Details you'll need to apply online:

Name and address of business. Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-XXXXXXX, or, if the LLC is a single member LLC, the EIN of the company or the Social Security Number (SSN) of the single member.

Can I open a business account with no money

While many business banks require an opening deposit to open a new account, you can still find financial institutions that do not require a minimum initial deposit. Securing a deposit-free business checking or savings account is a great task to accomplish in the early days of your company.